- July 23, 2022

- Posted by: CFA Society India

- Category:ExPress

Written By

M.R. Raghu, CFA, FRM, FCMA

CEO, Marmore Mena Intelligence

Structural factors shaping oil prices

Among the basic necessities for human survival (food, shelter and clothing) it may not be out of context to add energy needs. Energy cuts across everything from transportation to electricity. Thanks to a confluence of multiple factors including geopolitics, oil prices have increased tremendously during the last two years (currently at $110/barrel) inflicting pain on oil importers like India. India’s oil dependence is like the tale of the boiling frog and imposes a heavy cost on the economy and therefore on companies operating in the economy. High oil price impacts multiple economic activities and hence most of the economies around the world subsidize energy heavily so that GDP growth is not impacted. Before, we examine the portfolio context let us examine the structural factors shaping oil prices globally.

At a broad level, we have oil producers, oil consumers and oil exporters/importers. The dynamics shaping the thinking is different based on which lens you use. Major oil producers like the USA are also major consumers leaving little for exports. In fact, the US produces more oil than Russia. Major producers like Saudi Arabia or Russia enjoy a significant surplus in oil production that they profitably monetize through exports.

However, large economies like China and India continue to be just oil consumers with no significant domestic production. This causes them to be energy dependent on oil exporters who control the supply. Hence, studying the factors that influence supply may be important here. Presently OPEC+ that includes major Middle East oil exporters and Russia tightly control the market to defend prices. However, the Russian-Ukraine conflict has created a deep divide between importers (like the EU) and exporters (like Russia). It is highly unlikely that “business as usual” returns any time soon between Russia on one side and the US/EU on the other. Essentially oil has introduced a new political cost to buyers apart from the environmental cost that they were paying earlier.

Oil price experiences significant volatility due to which investments in new fields have also become volatile. Also, given the clean energy demands and appreciation, the conventional oil sector experienced significant underinvestment during the last decade capping the supply. Most of the oil exporting counties need an oil price of $80 and above to sustain their budgets. Anything less than this would inflict a hole in their budget. However, oil price above $100 starts to bite consumers. Hence, both consumers and exporters lobby to achieve some sort of equilibrium. Energy demand is highly correlated to global growth and hence any recessionary fears will have the effect of pulling down the oil price. In this interplay between demand and supply comes the unpredictable geo-political developments (like the Russia-Ukraine war) that can cause temporary spikes in oil prices.

Commodities markets are rarely in equilibrium and hence overshoots on both the demand and supply side can feed high volatility. In short, oil price less than $80/barrel is good news for consumers and bad news for exporters. Oil price within a range of $80-$120 can be considered an equilibrium band while oil price above $120 is bad news for consumers and good news for oil exporters . The huge underinvestment in the sector coupled with supply outages due to geopolitical reasons makes me believe that oil price has structurally moved to a band of $80-$120/b in the long-term with significant volatility. Such a trend will also accelerate the move towards alternatives like renewable energy which can be bearish for oil exporters in the long run.

Impact on the Indian Economy

The first immediate touch point of high oil prices is through the current account balance estimated at -1.2% for FY21-22. In terms of the impact of high oil prices, it is estimated that a $10 increase in oil price is likely to result in a widening of the current account deficit by 40 basis points from levels of $100/barrel oil price and a similar impact on inflation. Another related touch point would be a sub-set of the Current Account which is a trade deficit. A trade deficit is essentially the difference between imports and exports. For the 1st quarter of this fiscal year (April 2022-June2022), India’s trade deficit will balloon to $70 billion up from $31 billion a year earlier. Overall trade deficit is now expected to touch 1.5% of GDP leading to dollar deficits. Net energy imports at $150 billion is roughly equivalent to 5% of India’s GDP. High oil prices will result in more outflow for essentially the same quantity. For e.g., in FY21-22, India paid $144 billion for oil imports ( 212 metric tons of Crude and 40.5 metric tons of crude products) while in FY 20-21, India paid $77 billion (196 MT of crude & 43 MT of crude products). For a marginal increase in the quantity, the cost has almost doubled thanks to the high oil price. Hence, it is a significant pain to contend with.

The second important touchpoint would be in the form of higher inflation. Crude and crude derivatives account for approximately 5% of weight in CPI and roughly 10% in WPI. Hence, any increase in crude prices will influence the overall inflation significantly. Fuel is the main driver of inflation, having increased 10% in May 2022, while Food increased by 8% taking the overall inflation to 7%. A reading one year back produced a fuel increase of 12%, a food increase of 5% and overall inflation at 6.3%. High inflation triggers several policy responses both from RBI and the government as emerging markets the world over know how lethal inflation management could be if left unaddressed for a period of time. Also, high energy prices tend to reduce domestic demand as people tend to cut down consumption of other products in order to pay for fuel.

There are many options to manage the dollar deficit induced by the trade deficit. We should either increase exports or reduce imports or attract capital inflows. The situation presently is not conducive for any of them to happen. For example, higher export growth can happen only when the global GDP growth picks up. Presently, the world is anxiously waiting for the recession to play out. Reducing imports can happen on the back of a slowing economy triggered by higher interest rates. However, this technique will take time to play out and will not produce an immediate result. The third option of augmenting capital inflows is easier said than done in this volatile geopolitical environment. If there is anything, India is experiencing severe capital outflows at least on the portfolio side. If we cannot reduce imports through increasing interest rates, we can reduce imports by making them expensive via currency devaluation or depreciation.

