- March 13, 2021

- Posted by: CFA Society India

- Category:ExPress

Written by

Prashant Shah, CFA, CIPM

(Disclosure: The views, analysis and conclusions expressed in this article are personal. They do not represent the views of my employer in anyway whatsoever.)

Nowadays if one were to evaluate the composition of the Board of Directors of any listed company, the first thing we would look at is how many independent directors are there on the board. In fact it has now become a fad for many companies management to tom-tom the fact that their board is majority composed of independent directors.

However, is it a reality? Do Independent Directors really exist? Or is it another one of those tricks played on us investors by the powers that be (the Promoter/Management/Regulator/Government – take your pick).

Consider the method in which Independent Directors are selected and appointed.

In all cases that I have come across in my investing career, Independent Directors are chosen by either the Promoters or the Board of Directors or the Management who recommends the names of the persons proposed to be appointed as Directors to the shareholders for their approval. And the pool from which these potential director candidates are chosen from? I would now challenge the reader to think for themselves if they had to choose someone for personal or professional representation, either for themselves or on behalf of another, dependent party, how and who would you choose?

Even in the most imaginative situation, the potential pool is very much restricted to:

1). Friends;

2). The Regular Social Circle;

3). The Professional Circle.

Anyway one slices and dices it, the pool basically is composed of people one already knows and trusts. So an independent director will be basically chosen from a pool of people with which the proposer already has comfort and a rapport with. The above is true even in case of a completely professional promoter/director/Board (another mythical creature in my opinion). After all, one does not devolve any kind of responsibility on someone you don’t know or don’t have enough confidence in.

And as I already alluded (albeit a bit vaguely in my question above), a director is appointed on the Board for a reason and for the skill-set/experience/reputation that they bring along with them.

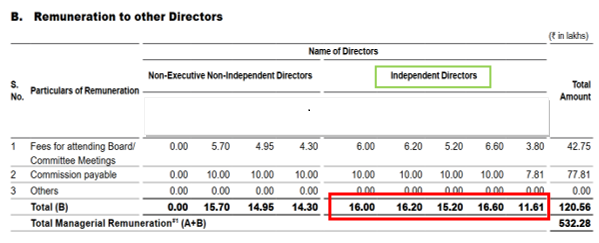

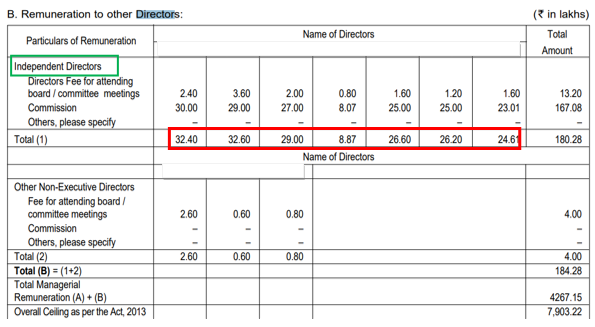

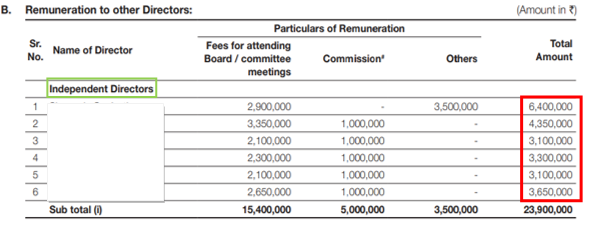

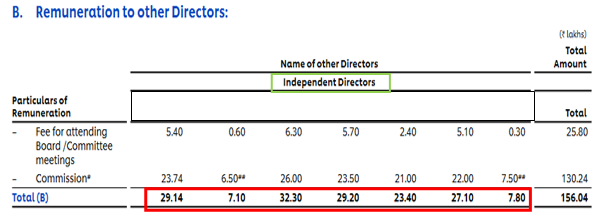

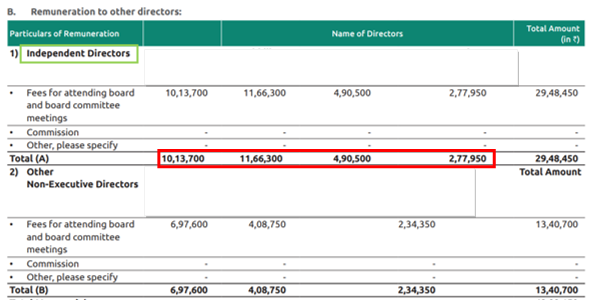

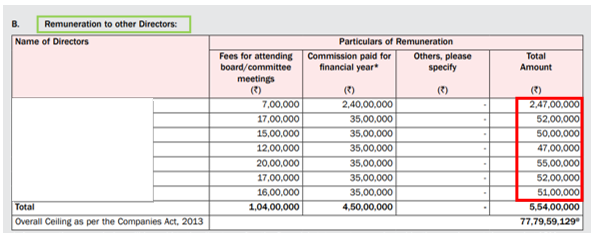

And the director also has his/her own motives to come onto the board, especially as an independent director. First off, consider the remuneration paid by the company to the directors for discharging their duties. I have provided below extracts of the remuneration paid to directors of a few listed large-cap, mid-cap and small-cap companies in FY’20. I have redacted the names of the directors as my motive is to simply provide examples of remuneration paid to directors and not point fingers at any one director or company in particular. All these data are in the public domain and can be found with a bit of searching.

