- October 4, 2022

- Posted by: CFA Society India

- Category:ExPress

Written By

Vaibhav Agarwal, CFA

Head of Research – Basant Maheshwari Wealth Advisers LLP

There was a common adage that “When the US sneezes, India catches cold”. This referred to the fact that whenever there was a turmoil in global markets like the US, it was inevitable that the Indian stock markets also felt the pain. Hence, our markets were supposedly linked or ‘coupled’ with the US economy.

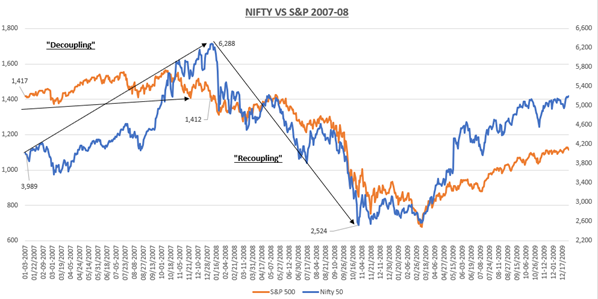

In my initial days in the stock market in 2007 there was huge chatter about the word ‘Decoupling’. During those periods it was expected that emerging markets would offer higher growth than the more developed or matured economies of the west. Hence, even though there may be a slowdown in the US, the emerging market economies would be insulated. Hence, India outperformed the US during that period. During first 6 months of 2007, even though the S&P was almost flat, NIFTY went up by 58%!

But the whole decoupling episode ended during the 2008 Global Financial Crisis. Even though our economy was more domestic oriented, Nifty fell almost 60% from the peak!

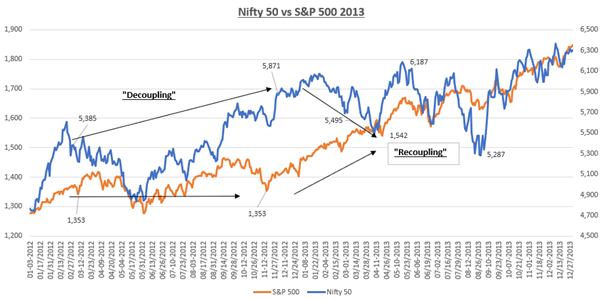

If we look back to the 2012-2013 period – from July 2012 till Dec 2012 the S&P was almost flat while Nifty was almost up 13%. Again, there were talks of “decoupling”.

Next came the “Taper Tantrum” in 2013 when the US Fed gave indications of tightening the QE program and sucking out the excess liquidity. FIIs sold equity in the emerging markets and there was a sharp correction in both the Indian equity and currency markets.

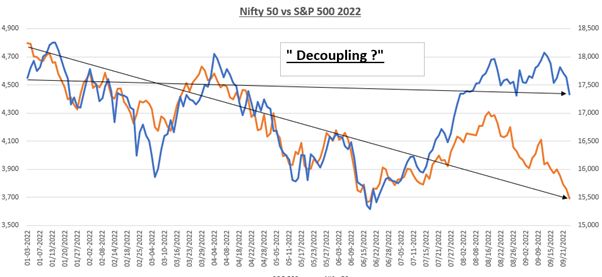

Fast forward into 2022. In 2022, YTD performance of S&P has been -23%, Dow Jones -19% while Nifty has been almost flat (-1%). So there has been a big outperformance of India vs the US and talks of decoupling have re-emerged. However, I believe that it will be short-lived this time too.

Let us examine the fundamental reasons why it is difficult for a large economy like India to be “Decoupled” from what happens in the US.

If the US economy goes into a recession, then there are demand shocks for Indian exporters, specially the IT services for whom large US tech companies are the main customers. Even though some IT companies can do well due to their expertise and focus on niche verticals, as a sector there will be demand headwinds. So, demand shocks in important markets like the US and Europe have the potential to impact the earning prospects of many Indian listed companies. The more the integration of India with global markets, more will be the volatility due to macro uncertainties.

Secondly, India is part of the emerging market index. In general, there is a common belief among FIIs that there is higher risk while investing in emerging markets due to currency risk, interest rate risk, inflation risk or country specific risks. Whenever there is risk-off in the markets, foreigners sell emerging market equities and simply park their funds in safe havens like the US dollar. So, even though from a fundamental standpoint India may be attractive, there is an outflow of funds from FIIs.

Also, India is a major commodity consumer in the world. How can we be decoupled from the fact that macro events like the Russia-Ukraine war resulted in very high oil prices which inevitably causes higher inflation in India?

The last couple of years have been very good for the metal companies in India. This was solely because of the fact that post covid there were global supply constraints, while easy liquidity from central bankers created big demand worldwide. So how can an Indian metal company, whose profits are linked to global metal prices, be decoupled from what happens globally?

Our monetary policies are also a function of what the US Federal Reserve does. If the US raises interest rates and we don’t, then there will be an outflow of funds. This will put pressure on the rupee and impact the forex reserve in the country, if RBI intervenes in the FX market to reduce the volatility in the rupee.

As long-term investors we should not be too concerned about whether the markets are decoupled or not. History tells us that longer term returns depend upon the earnings growth of a company. Indian markets have given almost 14% CAGR from 1980 to 2022.

Multiple factors are working in favour of Indian corporates. Domestic demand is strong and Capex cycle is starting driven by the PLI scheme. Balance sheets of companies are well repaired. China+1 strategy also means that Indian exports are booming. At the same time, credit growth is returning to banks. Formalisation of economy is also happening at a fast pace with GST and income tax collections starting to rise steadily.

India has a huge burgeoning middle class that is becoming more aspirational, leading to more discretionary spending. One has to just see how China’s growth accelerated when their per capita income exceeded $2500 during the 2000-2010 decade.

In the next decade if India’s real GDP has a growth rate of 7-8% and assuming inflation of 4-5%, our nominal GDP should grow at 12-13%. One can assume that earnings would grow roughly in tandem with the nominal GDP, as witnessed during the last 40-plus years history of the Sensex. So, our index itself should grow at least at a 12-13% CAGR over the next decade.

India is the only oasis in this world which is starved of growth. It is virtually impossible for foreigners to not invest in India in a meaningful way over the longer term.

Warren Buffett always says that “In the Short-Run, the Market Is a Voting Machine, but in the Long-Run, the Market Is a Weighing Machine”. We should free ourselves from the baggage of thinking whether the markets are decoupled or not. These are merely short term aberrations that keep on happening from time to time. However, the next decade will be a golden period in the history of Indian stock markets. Let’s focus on wealth creation over the next decade!

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may be associated with in a professional or personal capacity, unless explicitly stated.”

About the Author:

Vaibhav Agarwal, CFA is the Head of Research at Basant Maheshwari Wealth Advisers LLP and has been an integral part of the firm since 2017. He is also a Chartered Accountant, a Company Secretary and also has a Master’s degree in Finance. Vaibhav has more than 14 years of experience in stock market investing across sectors and stocks. He has worked with several global investment banks and multinational companies in various roles. Vaibhav provides regular opinion on markets, economy, sectors and other business angles through columns and speeches. Vaibhav enjoys watching and playing tennis, as well as reading books, apart from his passion towards stock market investing.

LinkedIn: linkedin.com/in/vaibhav-agarwal-cfa-b5367549

Twitter : https://twitter.com/_vaibhavagarwal