- May 27, 2020

- Posted by: CFA Society India

- Category:ExPress

Contributed By: Rajnish Kumar

The COVID-19 pandemic represents serious economic, social and psychological impact globally and Emerging Market (EM) in particular due to lack of health care infrastructure as well as poor living conditions. The full impact of the pandemic is yet to be seen but initial impact on financial market suggests that the COVID-19 has affected EM regions differently. This presents a very unique opportunity for institutional investors to buy undervalued countries and diversify across different EM regions.

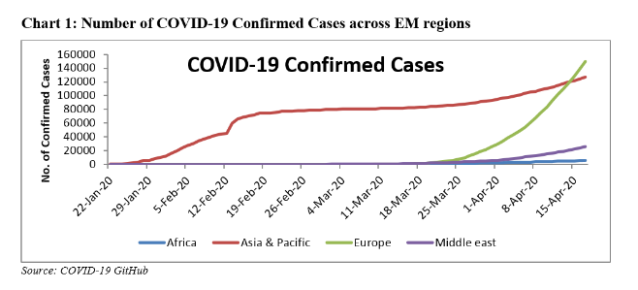

On March 11, 2020, World Bank declared COVID-19 as pandemic after there were 118,000 confirmed cases in 114 countries. However, it was detected first in Wuhan, China on December 31, 2019. Since then there has been exponential increase in confirmed cases across EM regions. Chart 1 presents the number of confirmed cases across EM regions (countries part of JP Morgan EMBI Global Diversified, grouped in different regions). Asia has highest number confirmed COVID-19 cases followed by Europe EM countries. The number of confirmed cases of COVID-19 in Africa is insignificant as compared to other EM regions. It would be interesting to examine if the impact of COVID-19 on EM debt market isrelated to number of confirmed cases in the region or are there any factors at play which are impacting the debt market.

To examine the impact of COVID-19 on EM debt market, we consider three different types of EM indices, namely: JP Morgan EMBI Global Diversified (hard currency sovereign index, EMBIGD), JP Morgan CEMBI Broad Diversified (hard currency corporate index, CEMBIBD) and JP Morgan GBI-EM Global Diversified (local currency sovereign index, GBI-EMGD). For past several years, EM debt market has garnered lots of interest from institutional investors globally. The incremental interest in sovereign local currency is greater as compared to hard currency (sovereign as well as corporate). As seen in Chart 2 below, since the inception of local currency debt, the market capitalization has increased drastically over time as compared to hard currency debt.

The issuance of variety of EM bonds provides good diversification benefits to institutional investors during the risk-on period. However, during risk-off period (COVID-19), it would be interesting to see how different EM regions are getting affected due to the pandemic.

The factors which impact the performance of EM debt market differs between sovereign local currency and hard currency sovereign and corporate debt. Therefore, even though, COVID-19 is a pandemic and has created a risk-off period, resulting in flight to safety, all three types of index market is going to be negatively impacted but considering that EM countries are at different stages of socio-economic development, there is differentiated impact across indexes as well as across EM regions in the respective indexes.

As on April 17, 2020, GBI-EMGD consists of 19 countries with maximum weight of 10% to Brazil, Indonesia, Mexico and Thailand. EMBIGD has 73 countries; however, it has only 32 countries with weight of more than 1%. China has the maximum weight of 4.63%. CEMBID consists of 57 countries but less than half of the countries make up for more than 90% of total weights, with China occupying the top spot with 8.15% followed by Brazil (5.42%). With respect to number of constituents/ countries, EMBIGD is more diversified as compared to other two indices.Considering that three indexes represent different asset classes and each index include quite a few countries, they provide a good source of diversification benefits to institutional investors and at this stage of COVID-19 pandemic, a tactical allocation across countries and assets can enhance risk-return of the portfolio.

To examine the impact of COVID-19 acrossEM debt markets’ performance, we plot the cumulative returns of each indexes, grouped under different regions along with the respective indexes performance. Chart 3 to Chart 5 presents the daily cumulative returns charts for GBI-EM GD, EMBI GD and CEMBI BD respectively from January 16, 2020 to April 16, 2020.

Since the advent of COVID-19 on December 31, 2019 and before WHO’s declaration of COVID-19 as pandemic on March 11, 2020,we see a differentiated impact across the Emerging Market regions as well as indexes, however, the pattern of impact is similar across different indexes. There are two distinct impacts of COVID-19 on EM indexes. The first one starts around February end and for a brief recovery within a week, the indexes return goes into tailspin beginning March 2020. Further, the drawdown is more for local currency sovereign indexes followed by hard currency sovereign and hard currency corporate.

Comparing between regions across indexes, Africa is the worst hit with biggest drawdown across all three indexes followed by Latin America and Middle East.

The cumulative performance chart clearly dictates different perception/ expectations of institutional investors regarding future growth path and recovery from COVID-19 across EM regions. This differentiating impact across EM regions can provide institutional investors to take advantage of future possibilities. One of the reasons that can be a contributing factor in differentiating impact on EM debt market can be health care expenditure by EM countries.

Chart 6 presents the average current health expenditure by EM countries, grouped into different regions. Asia and European EM countries are spending more as compared to other EM regions, which is a lot less as compared to any developed countries. Africa has the lowest health care expenditure per capita and as per the charts above, even though the number of confirmed cases is a lot less as compared to other EM regions, the drawdown is more for Africa regions is more as compared to any other regions. This dispersion of health care infrastructure across EM regions is going to greatly impact the recovery of EM countries from COVID-19 pandemic and institutional investors can incorporate this information in their portfolio construction.

The revival of EM countries will depend on economic stimulus by government and central banks which in turn will depend on capacity in monetary and fiscal space of the respective countries, political will and social consciousness. Country selection is going to be a key variable during this time and institutional investors can gain by incorporating the differentiating factor in their portfolio construction.

About Rajnish Kumar, PhD

Rajnish Kumar has over 8 years of experience in factor research across equity and fixed income. His area of interest includes ESG, smart beta, portfolio construction and risk-return attribution analysis across different asset classes. He has publications in top tier journals. He holds PhD in Economics from Indira Gandhi Institute of Development Research, Mumbai.