- August 12, 2024

- Posted by: CFA Society India

- Category:ExPress

Mihir Shirgaonkar, CFA

Vice President – Alternative Investments, Phillip Ventures IFSC Pvt. Ltd.

Member – Public Awareness Committee, CFA Society India

An Uncommon Category | Introduction

On 3rd July 2024, the FTSE Russell changed the classification of Pakistan to a ‘Frontier Market’ from a Secondary Emerging Market. This change was carried out for the failure of the Pakistani stock market to meet the minimum securities count required for maintaining the secondary emerging market status.[1]

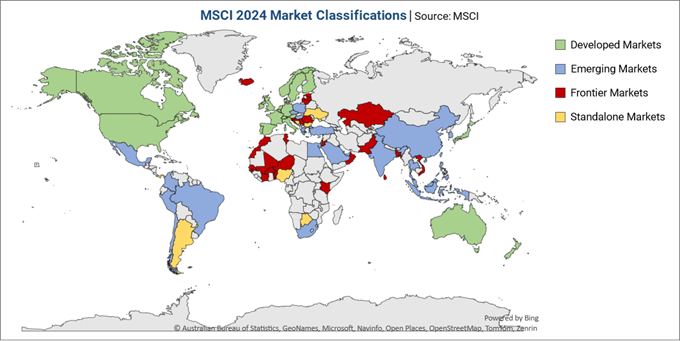

Frontier Markets are a segment of economies that lie between Emerging Markets (EMs) and Least Developed Countries (LDCs). These nations have better macroeconomic fundamentals than the least developed countries but are considered relatively riskier than their emerging market counterparts. Frontier markets are characterized by thinly traded illiquid stock markets, limited investment avenues, lower historical growth rates, and idiosyncratic risk factors. A combination of these characteristics makes investing in these markets highly volatile with the potential for outsized returns as well as the risk of significant value erosion. The presence of idiosyncratic risks results in frontier markets possessing a low correlation with emerging and developed markets.

Organizations such as MSCI, Standard and Poor’s (S&P), and the Financial Times Stock Exchange (FTSE) have different criteria to classify a nation as a frontier market. Each organization has its respective methodology and uses parameters such as market capitalization, liquidity, number of listed companies, regulatory environment, openness to foreign ownership, and others for making the classification.

High-Conviction Bets | Investment Opportunities in Frontier Markets

Investors who recognize and capitalize on emerging trends may position themselves to benefit from the role of frontier nations in the next leg of global growth. Despite liquidity constraints, both institutional and retail investors have been investing early in the potentially high-growth frontier markets with the objective of enhancing overall portfolio performance.[2] The following are some of the considerations for allocating to Frontier Nations:

- Natural Resources: Many frontier nations are rich in natural resources and, thus, could witness significant investments in sectors such as mining, oil exploration, and agriculture. For example, the copper-rich nation of Zambia has the potential to fill the surging global demand from industries such as electric vehicles and renewable energy.[3] The South American nation of Guyana is now the third-largest non-OPEC oil-producing country with over 645,000 barrels per day as of early 2024.[4]

- Demographic Dividends: Frontier markets typically experience demographic advantages with a youthful and expanding population, which drives robust consumer demand and accelerates urbanization. A growing population fosters the emergence of a rising middle class, creating opportunities for businesses and investors. Vietnam, now the fifteenth most populous country globally with 100 million people, is in a demographic dividend period expected to last until 2042. This period is critical for the socio-economic development of the South East Asian nation and is likely to facilitate increased investments in areas such as livelihoods, healthcare, education, and employment.[5]

- Economic Reforms and Liberalization: Frontier markets that are proactive in implementing economic reforms and undertaking liberalization of their economies can foster a more favorable business environment, which attracts significant Foreign Direct Investments (FDI). These reforms, often including regulatory improvements, tax incentives, and open market policies, are the foundation for increased investor confidence, spurred economic activity, and rapid, sustained economic growth across multiple sectors. Uzbekistan has become a major destination for foreign investment due to significant government reforms, particularly the liberalization of market access since 2017. The Third Tashkent International Investment Forum is said to have witnessed the signing of multiple billion-dollar contracts by participants from over 90 countries.[6]

There has been an increasing push by institutional investors to allocate to frontier markets due to the diversification benefits arising from low cross-correlations between frontier nations and other markets. Many frontier nation allocations are available at attractive valuations given their out-of-favor sentiment.

