- June 23, 2021

- Posted by: CFA Society India

- Category:Careers, ExPress

CFA Society India had organized a research note writing competition as part of its ‘Women in Finance’ initiative this year. The competition gave women charterholders and candidates a chance to showcase their research to the wider investment community, get recognized and further their careers. The entries were judged by two eminent professionals: Shireen Bhan – Managing Editor of CNBC TV18 and Farida Khambatta, one of the world’s leading emerging markets investor.

This series will showcase the three entries of the competition, starting with research note of Namrata Mittal, CFA, the winner.

Key Themes that will emerge and shape the Indian economy over the next 5 years

#1: Formalization of the Economy and shedding dwarfism of Indian businesses

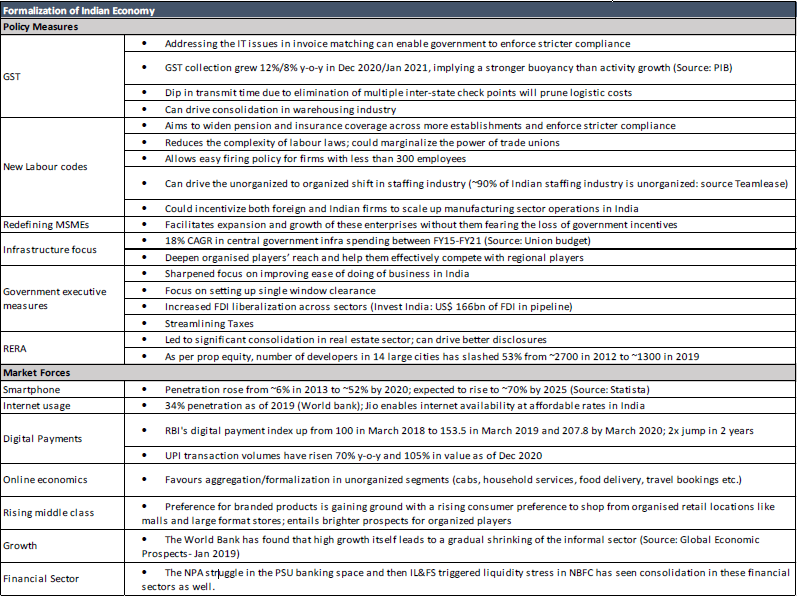

Indian businesses are witnessing consolidation across sectors. Recent policies (FDI liberalization, GST with stricter compliance, labour reforms, redefinition of MSMEs and single window clearance likely in 2021) and market developments (rising internet and smartphone penetration, rise in e-tailing, growth of mid-tier cities and brand consciousness among households) favour shift from unorganized sector to organized sector and scaling up of businesses in India. Relatively high share of unorganized sector in Indian economy (~50% of India’s GDP) makes us believe that this theme may continue to play for several years in India.

We are likely to see increased impermanence in MSMEs in post COVID era, even as government’s credit guarantee schemes and RBI’s one-time restructuring had offered some near-term respite. Thus, the market share gains for listed players are likely to continue. As one of the many examples, President of Single Screen association has been quoted saying that ‘of ~7,000 single screen theatres existent in India, nearly ~2,000 screens would likely be forced to shut down post COVID’.

Table 1: Policy measures and market forces driving consolidation across a multiple sector:

