- January 14, 2015

- Posted by:

- Category:BLOG, Events, India Investment Conference, Mumbai

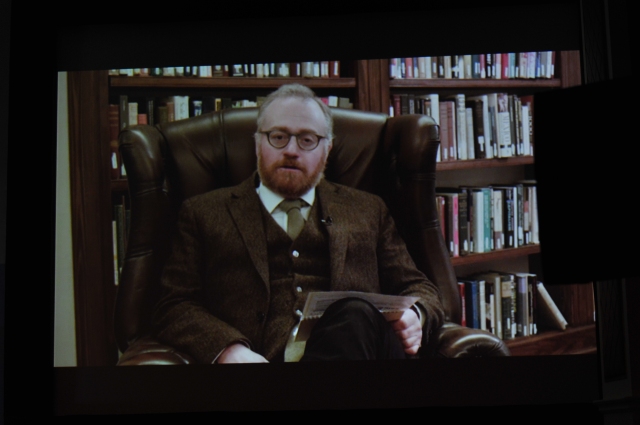

Speaker: Russell Napier, ASIP, Independent Strategist and Co-Founder ERIC

Speaker: Russell Napier, ASIP, Independent Strategist and Co-Founder ERIC

Moderated by: Sunil Singhania, CFA, CIO, Equity Investments, Reliance Mutual Fund and member Board of Governors, CFA Institute

Written by: Chetan Shah, CFA, Senior Portfolio Manager, Religare Invesco AMC and Director IAIP

After World War 1 the US became a strong economic power. Post World War 2 it became both a strong economic and military power. Yet the P/E multiples (based on Shiller’s CAPE) in the US are unable to sustain above 23 times. Accordingly to Russell the mean reversion of equity valuations are fundamentally driven by the power of arbitrage with high valuations triggering higher supply and low valuations resulting into lower supply.

Technology changes or newer innovations result into higher growth rates and higher P/E multiples. This is observed during 1920s-30s when commercialization of electricity and automobiles changed the world outlook. More recently it was in 2000 when internet & related businesses took off. However, the P/E multiples are unable to sustain as supply comes up faster. We as an investors spend too much time forecasting demand for product or services and little time on estimating supply.

Lower inflation and higher growth environment usually will result into higher P/E multiples. Inflation rising from 1% to 3% doesn’t affect the P/E multiples. But above 4% the multiple starts to shrink. Equities get cheap because of deflation.

The US current account deficit, a key driver of global liquidity, is not growing due to some structural reasons like shale oil & gas, rising Chinese wages, and lower spending by baby boomers as they retire. Even the trade deficit with China is stagnant. A rising dollar tightens liquidity and affects those borrowing in dollars. Countries with higher current account deficit or higher foreign denominated debt as percentage of GDP tend to be affected. Most of the Asian countries are comfortable on latter. However, Eastern Europe is currently in a situation where Asia was in 1997-98.

Strong dollar is also bad for commodities and key emerging markets like Russia. Spreads on high yield and junk bonds of oil & gas companies are up due to lower oil prices. One will have to examine if the crisis across the oil economies will freeze the credit system?

China has learnt from the US monetary policy action over the recent past and is likely to print money to stimulate its economy. The stock market seemed to have sensed this last year. It needs to tackle on foreign exchange rate devaluation. A 10-30% change in RMB would be bad for countries like Germany.

According to Russell gold is at a tipping point of a rally. Japan story will succeed. He is positive on India macro story but not on valuations.

– CGS

PS: For the complete coverage of #IIC15 (for India Investment Conference 2015) kindly click on the links to the posts on the WordPress or search under the tab “India Investment Conference”:

- India Investment Conference (#IIC15) – Rebooting India to Realize its Potential…

- The Coming Consumption Boom from the Emerging Middle Class, by Vikram Mansharamani

- The Role of the Right Brain in Investing, by Jason Voss, CFA

- Financing Infrastructure to Reignite Growth, by the Infra Panel

You could also read tweets by typing #FutureFinance, #IIC15, @iaipcfa

[…] Mean Reversion of Equity Valuations, by Russell Napier […]

[…] ← #IIC15 – Mean Reversion of Equity Valuations: The Causes […]

[…] Mean Reversion of Equity Valuations, by Russell Napier […]

[…] Mean Reversion of Equity Valuations, by Russell Napier […]