- October 28, 2024

- Posted by: CFA Society India

- Category:BLOG, ExPress

Mihir Shirgaonkar, CFA

Vice President – Alternative Investments, Phillip Ventures IFSC Pvt. Ltd.

Member – Public Awareness Committee, CFA Society India

Going Mainstream | Introduction

In January 2024, the Securities and Exchange Commission (SEC) in the United States approved multiple spot Bitcoin Exchange Traded Funds (ETFs). Unlike their Bitcoin-linked futures-based counterparts launched back in October 2021 [1], spot Bitcoin ETFs invest directly into the Bitcoin, holding units of the cryptocurrency as part of their portfolios. This regulatory green light was granted to financial behemoths including BlackRock, Fidelity, and Grayscale, and has paved the way for a broader acceptance of Bitcoin (BTC) as an investible avenue alongside traditional equity, fixed income, and commodity allocations. The approval followed nearly a decade of anticipation, as earlier applications were repeatedly denied due to concerns over market manipulation and lack of regulation in cryptocurrency trading. The first days following the SEC approval had investors collectively pouring in USD 1.9 billion into 9 spot Bitcoin ETFs.[2]

The SEC followed up with a round of approvals for another set of crypto-backed ETFs, this time to spot Ethereum ETFs, further cementing the role of cryptocurrencies within mainstream financial portfolios. The approvals are expected to only drive more liquidity into the cryptocurrency markets, providing both retail and institutional investors with a seamless way to gain exposure to Bitcoin and Ethereum without needing to maintain digital wallets to hold these cryptocurrencies. The decision of the SEC has been widely viewed as a significant milestone, setting the stage for increased participation by investors in digital currencies.

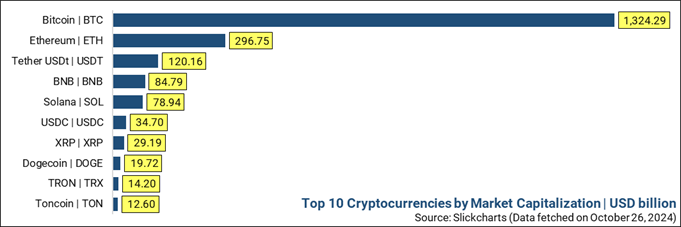

The total market value of all cryptocurrencies is around USD 2.27 trillion with Bitcoin making up about 58%. [3]

Investing in Cryptocurrencies | Comparative Returns and Risk Considerations

The approval of spot Bitcoin and Ethereum ETFs has integrated these cryptocurrencies more fully into mainstream financial markets, offering investors streamlined access to these assets. This development has also facilitated direct comparisons between crypto assets and traditional classes.

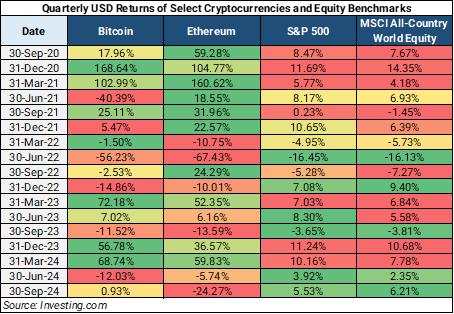

Both Bitcoin and Ethereum have experienced significant price surges relative to traditional equities over short periods, yet they have also demonstrated sharp corrections that have extended for prolonged periods. For example, Bitcoin saw more than 75% of its value getting wiped out from its high in November 2021, taking over 30 months to regain the lost value. Ethereum has witnessed a value drawdown of nearly 80% from its high in the past 5 years. On the other hand, the S&P 500 Index and the MSCI All-Country World Equity Index have witnessed relatively smaller drawdowns of around 33% each, both during the meltdown in global markets amid the outbreak of the COVID-19 pandemic in March 2020. This only highlights the downside risks of having cryptocurrency allocations in the portfolio.