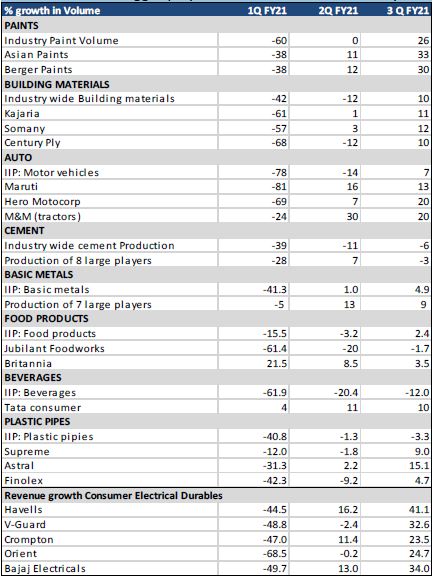

Investment Implication: The decade gone by was marked with reduced corporate profits (7.2% of GDP in FY08 to 1.5% of GDP by FY20; based on ~30,000 companies; source: CMIE). Productivity is higher in cases of larger enterprises vs. smaller ones led by economies of scale/ operating leverage. Thus, consolidation should enable earnings recovery in Indian economy. This is extremely critical at current juncture, given that there is little room for further multiple expansion in traditional businesses. The force of industry consolidation can already be witnessed in property developers, financial sector, healthcare (diagnostic sector), tiles, pipes, engineering and construction contractors, retail (branded apparels), film exhibition and paints (Table 2). The companies with superior competitive prowess and potent balance within the organised space will outperform peers.

Risks: Government policy needs to be supportive and industry be able to manage political backlashes effectively. Risks also emanates from lack of skilled labour, adequate R&D and on the job training, while acts as a potential break to scaling up abilities. Further, government need to continue streamlining the regulations for Indian corporates and address other basic inefficiencies (such as profit driven by electricity theft).

Table 2: Sales for bigger players much better than industry wide sales growth

Source: Company Data, CMIE; NB: The volume growth reported for companies are just a factual statement and in no way represents stock recommendation of the writer or the organization

#2: Savings into long-term financial products

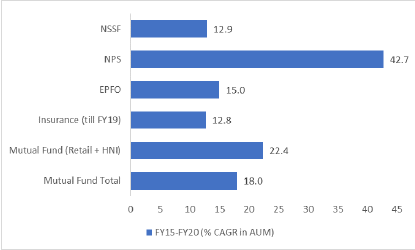

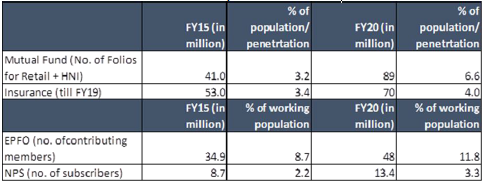

India has seen increased traction of long-term financial savings products over the last six to seven years (Chart 1). Positive real rate of return (owing to moderating inflation), reduced attractiveness of real estate and increased awareness (a behavioural shift) favoured financialization of savings. Government by including a larger worker base in the net of pension and insurance products and regulators enabling better governance of financial sector have also played a role in making financial assets attractive. Finally, the adoption of digital platform and internet penetration has also enabled better marketing of the financial products, whereby savers can track the performance of their savings and make more intelligent decision.

Growth in Indian asset management space has just begun and is a long-term structural play. India has the second highest gross savings rate (30% in 2019) after China (46%), yet the penetration of long-term saving products is abysmally low (see Table 3).

Investment Implication: We may see increased instances of IPO for asset management and insurance companies and the related financial intermediaries, which may be an attractive investment opportunity. Recently, in 2021 Budget, government increased the Insurance sector FDI to 74%, which augurs well from long term perspective especially for smaller insurance players. Further, savings into pension funds and insurance tend to be sticky. Policy makers can tap into their resources for longer-term infrastructure financing.

Risks: Risks stem from stronger than expected real estate recovery or legalisation of alternate currency which may lead some investors to shift away from financial savings (particularly mutual fund). Secondly, we do not see any material reflation thesis playing out in India. High inflation environment historically is seen to favour physical assets over financial assets. Investment in financial sector is also subject to risks from unfavourable change in government taxation policy. At this point, it will also be critical for the industry experts to wisely anchor household expectations so that the realized returns match the expected returns on savings.

Chart 1: AUM growth in various financial products

Source: Union budget, NPS, statista, IRDAI, CMIE, AMFI

Table 3: Penetration of Financial products in India

Source: AMFI, CMIE, IRDAI, NPS

# 3: Infrastructure focus in India and Rising traction of Infrastructure Investment Trusts

In 2020, India came up with National Infrastructure pipeline, with projects guided to be worth Rs. 111 trillion (US$ 1.5 trillion) and to be executed between FY20-FY25. This has now swelled to US$ 1.8 trillion comprising 7,584 projects (as of 15 Feb 2021). As per government’s details, 40% of these projects are at some stage of implementation (1752 projects), 20% under development, while remaining 40% are still a nascent stage of conceptualization.

