- October 23, 2023

- Posted by: CFA Society India

- Category:BLOG, Events

Speaker - Sanjay Bakshi, Distinguished Adjunct Professor, Finance at FLAME University

Moderator - Raunak Onkar, Research Head & Fund Manager, PPFAS Mutual Fund

Contributed by - Ajay Minocha, CFA, Member, Public Awareness Committee, CFA Society India

CFA Society India had the privilege to host Prof. Sanjay Bakshi, Adjunct Professor, Flame University for an enlightening session on Evolutionary Biology and its linkages to business and investment process during the 7th Value Investing Pioneers Summit on 7th October 2023 at Hotel Hyatt Regency, Delhi.

![]()

Prof. Bakshi started the session by discussing about the functional equivalents in business and investing like maintenance capex, Low return on capital + growth and inflation. A great business case is where there is “High ROIC + Growth” where growth requires very little or no incremental capital as we see in well- established monopolies which are able to generate sustainable returns. The investments also necessarily need to earn a higher return than prevailing rate of inflation in order to justify the fundamental risk. For example, Red queen effect from a famous fairy tale (getting nowhere despite running very fast) can be mapped to businesses which need enormous amount of investment just to survive and do not generate returns in long run.

Next, the speaker talked about the importance of pattern recognition. He shared a famous quote by Warren Buffett- “We’ve seen Patterns. Pattern recognition is very important in evaluating humans and businesses”. By constantly looking at objects in environment, reading different material and asking ourselves two fundamental questions- (1) What does it remind me of and (2) Why does it remind me of it?, we can greatly improve our understanding of the world and our decision making. A famous biological pattern is a species of frog which feeds on a species of fly. If the frog evolves to have a stickier tongue to catch flies, the flies can also evolve to have a slippery body to help them escape, negating the frog’s competitive advantage (think of innovative product designs or enhanced road network in a city).

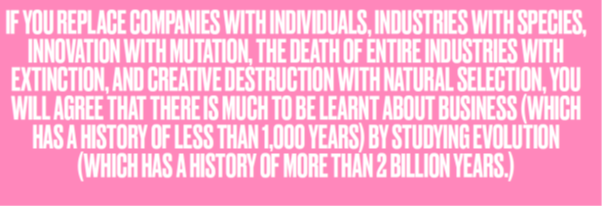

Prof. Bakshi candidly shared his love for the book, “The Selfish Gene” by Richard Dawkins. The basic Dawkins’ insight is to look at a world from the gene point of view. Just as evolution has gradually developed the eyes, wings and claws, human enterprises have developed behaviour patterns winnowed by their successes and failures. What are few parallels between evolutionary biology and business?

- #1 Adaptation and survival: in both economics and evolutionary biology, adaptation and survival are critical. Just as species evolve to adapt to changing environments and better compete for limited resources, businesses must adapt their strategies and business models to survive in competitive markets.

- #2 Natural selection and competition: evolutionary biology emphasises natural selection, where individual organisms that possess advantageous traits have a higher chance of surviving and reproducing. Similarly, in economics, competition plays a crucial role. Businesses with innovative ideas, efficient processes, and superior products or services have an advantage in the market and are selected by consumers as their preferred choice

- #3 Darwin’s “natural selection” and Adam Smith’s “invisible hand”: both are based on the concept of self-regulation, where individuals or species are driven by their own self-interest to make decisions that benefit the whole environment/ economy.

- #4 Extinction : Both evolutionary biology and business involve extinction of weaker species / entities

Post this, some lessons were shared from Paul Krugman’s talk given to the European Association for the Evolutionary Political Economy:

- That what doesn’t kill you makes you stronger (Lindy Effect) – a fundamentally strong business model not only survives the stressful times but often emerges as a winner.

- Nature and business are pari-mutuel games where bacteria/ genes/ businesses bet against each other and the one who survives benefits immensely.

- Role of randomness and luck mutations are random i.e. sometimes random events do play a significant role which benefits one particular business on the expense of others. However, natural selection often selects fittest and it isn’t random over long-term.

The distinguished Professor also encouraged the attendees to think about the concept of mutations more deeply. “Innovation is analogous to mutations”, he remarked and took several examples like Amazon and Red Bull brand to bring home this point.

It is also critical to know about the first principals in evolution and investing like:

- Offsprings resemble their parents, characteristics are passed onto other generations- Some fundamental characteristics never change in some business models.

- However this process is not perfect, often results in mutation errors which can also turn out to be an opportunity like innovation in business world

- There are more individuals born in each generation than to survive, become adults and reproduce -many businesses die young

The learnings for investors from each of these principles are that they should look at stocks as part ownership of business, market fluctuation as friend and aim to profit from them. Finally, margin of safety must never be ignored.

Some other models from evolutionary biology:

- Bacteria and growth: In a finite world, high growth rates must self destruct. If the base is tiny then it may take a longer duration but a high-growth party always normalizes due to saturation, high competition, market constraints etc.

- Cumulative advantage and compound interest: A successful organism has a higher chances of survival which is similar to a high ROCE business as it is likely to run by a competent management, has higher resources and is able to take more calculative bets.

- Extreme specialisations and Niches: Some bacterium can survive in most unimaginable conditions thereby making them contain a specialised survival quality. In business world also, people/ companies acquiring extreme specialisations/ niches can be immensely successful. For e.g. luxury product businesses

- Camouflage: Similar to living organisms who are able to camouflage themselves in order to be safe from any attacks, some businesses also effectively camouflage their earnings for a variety of reasons (saving for future, avoid taxes or regulatory scrutiny, attention from competition).

- Booby traps: Venus flytraps or Jellyfish possess unique quality to attract and trap their preys. Similarly, in investing world many companies come in the market to trap gullible investors.

- Slack: Nature likes to over ensure itself through extra layers of protection. Similarly, many businesses have robustness to survive any oncoming difficulties i.e. excess cash, zero debt, low customer/ supplier concentration etc.

- Fitness landscape: Sometimes species need to completely evolve themselves in order to survive. For example, ICE vehicle manufacturers migrating towards producing EVs.

- Learning from extinction type situation: More than 99% of the species living on earth have gone extinct. However in business world, bad decisions as well as bad luck can be the biggest reasons of extinctions.

Finally, Mr. Bakshi shared some tips on how he tries to avoid extinction events:

- Avoid F&O trading specially if you do not understand it

- Avoid buying stocks on leverage

- Avoid IPOs

- Avoid businesses which constantly burn cash or have high debt

Do not fight natural extinction (hoping for turnaround in a business where there can be none).