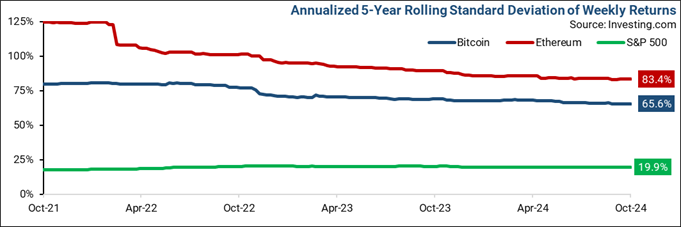

The substantial price gains and steep corrections seen in cryptocurrencies underscore the extreme volatility in their long-term returns. For instance, over the past five years, Ethereum and Bitcoin have exhibited annualized volatility exceeding 80% and 60%, respectively, in contrast to approximately 20% for the S&P 500 Index. Although the long-term volatility of Ethereum and Bitcoin has moderated in recent years, it may take a considerable amount of time—if ever—before these assets demonstrate volatility levels comparable to traditional equities.

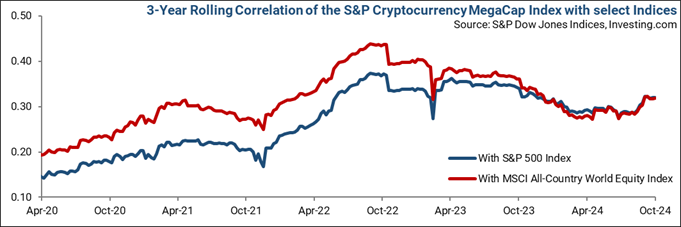

Cryptocurrencies have shown a consistently low correlation with traditional financial markets, making them appear as a means to achieve overall portfolio diversification. For example, the correlation coefficient between the S&P Cryptocurrency MegaCap Index (an index designed to track the performance of Bitcoin and Ethereum) and the S&P 500 Index has generally ranged between 0.2 and 0.4 when observed for 5-year periods. This low correlation implies the price movements of the two cryptocurrencies are largely independent of the performance of the broader equity markets, theoretically offering diversification benefits. However, in this case, the low correlation least likely guarantees effective diversification, especially given the high volatility and downside risks associated with cryptocurrencies.

Regulatory Landscape | Recent Judgements on Cryptocurrencies and their Nuances

The regulatory environment surrounding cryptocurrencies has been evolving rapidly, with recent court rulings and ongoing cases playing a crucial role in shaping their treatment as a legitimate asset class:

- SEC vs. Ripple: In December 2020, the SEC accused Ripple Labs of conducting an ‘unregistered securities offering’ through the sale of its cryptocurrency Ripple (XRP). The SEC argued that the sale of XRP was required to be registered with the SEC as Ripple qualifies as a security under the Howey Test, a legal standard used to determine whether a transaction constitutes an investment contract. However, in a key ruling on July 13, 2023, the court found that XRP sales to retail investors did not violate securities laws and that XRP itself did not qualify as a security.[4]On August 07, 2024, the US District Court ruled that the sale of XRP to retail investors on secondary markets did not qualify as ‘securities transactions’. However, as part of the same ruling, Ripple Labs was fined USD 125 million for its failure to register contracts for the sale of XRP to institutional investors, the said contracts being deemed as ‘investment contracts’. [5] This differentiation between institutional and retail sales of XRP underscores the nuanced nature of the regulatory landscape surrounding crypto assets.

- SEC vs. Coinbase: The SEC v. Coinbase case began in June 2023 when the SEC charged Coinbase with operating as an unregistered securities exchange and a broker selling crypto staking services as investment contracts. Coinbase responded by seeking regulatory clarity on crypto assets and by requesting internal SEC documents, to contest the classification of crypto tokens as securities by the SEC. Coinbase argued that the enforcement methods adopted by the SEC lacked transparency and regulatory guidance, creating obstacles for the crypto industry. This dispute is an ongoing one, highlighting the need for clear and transparent regulatory frameworks for governing crypto assets.[6]

