- October 4, 2022

- Posted by: CFA Society India

- Category:ExPress

Rajeeb Bharali, CFA, Member, Public Awareness Committee, CFA Society India

Nitin Kumar Singh

Coming out of a benign market environment, which dwelt for a good part of the period post-GFC, the last 2 years have been marked by heightened volatility in capital markets, led by an unprecedented health crisis (COVID) that still continues to cast its impact. This has been further exacerbated by the Russia-Ukraine Conflict. Along with the intensified market uncertainty, we have also witnessed a substantial rise in global inflation. What started off as a blip in the supply chain post-covid-lockdowns gathered more steam led by strong demand due to amassed savings and swaths of relief funds. Over time, this has developed into a meaningful headwind, enough to keep central bankers across the world busy. To make matters worse, the ongoing crisis in Ukraine and the sanctions/counter-sanctions imposed on/by Russia have led to a massive spike in energy prices. With energy being a key input cost, the follow-through effect of supply shortages and price hikes have impacted consumers around the world.

With Inflation being a growing concern for investors and asset managers, it is only appropriate to revisit some of our beliefs on

- How various asset classes react to it?

- How we can position our portfolios to provide an effective short term hedge against inflation while continuing to generate positive real returns?

In this article, we look at a range of asset classes, including real assets, and gauge their efficacy in protecting against inflation. We also analyze how inflation has trended over the past century and what we can learn from historical evidence. Finally, we propose a way forward on how we can create an effective mix of asset classes that can help protect our investment portfolios against inflation.

Methodology:

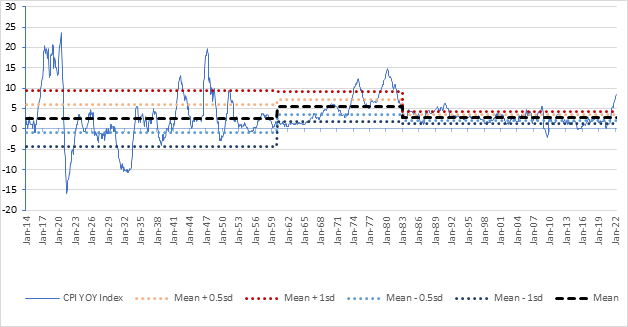

In order to test the performance and hedging abilities of various asset classes, we first need to understand patterns in inflation and be able to define “regimes”. We use “US CPI” as the indicator for inflation and study the historical record going as far back as we can (till 1914). As can be seen clearly from the chart below, we can identify 3 long-term structural shifts in trend.

- The period from 1914 till 1959 was one of high uncertainty/volatility with CPI undergoing wild swings on either side. This period included the 2 greatest wars that modern human civilization witnessed and saw some deep recessions like the great 1929 depression, German Hyper-Inflation etc.

- From 1960 until early 80’s, it was a period of an up-trending inflation. From around sub 2% levels, inflation rose to a high of ~15% during this period.

Finally, we have the regime that we are currently in. This started from early 80’s onwards. For a good part of last 4 decades, we have seen subdued inflation reading and a lot of sideways movement until very recently where CPI has touched the highest level in the last 4 decades.

Given 3 distinct structural regimes in inflation over the last century, it is imperative for any historical analysis to take into account these regime changes. To do this, we have categorized inflation into five different sub-regimes within each of the 3 structural regimes:

- Deflation : CPI <= 0

- Benign : CPI > 0 and CPI <= Mean of the regime

- Normal : CPI > Mean and CPI <= Mean + 0.5 standard deviation of the regime

- High Inflation : CPI > Mean + 0.5 standard deviation and CPI <= Mean + 1 standard deviation of the regime.

- Hyperinflation : CPI > Mean + 1 standard deviation of the regime.

Note: For any period to be classified as a regime, the classification must sustain for at least 6 months.

Having defined the inflation regimes, we then proceed to compare and contrast the performance of various asset classes under each of these regimes. We found that while traditional assets (equities, bonds) do relatively well in low-inflation (benign, normal) regimes, their performance starts to deteriorate as inflation picks up and enters the high and hyperinflation regimes. On the other hand, real assets like commodities, real estate etc. exhibit the opposite trend, i.e. performs better than traditional assets during higher inflation regimes.

Furthermore, we find the directionality of inflation to be of importance. Our analysis finds that, even within higher inflation regimes, traditional assets start recouping some of their losses as inflation cools off and proceeds in a falling trajectory. To identify the directionality, we compare the CPI reading to a moving average of the prior 6 months and follow the below logic:

- Falling: CPI <= MA of prior 6 months CPI

- Rising: CPI > MA of prior 6 months CPI

We analyze asset class characteristics in all the five regimes and to check different response of these asset classes to each regime. However, for this article we focus on just the hyperinflationary regimes as these periods are more prolonged and frequent in comparison to high inflation regimes. This prolonged nature of the regime also gives investors a chance to take measures to improve the inflation resiliency of their portfolios. We study these time-series separately and also a combined dataset.