The Indian currency has been exceptionally strong in the last few years, unlike an emerging market. A systematic currency depreciation of say 10% annually will also mitigate the need to use hard-earned foreign exchange reserves to defend the currency. Unlike other countries like South Korea or Japan where high forex reserves are primarily due to trade surplus (and dollar surplus implied), India’s high forex reserve is a function of capital flows rather than trade surplus. Capital flows can be volatile and can leave anytime. Hence, it may not be a wise idea to use these reserves to defend the currency.

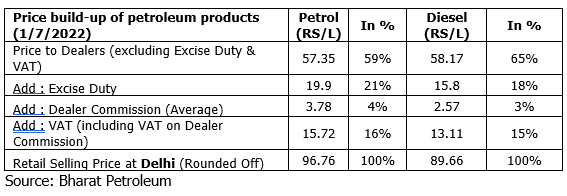

The economic impact of higher oil prices can also be examined from how the fuel pricing happens in the country. The data depicted in the table shows that there is a heavy tax component to the overall pricing which can be tweaked based on how it impacts the end consumers. In times of rising oil prices, the government can choose not to pass on the increase by calibrating the taxes and vice-versa. Any decrease in taxes will mean a decrease in revenues for the government which will increase the fiscal deficit. Hence, using this tool can at best be a temporary fix, while in the long-run higher oil prices will essentially result in high fuel prices at the pumps.

The Portfolio Context

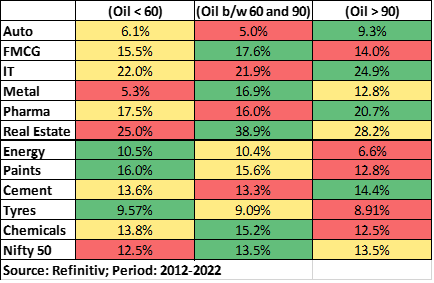

From a stock market perspective, higher oil price tends to affect some sectors directly and many other sectors indirectly. (Table) However, many of them might experience lags, as they need pass through time. Sometimes companies may decide to live with lower margins in order to protect the market share or market conditions may not be conducive to pass on the cost increase. While others may enjoy significant pricing power (due to market leadership) and hence may have a lower impact. Sectors like Paints, Tyres, Aviation, Chemicals and Logistics will have a direct and immediate impact while sectors like Cement, FMCG and Discretionary can have lag effects. Nearly 60% of raw material costs are accounted for by oil and oil derivatives for Paints and Tyres. For Aviation, 40% of raw material cost is accounted by Aviation Turbine Fuel (ATF). Based on a study of quarterly data since 2012, we can see that most of the sensitive sectors felt the heat of lower margins though we can notice some exceptions as well. For e.g., sectors like Auto, Information Technology, Pharma and Cement enjoy margin increases during a high oil price regime while sectors like FMCG, Energy, Paints, Tyres and Chemicals suffer margin erosion during a high oil price scenario. It will be instructive to underweight these sectors in times of high oil prices.

In conclusion, India’s oil trap can have serious long-term implications for economic growth, currency value and stock markets. Understanding this link and compulsions that define global oil market can enable portfolio managers to construct portfolios smartly. Any overshoot in oil prices can also significantly accelerate adoption of renewables which so far suffers from a very low market share. Macro observations on how this shift is playing out is crucial to portfolio positioning for the long-term.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”

About the Author

Raghu is the CEO of Marmore Mena Intelligence based in Chennai. Marmore is a subsidiary of Kuwait Financial Centre (Markaz), a leading asset management company based in Kuwait with AUM exceeding $3b. Marmore provides consulting and research services to Middle East and global clients. Raghu also serves as an Economic Advisor to Markaz. In a career spanning more than 33 years, Raghu has dedicated nearly 22 years in the Gulf region (Riyadh, Bahrain and Kuwait). Prior to his stint in the Gulf region, Raghu worked with several leading institutions based in India including the largest mutual fund Unit Trust of India and the largest engineering consultancy MECON. Raghu provides regular opinion on markets, economy, sectors and other business angles through blogs, columns and speeches. He specializes in big picture research with a keen interest in energy markets, asset management, investment research, capital markets and GCC. Raghu has obtained CFA Charter from the CFA Institute, USA (2003) and is a certified Financial Risk Manager (FRM) from the Global Association for Risk Professionals, USA (2005). He is also a Fellow member of The Institute of Cost Accountants of India (1987). He is associated with CFA Institute as a volunteer since 2003. He was the founding board member of CFA Bahrain Society and founding President of CFA Kuwait Society. He was also a member of Education Advisory Committee of CFA Institute (2012-2019). Raghu attended a 2-week Investment Management Workshop at Harvard Business School in 2007. Raghu enjoys motor biking, playing online chess, watching Cricket and reading books.

Website: https://www.mrraghu.com/

LinkedIn: https://www.linkedin.com/in/mrraghu/

Twitter: @mandagolathur