- January 8, 2023

- Posted by: CFA Society India

- Category:ExPress

Written By

Mihir Shirgaonkar, CFA

AVP - Alternative Investments, Phillip Ventures IFSC Pvt. Ltd.

Member - Public Awareness Committee, CFA Society India

Introduction

The Global Financial Crisis of 2008 was a turning point for international trade. The extreme stress on global financial markets and banking systems caused by the subprime meltdown dealt a massive blow to the free flow of trade, capital, and labor, the effects of which continued well into the 2010-2019 decade. The years that followed the crisis have not seen international trade grow at the pace that was otherwise witnessed in the 1980-2010 era of globalization. ‘Deglobalization’ is being increasingly identified as a trend, the origin of which can be traced to the 2008 crisis. In this article, an attempt is made to discuss trends in global trade in the context of events in the previous and current decades.

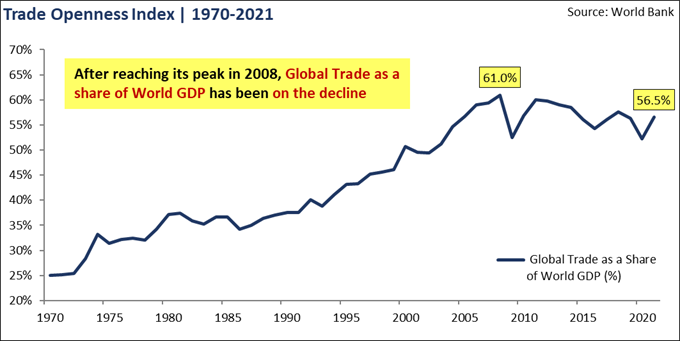

A reading of the Trade Openness Index (measured as the ratio of total exports and imports to the total GDP) of the world suggests that the impact of global trade on world GDP peaked in 2008. The share of global trade in world GDP is seen declining post-2008:

2010-2019 | Fragmentation Begins

The global financial system was still recovering from the aftermath of the 2008 crisis at the start of the 2010-2019 decade. World trade did bounce back sharply in 2010 from the 2009 lows. However, the growth of world trade thereafter has been characterized by the nomenclature slowbalization. In the context of global trade, the following events caused a significant impact in the years gone by:

Reforms and Policy Actions: The previous decade saw global powers turn inward as they pursued reforms that have been largely perceived as protectionist and, in some cases, against the principles of free trade. For example:

- The America First trade policy of President Donald Trump was aimed at a reduction of trade deficits of the United States by reducing imports and increasing exports. This policy looked at American withdrawal from international treaties and organizations.

- The Made in China 2025, a ten-year plan unveiled in 2025, is a national industrial policy of the Chinese Communist Party aimed at self-sufficiency in high-tech manufacturing. Per this policy, China aims to reduce its dependence on foreign technology and direct investments toward innovations that will enable domestic Chinese companies to compete locally and globally.

Shale Gas Boom in the US: The combination of hydraulic fracturing and horizontal drilling enabled the United States to significantly increase its natural gas and oil production post-2010. The availability of low-cost natural gas resulted in the US industrial revival with investments turning inbound. In 2019, the US trade deficit was USD 309 billion lower than what it would be if there was no shale revolution. By the end of the decade, the US was no longer the largest importer of oil.[1]

US-China Trade Wars: In 2018, the United States and China started implementing policy measures against each other in the form of tariffs on imported goods across various categories. One of the objectives identified by the US while imposing tariffs on Chinese goods worth USD 360 billion has been to reduce its trade deficit with China which stood at USD 419 billion by the end of 2018. It may, however, be noted that according to a study conducted by Columbia Business School, the US-China trade wars resulted in the overall growth of global trade by 3%, suggesting that the trade wars created new opportunities for trade.[2]

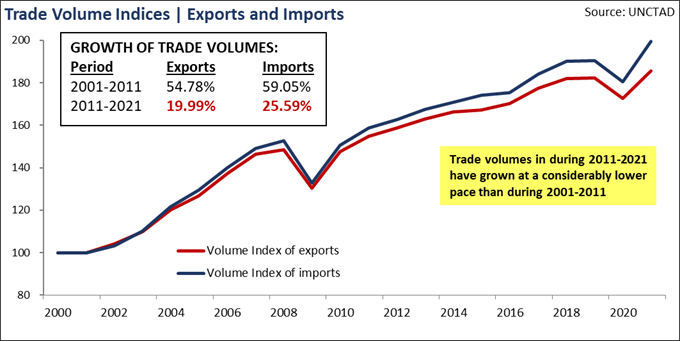

During the 2011-2021 period, the growth of merchandise volumes was seen slowing down as compared to that in the 2001-2011 years:

