- November 25, 2013

- Posted by:

- Category:Bengaluru, BLOG, Events, Speaker Events

Contributed by: Bhrigu Shree

The world economy and more so the Indian economy, seem like a mystery to comprehend. Our economy has witnessed broad ranging cycles with a period of unprecedented growth followed by a period of slack, all in the past decade. The expert and the novice alike have questions: Is the amazing growth story of India over? What is the true scenario today? Where do we go from here?

The Bengaluru chapter of the Indian Association of Investment Professionals (IAIP) organized a presentation on Indian economy by Kunal Kumar Kundu, Vice President and India Economist at Societe Generale, Bangalore. Kunal has over seventeen years of experience in observing, analyzing, commenting and interpreting the Indian economy.

Kunal started by asking the audience of their expectations for the Indian economy. While some were of the opinion that post 2014 elections there may be a ray of hope for the Indian economy, others were of the opinion that the expectation of the people will push politicians to undertake the right reforms. He also shares a view similar to that of the members who gathered at the meeting. He feels ambivalent about the economy: short-term growth prospects of the economy are not looking great, but, he believes, that the medium to long-term expectations currently appear intact.

The Scenario Today:

· Certain fundamental and strategic issues have arisen on account of short-sighted government policies that are focused on gathering political advantage rather than on sustained long-term economic growth.

· A declining growth rate of 4.0 to 5.0 percent can be considered strong given the current structural challenges faced by our economy

· An unstable fiscal and monetary policy coupled with a prolonged instability in the global scenario has resulted in the worsening of Current Account Deficit (CAD) and Fiscal Deficit. The fiscal deficit would require urgent attention by the Government.

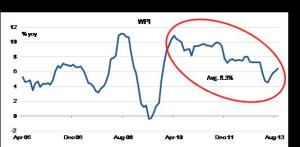

· Uncontrolled high inflation during the last few years despite efforts from the Reserve Bank of India (RBI) remains a matter of concern and has started to eat into the GDP growth story.

· Significant depreciation of the rupee from around Rs. 45 to Rs. 63 per $ occurred due to a combination of the above factors

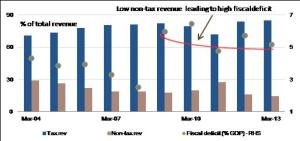

· Policy paralysis has resulted in low business sentiment and corresponding investment environment. These factors have resulted in a decline in tax collected as a percent of GDP. This leads to a greater dependence on Non-Tax sources for revenue, resulting in uncomfortable Fiscal Deficit. (Illustrated below)

· Inability to capitalize on a strong Demographic Dividend. Lack of focus on vital sectors such as health and education may result in an inability to capitalize on this resource.

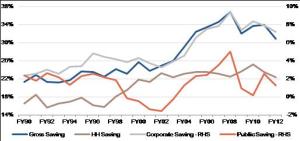

· Decline in financial savings due to an inflationary economy has resulted in decreased money circulation for investment and growth.

Medium to Long-Term Outlook and Conclusion:

Despite the current weak conditions in the economy, Kunal was positive about the medium to long-term outlook. He concluded the discussion by listing seven things which will help unlock the growth potential of the Indian economy:

- Boosting power supply and rationalizing power tariff

- Optimising use of natural resources

- Streamlining administrative procedures

- Leveraging favourable demographics

- Ensuring fiscal consolidation

- Building a single flexible market

- Reducing policy uncertainty to boost investment

The presentation was followed by an interactive session during which the members exchanged their view points with Kunal.

– B S

PS: For presentation kindly visit http://www.cfasociety.org/india/Pages/ContinuingEducation-Presentations.aspx