An increase in investment spending on infrastructure leads to increased demand for goods and services, and to job creation both in building it, and potentially also in ‘operating’ the asset. The income/wages generated by the increased demand are then spent elsewhere, resulting in a so called ‘fiscal multiplier’ effect. On the other hand, an increase in productive capacity resulting from better roads, faster trains, bigger ports, more reliable power supplies, and broader wireless access could have a longer-term “supply side” effect on growth.

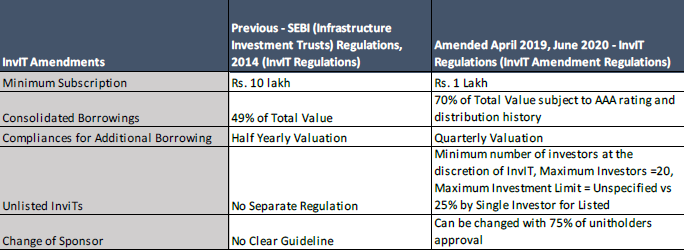

Investment Implication: Funding Infrastructure is an investment theme that can manifest in larger number of infrastructure investment trusts (or INViTS) getting listed which solves financing from both equity and debt perspectives. The regulations around these platforms are constantly evolving and the Government has encouraged suggestions in favour of protecting investor interest and encouraging more sponsors and investor managers (Table 4). Retail-isation of ownership in operating infrastructure assets has only just started in India with potential to multiply manifold every year.

Risks: Infrastructure investments are unlikely to be constrained by funding requirements on either the debt or equity side. The orderly execution, profitability, and demand for these infrastructure projects will determine whether infrastructure could again become a primary driver of investment growth.

Table 4: Amended Regulations reduce the minimum subscription size enabling increased retail participation

#4: Rising growth in mid-tier cities

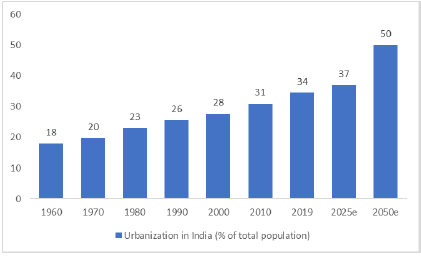

Urbanisation has been a much slower process in India than elsewhere (33% in 2019, World Bank). It is speeding up.

UN estimates Indian urban population rate to rise to 37% in 2025 and 50% in 2050 (Chart 2). But this is still lower and slower than elsewhere in Asia (presently at 55%). This also means that the benefits associated with urbanisation,

better schooling, smaller families, has been slower to unfold in India than elsewhere in Asia.

There are many small, dense settlements that would be counted as urban if population density were the threshold

rather than the size of the town or settlement. And it is here – in these mid-size cities and towns – where most growth is generated. Indeed, India’s urbanisation rate would be a full 10ppts higher under such methods.

One study has shown that that by 2025 India will have 69 cities with a population over 1 million. Economic growth will be concentrated around these cities, and the biggest infrastructure building will take place in these urban centres. Currently, only 27% of the urban population lives in middle-tier cities compared with nearly 50% in China.

Investment implication: As opposed to mega cities, the next leg of growth and profitability will emerge from mid-tier cities, whether it be in real estate or for businesses like home improvement, retail, education, and healthcare. Further, with higher income associated with urbanization, it could propel both consumption and savings. As such consumer durables upcycle appear to have long-leg. Further, savings rate for households that earn USD1,251-USD2,500 per year is 10% while that for households earning US$25,000-US$50,500 per year is 25%. Rising popularity of mid-tier cities reinforces our other theme of financialization of savings in India.

Chart 2: Rate of Urbanization in India

Source: World Bank, UN study for expectations

About the Author

Namrata Mittal is the Indian Economist for SBIFM since 2014. Prior to joining SBIFM, she worked as a consultant in the Foreign Investment Promotion Board (FIPB Unit) and Capital Markets Division at Ministry of Finance, Government of India. She began her career as an Economics associate at HSBC Global Resourcing where she worked on economic research of South East Asian Economies. Namrata holds a Masters’ Degree in Economics from Delhi School of Economics, Delhi. She is also a CFA Charterholder.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”