- September 10, 2023

- Posted by: CFA Society India

- Category:Events

Speaker - Prof. Sanjay Bakshi- Adjunct Professor of Finance at FLAME University

Contributed by - Ajay Minocha, CFA, Member, Public Awarness Committee, CFA Society India

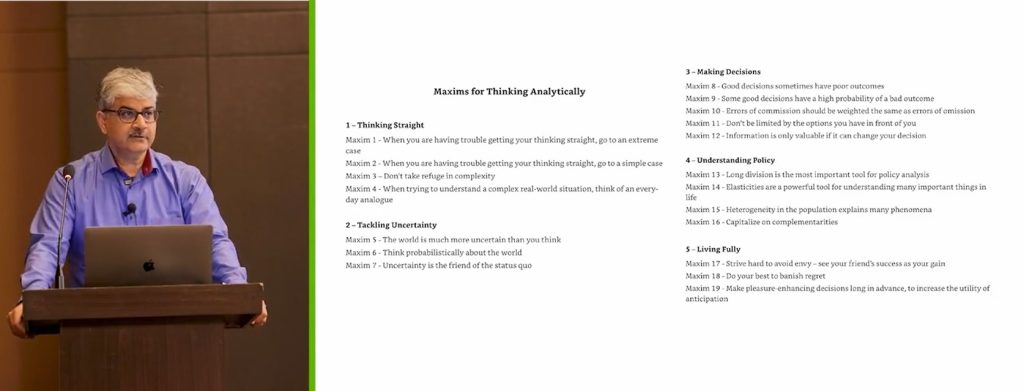

The session covered key learnings from Dan Levy’s book “Maxims for Thinking Analytically: The Wisdom of Legendry Harvard Professor Richard Zeckhouser” along with some practical learnings from Prof. Sanjay Bakshi’s wide experiences.

“The right way to think is the way Zeckhauser plays bridge. It’s just that simple. And your brain doesn’t naturally know how to think the way Zeckhauser knows how to play bridge.” – Charlie Munger

The session started with a discussion about the fact that risk and uncertainty are not same. Prof. Sanjay focused on couple of the key learnings from the paper “Blindness to the Benefits of Ambiguity” by Richard Zeckhauser and the book “The Upside of Uncertainty” by Nathan Furr and Susannah Harmon Furr to establish the importance of thinking logically. It was followed by an example about a company whose securities suffered a crash because of a research report. In order to make such uncertain situations profitable, it is extremely important to think logically and objectively analyze the opportunity without any fear or bias.

Maxim 1: When you are having trouble getting your thinking straight, go to an extreme case.

History actually contains enough events of wide extremes both on the positive side (boom) as well as the negative side (crash). Whenever faced with a situation where it is difficult to analyse the current situation, drawing learning/ patterns from the past similar extreme events can prove helpful as extremes do correct over a period of time.

For example, analogy given by Warren Buffet regarding the Dotcom stocks where analyzing the stocks from a business man’s perspective proves helpful. It includes assessing a fair return on investment as the business’s profit, and subsequent assessment of the revenue and unit economics required to reach that level. A lot of times, that unit economics is not possible, giving a straight answer to stay away from the investment.

- Also, analyzing the business from a bond holders perspective coupled with factoring constant earnings helps derive a fair value of the business. In such cases, growth generally comes for free for the value investors and the investment has a good chance to perform well over long-term.

Maxim 2: When you are having trouble getting your thinking straight, go to a simple case

Out of a lot of investing strategies, compounding money inside the business is a great strategy specially if the business is able to earn more than the cost of capital

There can be 5 components to the simple equation i.e. high returns on capital + protected returns + reinvestment opportunities + strong balance sheet + attractive valuation.

If we are able to identify these in a business, there are very high chances to have a winning investment at hand

- The complexities i.e. up-front investments, customer loyalty, divestment/ turnaround can be added later on as special cases to arrive at a robust conclusion.

Maxim 3: do not take refuge in complexity

- If there is 10% chance of either of 5 hypothetical elements going wrong, we have a 41% probability of failure which is very high.

- Therefore, simple and easy to understand businesses even with slightly less returns are better than businesses with too many complexities or moving parts as there is less probability of an error

- Some common examples of complexities are, businesses with large annual reports, complex organization structure, unclear commentary, containing unnecessary complicated content in their filings.

- The new-age AI tools are turning out to be very good to reduce complexities in documents/ terms where one has to necessarily deal with a complex situation.