Certain jurisdictions have already started introducing frameworks to govern the functioning and transacting in crypto assets. For instance, the Markets in Crypto-Assets (MiCA) regulation is a comprehensive framework introduced by the European Union to regulate crypto-assets. Enacted in June 2023, MiCA is designed to enhance financial stability and investor protection across EU countries. The regulation covers crypto-asset types like asset-referenced tokens and e-money tokens and outlines strict requirements for providers, authorization processes, and trading platform regulations, while also excluding certain categories of digital assets. MiCA will be fully enforceable by December 2024, marking a significant regulatory milestone for the crypto industry in Europe.[7]

Cryptocurrency Framework in India | Navigating the Legal Landscape

The Cryptocurrency and Regulation of Official Digital Currency Bill was proposed in 2021. Key provisions of the proposed bill include bans on private cryptocurrencies, the establishment of a regulatory authority, the introduction of an official digital currency, and the promotion of blockchain technology.[8] The bill is yet to be passed, resulting in ambiguity around the legal status of cryptocurrencies in India. Multiple regulatory frameworks have started including cryptocurrencies under their respective areas of purview by introducing regulations on ‘Virtual Digital Assets’ or VDAs.

Some aspects of the regulatory frameworks and developments in India applicable to cryptocurrencies:[9]

- Legal Status: In March 2020, the Supreme Court of India lifted a ban that was imposed by the Reserve Bank of India in 2018 on cryptocurrency transactions. With the lifting of this ban, holding and trading cryptocurrencies in India is not illegal. However, cryptocurrencies are not recognized as legal tender, implying that the holders will most likely not be eligible for legal protection in Indian courts in case of disputes.

- Taxation: In the Finance Act 2022, additions were made to the Income Tax Act, 1961 to regulate investments in crypto assets by introducing provisions and clauses pertaining to Virtual Digital Assets. Section 115BBH(1), the income arising from the transfer of virtual digital assets shall be taxed at the rate of 30%. Thus, both short-term and long-term capital gains shall be taxed at a flat rate of 30%, without any benefit of indexation on LTCG or deduction of expenses on transfer of VDAs.[10]

- AML and KYC Compliance: The Ministry of Finance has extended the scope of the Prevention of Money Laundering Act, 2002 (PMLA) to include Virtual Digital Assets. Stringent norms have been imposed on the Know Your Customer (KYC) requirements on cryptocurrency businesses. Such businesses are also required to secure a license from the Financial Intelligence Unit of India (FIU-IND) and adhere to Anti-Money Laundering (AML) regulations. Implementing the Travel Rule — a global benchmark established by the Financial Action Task Force (FATF) — further strengthens efforts to prevent money laundering and terrorist financing.

While maintaining a cautious approach toward private cryptocurrencies, the Reserve Bank of India has expressed interest in developing and issuing a Central Bank Digital Currency (CBDC). Pilot projects and feasibility studies have been conducted by the RBI to evaluate the potential advantages and challenges of implementing a digital form of the Indian rupee.

Crypto-Oligopoly | Conclusion

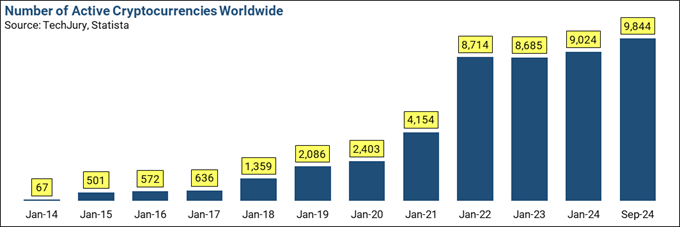

In March 2024, the universe of cryptocurrencies had expanded significantly, with over 13,200 cryptocurrencies in circulation. However, only around 9,000 of these are considered active with the remaining becoming ‘dead cryptos’ or digital currencies that have become inactive or worthless, typically due to lack of use, abandonment by developers, scams, or failure to gain market adoption. Presently, there are over 420 million worldwide users of cryptocurrencies, of which Asia constitutes 263 million users. Awareness and popularity of specific cryptocurrencies remain high, especially for well-established coins. As per the 2021 Gemini Report, Bitcoin was by far the most recognized currency, with 95% of crypto users as well as individuals knowledgeable about cryptocurrencies aware of it. Ethereum followed, with 38% awareness, and Bitcoin Cash was known by 24% of respondents surveyed.[11]