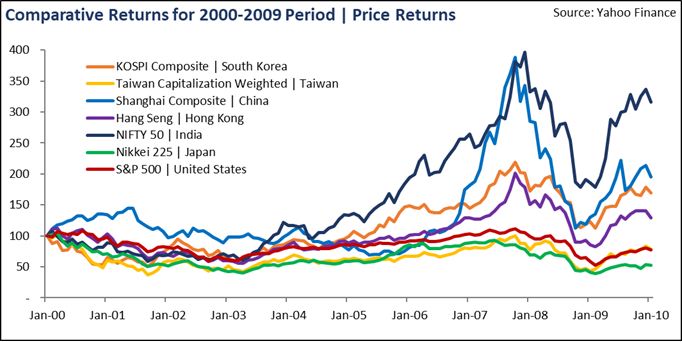

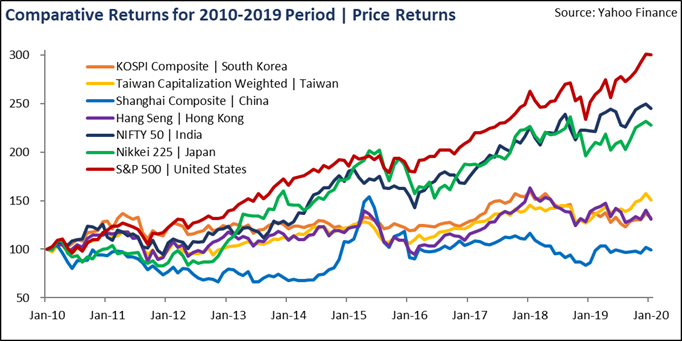

Interestingly, equity benchmarks of select emerging market economies (South Korea, Taiwan, China, Hong Kong, India) outperformed those of the United States and Japan during the 2000-2009 years which are considered the peak period for globalization. In contrast, during the 2010-2019 period, the above-chosen emerging market equity benchmarks largely underperformed those of the two developed economies.

The 2020s | Fragmentation Continues

The current decade is synonymous with disruptions. The events that followed the onset of the pandemic in early 2020, have exacerbated the slowing growth of international trade:

Prolonged Pandemic: The institution of national lockdowns in response to the spread of the COVID-19 virus caused severe disruptions in manufacturing due to a shortage of labor and a slowdown in the movement of raw materials and finished goods. For a brief period, this brought about the export of major goods to the brink of a complete halt. The recurrence of fresh outbreaks of the virus continues to result in international travel restrictions which impairs the free flow of labor.

Supply Chain Disruptions: Increasing demand for e-commerce and shifting consumer preferences following the reopening of the economies after the initial pandemic-induced slowdown gradually led to demand-supply mismatches and added pressure on the global supply chain in the form of surging shipping costs, port congestions, increased lead times, and semiconductor shortages among others. Strict lockdowns imposed by China as part of its Zero-COVID policy aggravated the problems for global manufacturing. Continued disruptions in supply chains have propelled organizations to rethink their supply chains and diversify away from China. According to a survey by Capgemini, close to two-thirds of organizations surveyed are actively investing in regionalizing and localizing their manufacturing and supplier base.[3] This is contrary to the otherwise historically cost-efficient practice of outsourcing manufacturing to nations with low-cost labor.

Russia-Ukraine Conflict: The Russian invasion of Ukraine in February 2022 and the actions that followed introduced a new set of disruptions to the global supply chain. Sanctions imposed on Russia collectively by the United States and other nations resulted in Russia being cut off from SWIFT, thus, effectively from global trade. A report by World Bank has suggested that the Russia-Ukraine conflict is likely to result in a decline in world trade by 1% which will also result in a lowering of global GDP.

US-China Chip War: In October 2022, the United States announced controls directed toward exports of semiconductors to China by not only US-based chipmakers but also global giants using American technology. Global suppliers of semiconductors and fabrication tools will most likely suffer a major dent in their revenues due to demand lost from China. In these export controls, restrictions have also been imposed on individuals associated with Chinese chipmakers.

Opportunities for Select Emerging Markets

Since the beginning of the US-China trade war, global manufacturing has been seen moving away from the ‘world’s factory’ (China) to five nations: India, Taiwan, Vietnam, Malaysia, and Bangladesh. However, achieving the scale of infrastructure built by China over the years will be an uphill task for these other nations.

Mexico and select South American nations may also benefit from the abovementioned shift. American firms may benefit from nearshoring their manufacturing operations by shortening their supply chains.

It is to be seen to what extent can the above opportunities translate into equity returns for the respective nations.

Conclusion

Disruptions to the global supply chains amid a prolonged COVID-19 pandemic and geopolitical dynamics and increasingly protectionist measures by nations as a response to geopolitical dynamics are likely aggravating the already slowing growth of global trade in the present decade. Nations that have been largely dependent on an otherwise successful export-driven model of growth may have to consider inward-oriented strategies to mitigate the effects of a likely slowing global trade.

References

[1] Yergin, Daniel. (2020). The New Map: Energy, Climate, and Clash of Nations. Penguin Press

[2] Khandelwal, Amit. (Updates 2022, February 2017). U.S.-China Trade War increases Global Trade. Columbia Business School Newsroom. – https://www8.gsb.columbia.edu/newsroom/newsn/12435/us-china-trade-war-increases-global-trade

[3] Capgemini Research Institute. (Published 2020). Fast Forward: Rethinking Supply Chains for a post-COVID world. Capgemini. – https://www.capgemini.com/wp-content/uploads/2020/11/Fast-forward_Report.pdf

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”

About the Author

Mihir Shirgaonkar, CFA heads the Alternative Investments division at Phillip Ventures IFSC Pvt. Ltd. and has been a part of the firm since 2021. He is a Chartered Accountant and MBA-PGPX from the Indian Institute of Management Ahmedabad. He has over 8 years of experience in the asset management industry and has worked with DSP Investment Managers (erstwhile DSP BlackRock) and HDFC AMC in his previous roles. In his career so far, he has handled multiple areas which span portfolio management, market making, valuations, fund administration, and project management. His other interests include philosophy, reading, photography, trekking, coding, and travelling.