Maxim 4: when trying to understand a complex real- world situation, think of an everyday analogue

- According to Richard Zeckhouser, “Analogic thinking is also analytical thinking”. Mapping the analogs with investment process can provide a good starting hypothesis.

- Sanjay discussed some real-life examples i.e. Temporary disruptions during Covid(ripples in the pond), considering all the companies as same (man with a hammer), trying to exploit small arbitrage but ignoring a bigger risk (pennies in front of a steam roller) etc.

- While everyday analogs provide a good starting point to the analysis but they shouldn’t be trusted without proper due diligence. The analogs coupled with objective and detailed analysis can provide valuable insights to the investment process.

Maxim 5: The world is much more uncertain than you think

- Uncertainty is inherent but it doesn’t have to be bad all the times as it also opens the door to possibilities.

- Some examples of asymmetric payoffs i.e. lottery tickets, turn around stocks, panic selling etc. where although the probability of downside may be high but the possibility of upside can be huge

- Combining situations having asymmetric payoffs with risk management framework (setting the downside limits) proves rewarding in the investment process

- Portfolio level uncertainty/ risk is important to achieve good returns with a mix of businesses having different kind of payoffs.

Maxim 6: Think probabilistically about the world

- It is important to evaluate investments through a special situation framework along with a base rate.

- Post the initial analysis, one needs to be objective and should be able to quickly adapt the process as per the new and constantly changing information.

- Probability of particular events helps to a greater degree in this case however it is more important to be directionally correct rather than running behind the actual probability number

- To evaluate arbitrage situations one must answer four questions: (1) How likely is it that the promised event will indeed occur? (2) How long will your money be tied up? (3) What chance is there that something still better will transpire? and (4)What will happen if the event does not take place?

Maxim 7: Uncertainty is the friend of status quo [but it doesn’t have to be so]

- “We are all wired to fear the downsides of uncertainty, but we forget that change, creation, transformation, and innovation rarely show up without some measure of it” – Furr, Nathan

- At uncertain times, instead of thinking of an exit/ status quo, investors can smartly improve the quality of their portfolio.

- The best way to do this is to substitute relatively worse stocks with the better earning/ compounding stocks which may have corrected during the crash/ uncertainty.

- This greatly improves the overall long term risk/return profile of the portfolio.

Maxim 8: Good decisions sometimes have poor outcomes

- The right way to judge the soundness of an investment process is through the number of good outcomes it has produced over time rather than isolated bad outcomes.

- Tweaking the investment process on the bases of one bad outcome can result in huge opportunity costs for e.g. investors choosing to stay away from consumer discretionary businesses due to Covid impact.

- On the other hand, one should not adopt a bad process if it ends up producing a good outcome by chance as it carries a huge error of commission.

Maxim 18: Eliminate regret

- It is important to stay rational and grounded in the investment journey which means neither regretting on bad outcomes resulting out of good decisions nor taking pride in good outcomes out of a bad decision

- It is essential to take action post a bad outcome, treat the mistakes resulting in bad outcomes as learnings/ tuition fee and move on

Maxim 9: Some decisions have a high probability of a bad outcome

- There are a lot of opportunities having a high probability of loss and very low probability of profit but it still makes sense to invest in them as the upside (even if remote) is very high

- However, combining such investment with judicial risk management is essential to limit the downside and capitalize the upside on a portfolio. For e.g. lower percentage of overall portfolio

- When faced with all the bad outcomes for e.g. levered portfolio in market crash, personal emergency etc. one can choose the least bad outcome instead of status quo or ruining an otherwise sound process of investment.

Maxim 12: Information is only valuable if it can change your decision

- Most of the information that we come across is noise however it may be noise for a business/ fundamental analyst but important for market analyst. For e.g. stock price movements due to index changes, FII flows etc.

- A fundamental/ value investor can utilize the signal framework to separate important information i.e. Noise generally doesn’t impact the business in long term, small pieces of information which have a very low signal of a big fundamental change and the most valuable is information which has the capacity to completely change or strengthen the initial hypothesis.

- Also, as a business or fundamental analyst, spotting trends before it becomes the news is helpful to take sound investment decisions.

Maxim 10: Errors of commission should be weighted same as errors of omission

- Errors of commission generally get weighted more heavily than errors of omission, a tendency sometimes referred to as omission bias. Humans seem to be programmed that way. Richard and many other scholars argue that we should make efforts to give them the same weight.

- Some work suggests that actions, or errors of commission, generate more regret in the short term; but inactions, or errors of omission, produce more regret in the long run – Levy, Dan.

The session concluded with a lively discussion with the participants.