- July 23, 2022

- Posted by: CFA Society India

- Category:ExPress

Written By

Alok Agarwal, CFA, CMT

Fund Manager- Equity, Alchemy Capital Management

One of the most talked about subjects in recent years has been the action taken by the Central Banks across the world and its impact on various risk assets – especially equity.

I am trying to understand the inflation and liquidity aspects from the viewpoint of an equity investor.

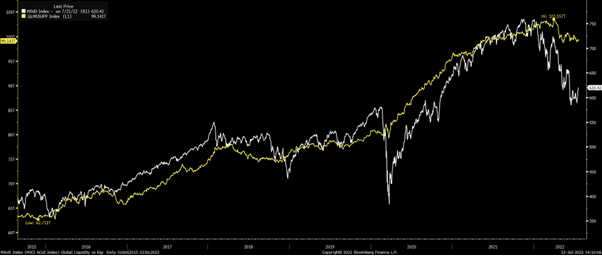

At the outset, I wanted to first understand objectively, whether inflation and global liquidity has an impact on the equity markets. To take the study further, inflation numbers were officially present, but the liquidity number was not something which was readily available. Hence, I took the money supply (M2) of the top economies/regions of the world and added them together to get my liquidity proxy, which we call “The Global Money Supply”. To see the relation visually, I drew this Global Money Supply (in yellow) along with Global Equity Market Index (in white), as shown below:

Source: Bloomberg Finance L.P.

The correlation was clearly established (of course with its own lag/lead effects). The sharp rally in global equity markets in 2017, 2020 (post-Covid) and 2021 coincided with sharp increase in global money supply. Interestingly, in 2018 and 2019, when global money supply was consolidating, the global equity markets also didn’t move much, but broader markets in most countries saw sharp corrections.

This analysis had objectively proven the importance of liquidity on global equity markets, especially in the post GFC times, ever since cutting rates and expanding balance sheets (Quantitative Easing) had become a mantra for problem solving for most central banks.

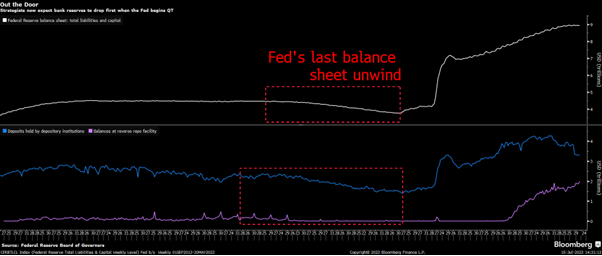

Intuitively, more liquidity would lead to more money chasing the same set of goods and services and hence, it should lead to inflation. Interestingly, while Quantitative Easing (QE) was on ever since GFC, inflation was largely contained across the world, especially in the developed countries. Inflation in control meant that the Central Banks could effectively “print” their way out of their problems. It was also good for the ruling governments as it ensured their deficits were smoothly financed and they could dole out concessions to the public at large, gaining political mileage along the way. The cycle was smooth, complete and seemingly a win-win situation. Just to give you an indication of the expansion, Fed Reserve Balance grew from $0.7 tn in 2002 to $0.9 tn in 2008 (July) – an annualized growth of mere 5.2%. Over the next 7 years, the Fed balance sheet expanded 5x to $4.5 tn (26% CAGR). The expansion stopped for some time and the Fed also started reducing the size in 2018 and 2019 to take the total assets to $4.2tn in Feb 2020. But, then Covid struck, and now the Balance Sheet stands at $9 tn.

Source: Bloomberg Finance L.P.