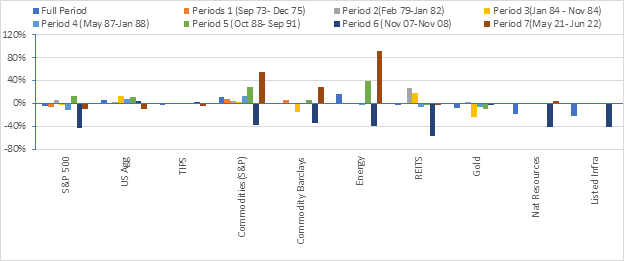

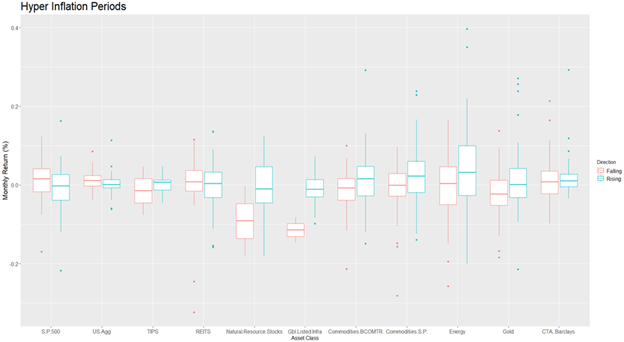

Period 6 can be assumed as a special case as the underlying reason for that hyperinflationary environment were very unique. From the above chart we can see that in general, Commodities especially Energy tends to vary in the short term but the performance still seems mixed. However, we can improve our understanding further if we break the regime into rising and falling inflation. Below chart demonstrates the divergence in performance across asset classes during rising and falling inflation.

Note: The chart above shows 2 different indices for Commodities – Bloomberg Commodity Index (BCOMTR Index) and S&P GSCI index. The reason for including both indices is to examine the impact of “Energy”. BCOMTR Index is relatively equal weighted across commodity sub-sectors while S&P GSCI has ~52% of its allocation to Energy alone and this does result in a performance differential.

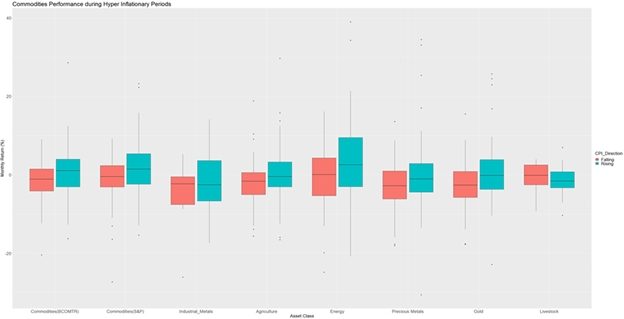

Further segregating Commodities to understand the dynamics across its sub-sectors, we see in the below chart that Energy is a key component as it relates to providing an inflation hedge.

Some of our key findings are summarized below:

- We can see that traditional asset classes (Equities and Bonds) suffer particularly in Hyperinflation – Rising Inflation.

- Gold, contrary to the general market belief, is not an effective inflation hedge in the short term.

- REITS do relatively well in high inflation regimes but most of the good performance is realized when inflation starts to fall. That might be tied back to REITS being more tightly correlated to equities.

- Commodities do quite well as a short term inflation hedge. We also further breakdown Commodities into underlying components and observe the same trends in rising and falling hyperinflationary regimes. We also compute Hit Rates for different asset classes which further favor Commodities (>60%) as a better short term hedge for inflation.

- Treasury Inflation Protected Securities (TIPS), which provide income explicitly linked to realized inflation through a semi-annual adjustment to the bond principal, have a lag in their indexation to CPI. However, given its design it does protect against higher inflation, generating a positive, albeit small, positive real return most of the time.

Thoughts on Portfolio Construction:

How the above observations can be accounted for in portfolio construction to tackle inflation is in itself a very broad topic and warrants further work.

Our initial thought is to consider inflation as a tail risk in the short term to which a potential solution could be to create a basket of real assets (Commodities, Real Estate, TIPS) that can be used tactically based on our views of inflation forecasts. One argument in favor of having this basket of real assets as a strategic asset allocation piece is that it can be a good diversifier to traditional assets. However, our initial assessment shows that having it as a strategic component comes with an opportunity cost.

The creation of the basket would need a few considerations to be built in:

- Short term asset class correlation term structures during inflationary periods: The correlation between the asset classes change quite noticeably at the start of high inflation periods and then revert back to more stable long term means by 30-48 months.

- How much allocation should be given to the basket since the basket itself has significant directional risk. Hence, an appropriate framework to tactically rotate in and out of the basket needs to be devised.

Conclusion:

Inflation has been a bane for investors and will continue to be so. While the last 2 decades witnessed muted inflation, it has picked up significantly of late registering multi-decade highs. Initially thought to be transitory by many, inflation now poses a real threat to investors and the current bout of high inflation could well pan out to be the start of a new and sustained high inflation regime. Hence, a dedicated effort should be made to position one’s portfolio in line with rising inflation and be able to navigate through this period while continuing to generate attractive real returns. Real assets, more specifically, Commodities can be an attractive asset class to look at given its proven track record of hedging against inflation. An effective way to integrate real assets into one’s portfolio can contribute meaningfully as we navigate through this high inflationary period.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”

About the Authors

Rajeeb Bharali, CFA

Rajeeb is a seasoned investment professional with ~11 years of experience in the field of investment management. His primary area of work is into asset allocation/portfolio construction for Fund of Funds (FoF) and investment manager research and selection. Rajeeb holds a BS in Engineering from Birla Institute of Technology, Mesra, graduating in 2008 and is an active member of the CFA Institute as well as the CFA Society India.

https://www.linkedin.com/in/rajeeb-bharali-cfa-57565095/

Nitin Kumar Singh:

Nitin is an investment professional with ~5 years of experience in the field of investment management. His primary area of work is into asset allocation and portfolio construction. Nitin holds a B-Tech in Engineering from IIT Dhanbad and MBA from NMIMS Mumbai, graduating in 2017. He has also cleared CFA Level 2.

https://in.linkedin.com/in/nitin-singh-0bb3aa67