This familiarity with key cryptocurrencies highlights the influence that major coins have in shaping the public perception and overall acceptance of digital assets. Thus, as cryptocurrencies become further embedded within mainstream financial markets, their unique return characteristics and volatility serve as a reminder that, while offering potentially attractive upside opportunities, these digital assets require thoughtful integration into traditional portfolios to balance potential returns with inherent risks.

References

[1] Macheel, Tanaya. (Updated 2021, October 18). First bitcoin futures ETF to make its debut Tuesday on the NYSE, ProShares says. CNBC – https://www.cnbc.com/2021/10/18/first-bitcoin-futures-etf-to-make-its-debut-on-the-nyse-tuesday-proshares-says.html

[2] McGee, Suzanne. (Updated 2024, January 19). Spot bitcoin ETFs draw nearly $2 billion in first three days of trading. Reuters. – https://www.reuters.com/technology/spot-bitcoin-etfs-draw-nearly-2-billion-first-three-days-trading-2024-01-18/

[3] Today’s Cryptocurrency Prices by Market Cap. CoinMarketCap. – https://coinmarketcap.com/

[4] Calvert, Kyle. (Updated 2024, August 08). Ripple vs. SEC Lawsuit: A Full Timeline of the Legal Battle. DailyCoin. – https://dailycoin.com/ripple-vs-sec-lawsuit-full-timeline-legal-battle/

[5] Katz, Mike. (Updated 2024, August 12). Ripple Labs Ordered to Pay $125 Million Civil Fine, Potentially ending SEC Lawsuit. Manatt – https://www.manatt.com/insights/newsletters/client-alert/ripple-labs-ordered-to-pay-$125-million-civil-fine

[6] Franjkovic, Teuta. (Updated 2024, October 16). SEC vs. Coinbase: Hearing, Filings, Court Dates and Details in Full. CCN – https://www.ccn.com/sec-vs-coinbase-hearing-filings-court-dates-and-details-in-full/

[7] Nevil, Scott. (Updated 2024, August 25). What Is Markets in Crypto-Assets (MiCA)? Investopedia. – https://www.investopedia.com/what-is-market-in-crypto-assets-6751039

[8] (Updated 2024, September 25). Everything You Should Know About Cryptocurrency Regulations In India. Sanction Scanner. https://www.sanctionscanner.com/blog/everything-you-should-know-about-cryptocurrency-regulations-in-india-488

[9] Saha, Dipannita. (Updated 2024, September 09). The New Age of Crypto: India’s 2024 Regulatory Framework Unveiled. Impact and Policy Research Institute. https://www.impriindia.com/insights/crypto-india-regulatory-framework/

[10] Taxmann. (Updated 2023, September 20). Understand the Taxation of Virtual Digital Assets. Taxmann. https://www.taxmann.com/post/blog/taxation-of-virtual-digital-assets

[11] Howarth, Josh. (Updated 2024, March 12). How Many Cryptocurrencies are There In 2024? Exploding Topics. – https://explodingtopics.com/blog/number-of-cryptocurrencies

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”

About the Author

Mihir Shirgaonkar, CFA heads the Alternative Investments division at Phillip Ventures IFSC Pvt. Ltd. and has been a part of the firm since 2021. He is a Chartered Accountant and has completed MBA-PGPX from the Indian Institute of Management Ahmedabad. He has over 9 years of asset management experience and has worked with DSP Investment Managers (erstwhile DSP BlackRock) and HDFC AMC in his previous roles. In his career so far, he has handled multiple areas which span portfolio management, market making, valuations, fund administration, and project management. His other interests include philosophy, reading, photography, trekking, coding, cooking, and travelling.