Looking at the above tables, it is easy to see that being a director on the Board of a company is very remunerative (to put it mildly looking at the compensation in some cases). Even assuming that the Independent Directors have their own day jobs which provide them with sufficient income streams (running into multi-crores p.a. in many cases), the compensation paid to them cannot be called pocket change that will not be meaningful to them. If it were not meaningful to them, not many would be bothered to take it up or to turn-up for meetings.

But for argument’s sake, let’s say they don’t do it for the money (however, meaningful it may be). Then why take on the responsibility which will require one to devote their valuable time which could have been used more meaningfully in other profitable or (even better) socially beneficial activities? And which, with recent events and actions by the regulators, involve significant legal, financial and reputational risks?

In my limited imagination (and understanding), if not for monetary purposes, a responsibility is assumed for either of the following 2 reasons:

1). The relationships between the Company Board/Management/Promoter and the proposed Independent director; and/or

2). The prestige associated with serving on a Company’s Board, especially of a marquee company.

Anyway you slice or dice it, there are powerful (financial and psychological) motives at play in serving on the Board of a company. And that begs a question as to why would anyone want to put themselves in a position where they lose all these benefits by crossing the decisions of the promoters/management/majority of the board? Maybe this is the reason why we have had so many cases of companies failing despite the Board having representation of “Independent Directors”.

So what is the alternative? How do we ensure that Independent Directors function in the manner and motivation for which this category of directors was created and for which they were appointed?

SEBI has recently released a consultation paper on Review of Regulatory Provisions related to Independent Directors (https://www.sebi.gov.in/reports-and-statistics/reports/mar-2021/consultation-paper-on-review-of-regulatory-provisions-related-to-independent-directors_49336.html). One of the proposals is that of a “Dual Approval” for appointment of Independent Directors through approval of Shareholders and subsequently, an approval of majority of minority shareholders. And another one is to replace profit-linked commission with ESOP type structure for the Independent Directors.

However, based on a cursory reading of the proposal, these do not resolve the core issue of identification, selection and motivation of the person to be appointed as an Independent Director. According to me, the answer lies in re-defining the talent pool and re-jigging the motivations of a person to serve on a board.

The first can be achieved by one of 2 ways:

1). SEBI can create a list of pool or people accredited to be Independent Directors from which Companies can choose; or

2). Independent Directors can be chosen from among the existing shareholders.

Of the 2, I feel the second option has potential to strengthen the role of the Independent Director, if it is designed and implemented properly. One criterion which can be implemented is that the person chosen from amongst the existing non-promoter and non-executive shareholders should have a minimum period of holding to qualify as a nominee. This will eliminate the possibility of a known party being placed amongst the non-promoter and non-executive shareholders for nomination. However, there will be problems associated with identifying the appropriate shareholder with the required skills and experience from among the many thousands of existing shareholders of a company.

The other way is to re-jig the motivation for serving on a Company’s Board through re-designing the compensation/remuneration structure for Independent Directors. Similar to ESOPs to KMPs of companies, Independent Directors can be compensated for their Board duties through Independent Director Stock Option Plans (IDSOPs). These IDSOPs can be designed to vest over the period of their directorships on the Board with a possible stipulation that they can be exercised only after their exit from the Board. An additional rider could be that the exercise can happen only after a cool-off period post the exit.

The IDSOPs will actually align the interests of the Independent Directors with those of the minority shareholders, whom they purport to represent when they are appointed on the Board. As is evident, they will be compensated only if the company does well which will be reflected in the financial performance and the stock price performance. So this will force them to act in the best interests of the company as a whole and for the minority shareholders in particular. And since the IDSOPs will vest sometime in the unknown future, these decisions should (hypothetically at least) be taken with a longer term perspective in mind.

This can be true even in cases where nominations and selections are from the above-mentioned pools of known parties of Company Promoters/Directors/Management. After all, over a period of time the IDSOPs to which the Independent Director becomes entitled, eligible and which will be vested will become a substantial amount for them also, which they will not be able to brush-off as insignificant or immaterial. So, in my belief, irrespective of the relationships between the Company and the Independent Director, they will be sub-consciously forced to act in their own best interests as shareholders of the company.

Hence, to bring Independent Directors from the realm of the Myth and into reality, we need to make them truly independent by recognising their motivations to serve on the Board of a Company and to compensate them appropriately and in the right form to align their interest with their purported representation constituency – the minority shareholders.

And in case of fraud or mismanagement on part of the Board, these IDSOPs, which are yet to vest and exercise, can be revoked and cancelled, leaving the Independent Director financially penalised as well as facing legal and regulatory actions.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”