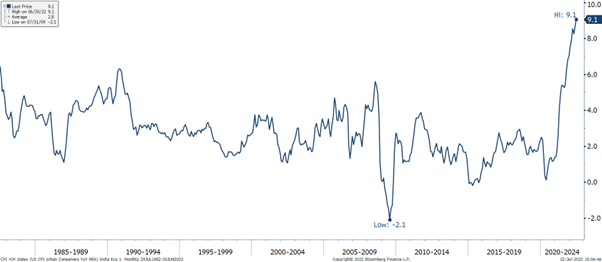

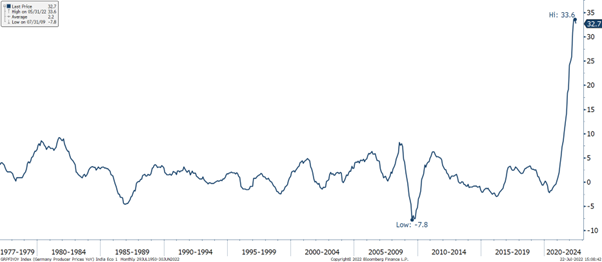

The all-so-smooth-ride is facing its worst enemy now – Inflation. The inflation is at a multi-decade high for most countries and not just the US. The US printed 9% inflation – not seen in the last 4 decades, Germany’s Producer Price Index is at 32.7% – the highest in recorded history since 1977, India WPI is in double digits for the last 15 straight months – not seen since 1991. The only major economy, which is not facing inflation trouble yet, is Japan, where inflation is at a seven year high of 2.4%, much lower than the 4-decade high of 4.2%.

US Inflation:

Source: Bloomberg Finance L.P

Germany PPI:

Source: Bloomberg Finance L.P

India WPI:

Source: Tradingeconomics.com | Office Of The Economic Advisor, India

The Central Banks initially dismissed the higher readings as transient in nature, but consistent prints and possibly lower political support ensured hikes at a pace not seen in recent history. While inflation has risen across the world to about 4-decade highs, the yields are nowhere close to even half of the yields prevalent 4-decades ago. While this comparison has been made by many, it doesn’t serve its intended purpose, due to various other macro level changes. In the initial part of post GFC QE, most people could not imagine that rates could be headed to near 0. However, in current times, most believe (and quite rightly so) that as long as inflation (and its expectations) remain well above tolerable limits, the Central Banks will be forced to continue with rate hikes and balance sheet reduction (or Quantitative Tightening, QT). As long as QT goes on, the global liquidity would be expected to fall. This is intuitively negative for risk assets – including equity.

The impact of QE was valuation expansion and abundant money available to most companies, even if they were burning cash. The reverse is likely true for QT. The valuations have compressed in the last 9 months. Nifty one-year forward PE has reduced from all-time highs of 22.8x in Oct’21 to 17.5x now (close to a 10-year average valuation) and news reports suggest that funding has dried up for those where profits are not in sight.

Clearly, bulk of the excesses in the markets have been taken out, significantly improving the risk:reward potential from here on.

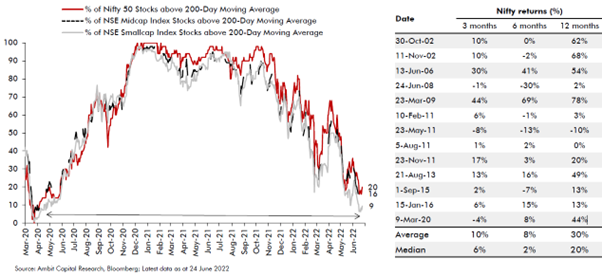

Historically, buying/adding in actual corrections has proven to be quite rewarding. E.g. Recently too, only 20% of the Nifty stocks were above the 200 Day Moving Average (DMA). A study of the last 2 decades reveals that, from the day this number goes below 20%, Nifty has delivered 20% 12M fwd. median returns.

Source: Ambit Capital Research, Bloomberg: Latest data as at 24 June 2022

When this cycle will turn is anybody’s guess. The joker in the pack is ‘Inflation’. The energy prices have corrected sharply in the last month or so, plus most metal prices are near 1-year low. These changes indicate that possibly we may have already seen the worst of inflation. If inflation and its expectations start heading south, the liquidity withdrawal could have a breather. Moreover, most strategy notes these days are being written about yield curve inversion and how it predicts recession. It’s difficult to imagine the possibility of recession along with rising inflation and rates. Hence, the cycle turn could be round the corner, like you, we are all watching closely.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”

About the Author:

Alok Agarwal, CFA is an experienced equity fund manager with a demonstrated history of working in the financial services industry and a successful fund management track record. He is currently working as Fund Manager – Equity at Alchemy Capital Management. In his prior role, he managed PGIM India Large Cap Fund, PGIM India Hybrid Equity Fund, and PGIM India Equity Savings Fund, among the open-ended funds offered by PGIM India Mutual Fund. He was also the fund manager of PGIM India Global Equity Opportunities Fund, which is a Fund of Fund. Agarwal is a guest lecturer for leading management institutes.