- April 9, 2024

- Posted by: CFA Society India

- Category:ExPress

Written by

By Kislay Upadhyay, CFA

Founder and Fund Manager, FidelFolio Investments

Let’s talk about investing basics today.

Dictionary defines investing as the “act of buying and holding assets to earn capital gain or income”. Too simple, right? But why is investment really needed?

Most common objectives of investment can be categorized into THREE buckets:

1. Protection against the unexpected

- Emergency needs

- Insurance (Life & Health)

2. Financial goals

- Short-term goals

- Medium-term goals: e.g. house, child’s education

- Long-term goals: retirement planning

3. General financial security & prosperity: Growing wealth

Still fairly easy, right? But where to invest? What are the different investment options and how to choose from them?

Introduction to different investment options / asset classes

Let’s begin by examining various investment options:

- Fixed Income (FD, Bond, Debt Mutual Fund): Lending money to bank, corporate or government

- Equity (Stock, Mutual Fund, smallcase): buying partial ownership in a company / business

- Alternative Investment – Real Estate & Commodity (Gold, Silver)

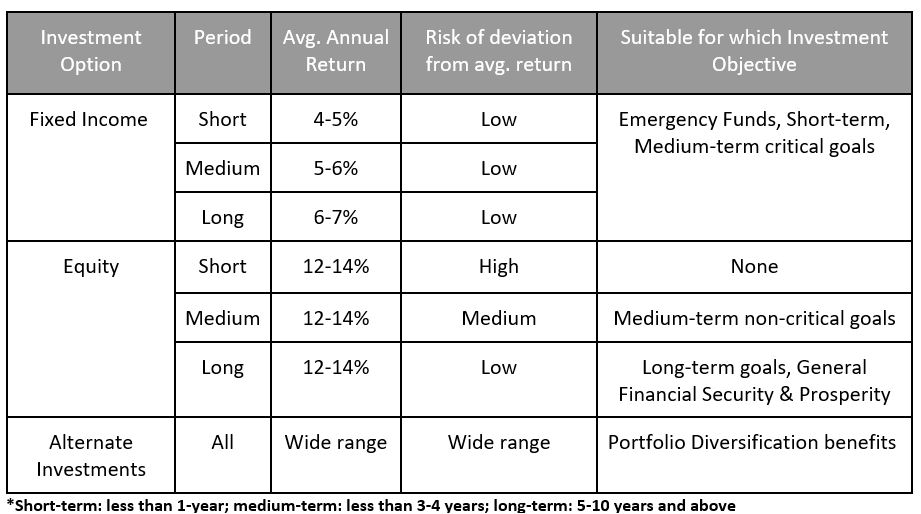

Apart from knowing the generic meaning of the different investment options, it is important to understand implications for an investor. Particularly, it is important to understand the risk, return expectations, and suitability for different investment objectives. The general understanding that fixed income is low-return & low-risk while equity is high-return & high-risk, is good to start, but not sufficient. The time horizon needs to be taken into consideration. Let’s look at the table below to understand risk, return and use-case of Fixed Income & Equity over different time horizons.

Two interesting takeaways from the table above:

- Equity is highly effective for long-term; it provides a lucrative free-lunch i.e. high-return with low-risk

- Fixed income is suitable for short-term

Equipped with a basic understanding of the various investment options, let’s start building a diversified portfolio.

Building a diversified portfolio

The table above provides a mapping of investment options, time-period and goals. This is goal-based investing, which is intuitive for common people to understand (mental accounting). While goal-based investing is a good way to look at the overall financial roadmap, practical investment allocation is done based on certain thumb-rules. In general, for an average investor (avg. risk appetite) allocation to investment options should look like below:

-

-

- Equity: 60%

- Fixed Income: 30%

- Alternate Investment: 10%

-

This means that if one has a wealth of ₹100 (after securing emergency fund and insurance), ₹60 should be invested in equity, ₹30 in fixed income and ₹10 in alternates. New investment is to be made to maintain this allocation. Over time, as financial goals are met from existing wealth, recalculation and subsequent reallocation is to be done.

What to do if my current portfolio allocation is sub-optimal?

In India, an average individual is heavily invested in traditional assets such as gold, real estate, and fixed deposits. Equity takes up less than 5-10% of wealth for the majority of common Indians. This was, (has changed), due to factors such as lack of financial literacy, lack of a transparent and regulated equity market, and difficulties in investing. If your portfolio too is far off from ideal asset allocation, reallocation should be planned & executed carefully.

Behavioural Perspective to Asset Allocation

The biggest practical enemy to keeping a diversified portfolio is our behavioural biases, which can derail even the most thought-out investment plans. Short-term market fluctuations can lead to panic and greed, resulting in suboptimal decisions. Key to avoiding it is setting realistic expectations and getting expert guidance to help stay in discipline.

In conclusion, while it is important to understand investment options to build a diversified portfolio, it is equally important to control behavioural biases and adhere to an investment plan.

Disclaimer: “Any views or opinions represented in this blog are personal and belong solely to the author and do not represent views of CFA Society India or those of people, institutions or organizations that the owner may or may not be associated with in professional or personal capacity, unless explicitly stated.”