- January 8, 2023

- Posted by: CFA Society India

- Category:ExPress

Written By

Nishit Vyas, CFA

MBA Candidate, University of Sydney Business School

Linkedin

The most striking feature of economic policy-making in 2022 had been the volte-face by central banks globally. The broad tonality has changed sharply from accomodative to ‘sufficiently restrictive’ and fueling growth has given way to combating inflation. The pandemic induced supply chain disruptions, war in Eastern Europe resulting in elevated crude prices and a tight labour market have significantly increased the input costs for businesses. With fiscal accounts already stretched and sovereign debt at historical highs for most countries, it is inevitable that the monetary policy takes precedence in making good the apparent disequilibrium. The large quantitative easing during the pandemic coupled with liquidity infusion did translate into asset inflation initially but also into price inflation inadvertently, which is now supposedly being corrected.

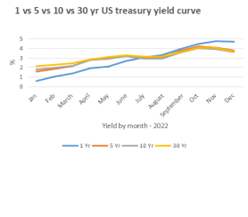

The last quarter of 2022 saw inflation records getting broken globally with Japan’s core inflation reaching a four decade high while Australia’s annual inflation reached a 32 year high despite eight successive rate hikes by the Reserve Bank of Australia. The Reserve Bank of India had to submit a report to the government explaining the reasons for breaching the inflation target in three consecutive quarters. Unprecedented rate hikes by the central banks; Fed (425 bps) and ECB (225 bps) are yet to significantly feed into inflation or inflation expectations but have given a strong signal to the markets about its short/medium term outlook on the future path of interest rates. However, have the global central banks jeopardized price stability by not withdrawing excess liquidity before it translated into peak inflation ? Could a more pro-active reversal of accomodative policies have prevented the kind of rate hikes we are currently seeing ?  Can monetary authorities be blamed for supply side shocks or geopolitical externalities ? Questions remain aplenty but answers limited. One thing is clear though – a wrong committed in one period cannot be reversed by committing an antithetical wrong in the next period. The series of (short term) rate hikes will inevitably impact economic growth with risks tilted to the downside and a potential recession. The impact of this is already being felt with subdued private capex, mass layoffs by tech companies and evidence of a flattening yield curve (as shown in the adjacent graph).

Can monetary authorities be blamed for supply side shocks or geopolitical externalities ? Questions remain aplenty but answers limited. One thing is clear though – a wrong committed in one period cannot be reversed by committing an antithetical wrong in the next period. The series of (short term) rate hikes will inevitably impact economic growth with risks tilted to the downside and a potential recession. The impact of this is already being felt with subdued private capex, mass layoffs by tech companies and evidence of a flattening yield curve (as shown in the adjacent graph).

While price stability and maximizing employment is the official mandate of most central banks, the impact of their policies on growth is seldom ignored. Furthermore, policy rates are just one instrument to control money supply with asset purchase programs through open market operations and reserve requirements also impacting the (excess) liquidity in the system. These instruments collectively play a role in impacting the demand side of the inflation equation while the supply side remains largely unaddressed. The objective of liquidity management by central banks today is to moderate the excess demand to align it with the existing supply (both goods & services as well as human capital) in the short to medium term. Interest rate changes cannot be the panacea to solving long term structural supply side challenges. Moreover, monetary policy operates with significant time lags and are based on backward looking data. This implies that the central banks are responsive and behind the curve at most times. As the Fed Chair said in his last press conference ‘there is no painless way to ensure price stability’ and we are certainly in for a long haul.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”

About the Author

Nishit Vyas is a MBA candidate at the University of Sydney Business School and works with big four professional services firm in Sydney. He is a Chartered Accountant and a CFA charter-holder by qualification and was earlier associated with Deutsche Bank in the economic research domain.