Idiosyncratic Considerations | Risks to Frontier Market Investing

Investing in frontier markets presents idiosyncratic risks that can take the shape of political, economic, and regulatory instability. Such risks can significantly impact investment outcomes and hence require a thorough understanding on the part of investors before committing to investment allocations. Some of the key risks to investing in frontier markets are as follows:

Political and Economic Instability: Frontier nations run the risk of sudden changes in government, abrupt regulatory shifts, and geopolitical tensions that can disrupt business environments and investment returns. In 2022, Sri Lanka saw the resignation of President Gotabaya Rajapaksa following nationwide protests. The country grappled with its worst economic crisis since independence, marked by 50% inflation, default in its foreign debt, and a severe shortage of essentials.[7]

- Market Liquidity and Governance: Frontier markets often suffer from low liquidity, leading to higher transaction costs and difficulties in exiting investment positions. Weak governance structures, including poor corporate governance and lack of transparency, further exacerbate these challenges. Kenya is allegedly a victim of significant governance challenges and pervasive corruption that have undermined numerous productive activities including select infrastructure projects.[8]

- Currency Risks: Currency volatility is a significant risk in frontier markets, where frequent devaluations and currency misalignments can lead to inflationary pressures, increased cost of imports, and challenges in managing external debt. In December 2023, Argentina announced a 50% devaluation of its currency, the peso, from 400 to 800 pesos per U.S. dollar as part of economic measures by President Javier Milei to address the severe fiscal deficit and hyperinflation faced by the South American nation.[9]

While the risks of investing in frontier markets are largely idiosyncratic, external shocks also pose significant risks to these nations due to their heavy reliance on global conditions. For instance, a spike in global interest rates can lead to capital outflows, increasing borrowing costs and causing sharp currency depreciation. Commodity-dependent frontier markets are particularly vulnerable to price swings, potentially disrupting export revenues and economic stability. Additionally, geopolitical tensions or global trade disruptions can severely impact these markets, only to exacerbate already existing vulnerabilities.

Shifting Classifications | Conclusion

Nations are periodically assessed by international organizations on multiple macroeconomic and related metrics and are accordingly upgraded or downgraded across classifications. Nations upgraded from frontier to emerging market status reflect successful transitions driven by economic reforms, stability, and growth. For example, Vietnam was being watched closely by global investors for its possible reclassification to an emerging market from a frontier market under the Country Classification review by FTSE Russel.[10] Conversely, downgrades to frontier market status, such as the recent reclassification of Pakistan, highlight the challenges and volatility inherent in these economies. Such classification changes also present risks and opportunities for investors, underscoring the importance of staying attuned to evolving market conditions when considering a strategic allocation in frontier markets with dynamic environments.

References:

[1] (Updated July 03, 2024). FTSE Equity Country Classification – Pakistan reclassification Secondary Emerging to Frontier market. FTSE Russell – https://research.ftserussell.com/products/index-notices/home/getnotice/?id=2612934

[2] Frontier Market (extracted from the Handbook of Frontier Markets, 2016). ScienceDirect. – https://www.sciencedirect.com/topics/social-sciences/frontier-market

[3] Bradstock, Felicity. (Updated 2024, July 23). Artificial Intelligence Is Sparking a Copper Boom in Zambia. OilPrice.com. – https://oilprice.com/Metals/Commodities/Artificial-Inteligence-Is-Sparking-a-Copper-Boom-in-Zambia.html

[4] (Updated 2024, May 21). Guyana becomes key contributor to global crude oil supply growth. U.S. Energy Information Administration. – https://www.eia.gov/todayinenergy/detail.php?id=62103

[5] (Updated May 2024). Research on Vietnams Demographic Dividend Period. ResearchGate. – https://www.researchgate.net/publication/381182893_Research_on_Vietnams_Demographic_Dividend_Period

[6] Polonskaya, Galina. (Updated 2024, May 10). Uzbekistan’s Investment Surge: Reforms Drive Major International Interest. – https://www.euronews.com/business/2024/05/10/uzbekistans-investment-surge-reforms-drive-major-international-interest

[7] Perera, Ayeshea. (Updated 2023, March 29). Sri Lanka: Why is the country in an economic crisis? BBC – https://www.bbc.com/news/world-61028138

[8] Carson, Johnnie. (Updated 2024, June 27). Kenya’s Crisis Shows the Urgency of African Poverty, Corruption, Debt. United States Institute of Peace – https://www.usip.org/publications/2024/06/kenyas-crisis-shows-urgency-african-poverty-corruption-debt

[9] (Updated 2023, December 12). Argentina announces a 50% devaluation of its currency as part of shock economic measures. CBS News – https://www.cbsnews.com/news/argentina-announces-a-50-devaluation-currency/

[10] (Updated 2024, March 28). Vietnam in waiting list for market upgrade to secondary emerging. Vietnam Law & Legal Forum. – https://vietnamlawmagazine.vn/vietnam-in-waiting-list-for-market-upgrade-to-secondary-emerging-71514.html

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”

About the Author

Mihir Shirgaonkar, CFA heads the Alternative Investments division at Phillip Ventures IFSC Pvt. Ltd. and has been a part of the firm since 2021. He is a Chartered Accountant and has completed MBA-PGPX from the Indian Institute of Management Ahmedabad. He has over 9 years of asset management experience and has worked with DSP Investment Managers (erstwhile DSP BlackRock) and HDFC AMC in his previous roles. In his career so far, he has handled multiple areas which span portfolio management, market making, valuations, fund administration, and project management. His other interests include philosophy, reading, photography, trekking, coding, cooking, and travelling.