- July 23, 2022

- Posted by: CFA Society India

- Category:ExPress

Sivananth Ramachandran, CFA

Director, Capital Markets Policy India, CFA Institute

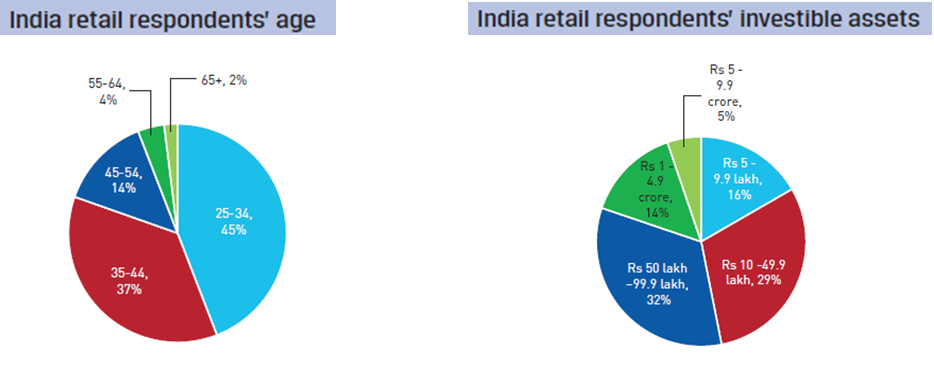

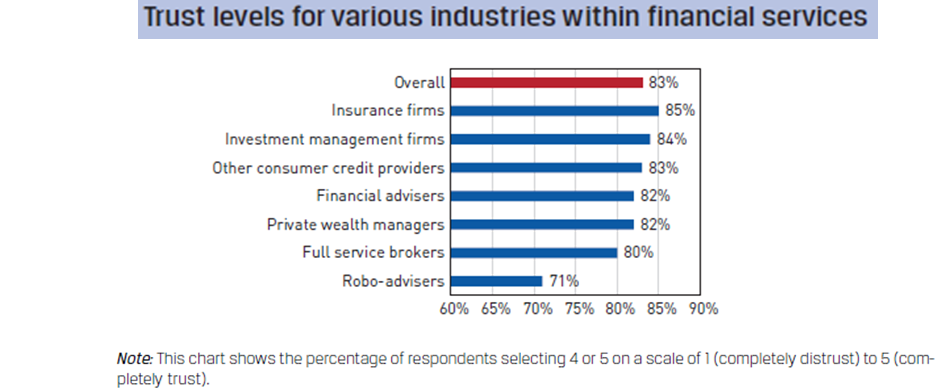

CFA Institute released its 2022 Investor Trust Study (the Trust Study), the fifth in our biennial series based on a survey of 3,588 retail and 976 institutional investors across 15 markets, including 200 retail and 75 institutional investors in India. We found that trust levels in financial services among retail and institutional investors have increased significantly since 2020 except for India. Although trust levels have marginally declined in India, it continues to have the highest trust level of any market (83%).

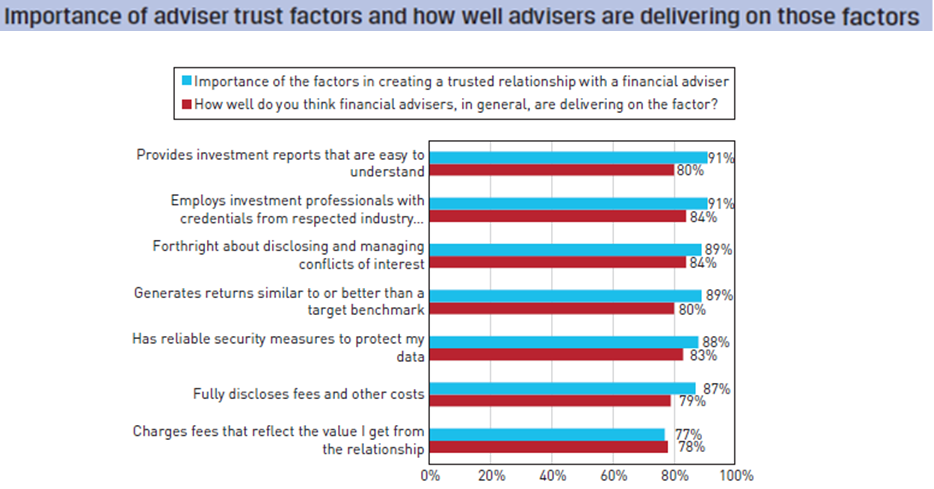

CFA Institute, along with the CFA Society India convened a roundtable on the Trust Study to discuss Indian retail investor–focused findings and the experience of market practitioners during the pandemic. The participants included registered investment advisers, mutual fund distributors, and private wealth managers. Within financial services, the trust levels remain consistently high across industries, with robo-advisers scoring the lowest at 71%. The participants identified a clear link between trust levels and performance but said that the recent market events around frontrunning potentially could affect trust, if it proves to be systemic.

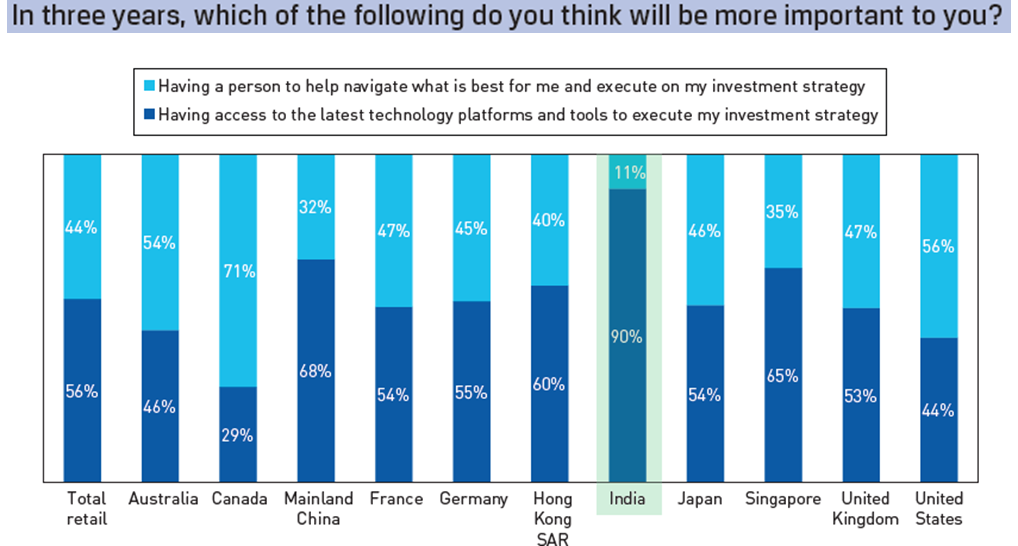

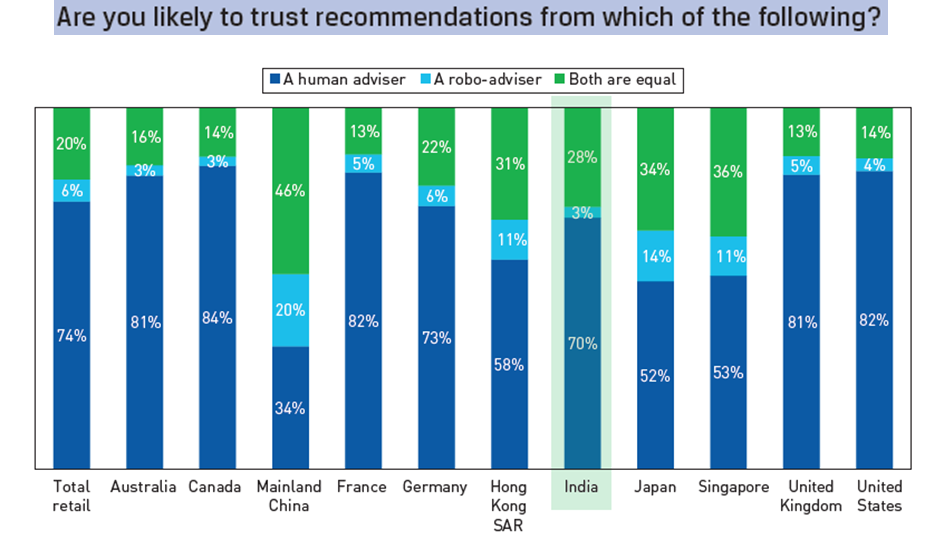

Our survey shows that technology can be a significant driver of trust, and Indian respondents are most likely to prefer technology over a person to execute their strategy, among all markets. But the same respondents also value human advice over robo-advice. The participants confirmed that these findings resonated with them. Some people are comfortable with technological tools for search and due diligence, but they still want to consult an adviser or visit a branch before making a significant financial decision.

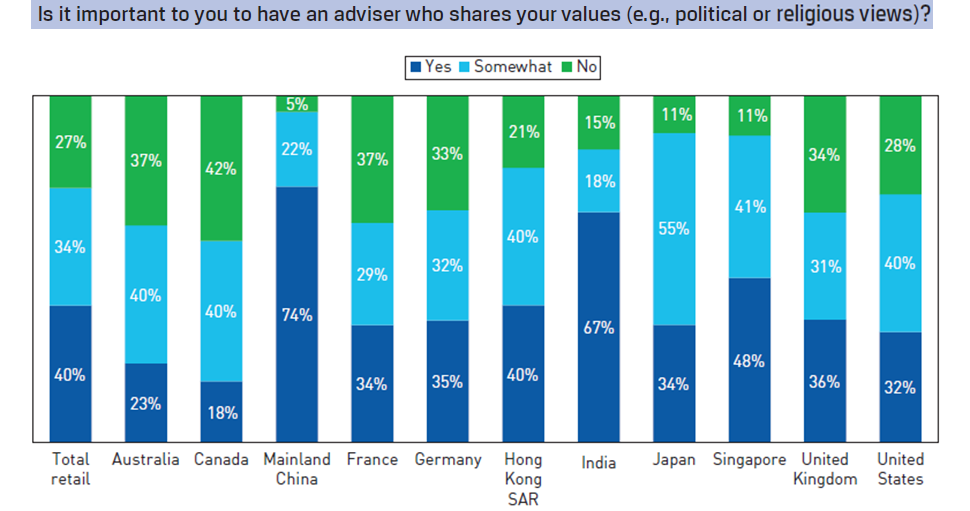

Trust is complex because it is personal. Personal connections can develop through the relationship with one’s financial adviser. According to our survey, 67% of Indian respondents said it is important for an adviser to share their values, the second highest response among the markets in our study, behind only China (74%). The roundtable participants echoed this finding and suggested that, in some settings, getting into the same space with the client (language, culture, or other characteristics) is a precondition to having conversations around personal finance.

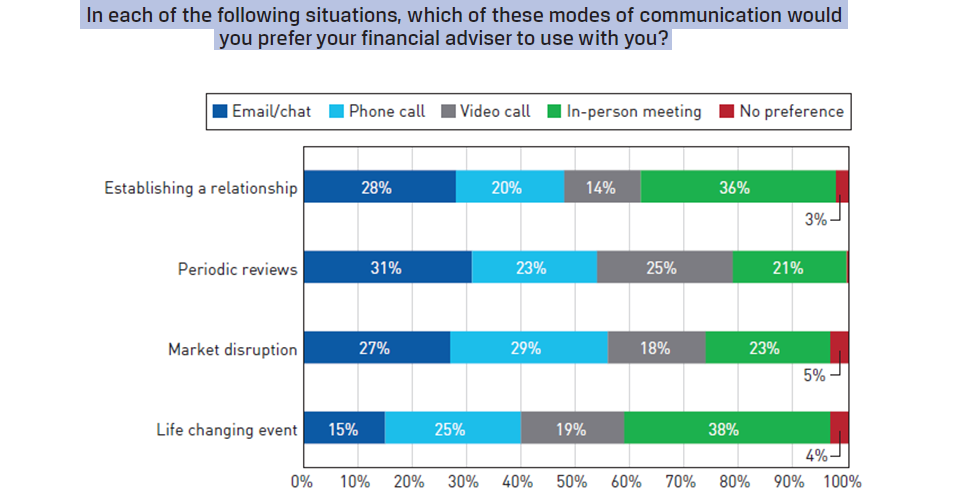

We also debated the modes of communication between advisers and clients in several high-trust situations. Indian respondents prefer interacting with their adviser remotely (emails, chats, phone calls, and video calls), but the start of a working relationship and life-changing events are the two most important times to establish a basis of trust in an adviser through in-person interaction. The participants felt these findings were intuitive, but suggested that client preferences are heterogenous, and it is important to avoid making assumptions about preferences based on income levels, age, or other characteristics.

The participants also shared their experiences handholding their clients during the March 2020 market disruption. Some felt the short-lived disruption made it easier to prevent clients from redeeming their investments at the wrong time. Others felt that clients who did not have a lot of market knowledge were exposed to less noise and stuck to their plans, whereas people with greater knowledge required more handholding.

The high level of trust among Indian investors is a positive finding in the Trust Study. The participants stressed the need for alignment with their clients and the importance of human connection as an enabler of trust.

To access detailed article please Click here…

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”