- December 26, 2018

- Posted by: Shivani Chopra, CFA

- Category:BLOG, ExPress

Contributor: Sumit Duseja,CFA (Co-Founder of Truemind Capital Services)

What we have learned from history is that people don’t learn from history. And that is the reason why a majority of investors do not earn good returns from their investments over the long term. Those who make superb returns on their investments are good students of market history and have learned the lessons quite well and stick to it.

There is no denying that equity markets go through a cycle. Broadly we can call it a cycle of Greed & Fear. These cycles have happened many times in the past and will continue to happen in the future.

Stock markets are a reflection of collective human emotions. Like we experience phases of joy and sorrow in our lives, similarly, equity markets also experience emotional upheavals due to collective actions based on perceptions of human beings.

Do note that the euphoric scenario in the cycle of Greed & Fear comes with the point of maximum financial risk. On the contrary, despondency in the cycle presents the point of maximum financial opportunity. To depict the same in terms of returns, let’s see the tables below:

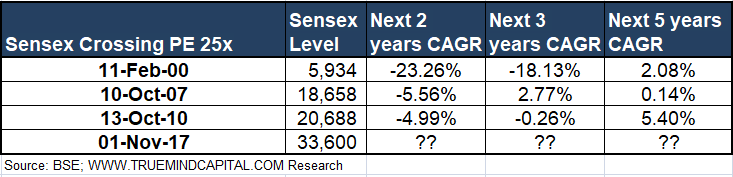

In a course towards market peaks in the last 20 years, following are the Sensex returns whenever it has crossed 25x PE multiple.

Sensex crossed 25x PE three times in the last 20 years and the average CAGR over the next 5 years period is paltry 2.54%.

On the contrary whenever Sensex PE fell below 14x multiple, the point to point returns in subsequent years have been terrific.

Equity markets generally go through intermittent (small) corrections and big secular corrections. The intermittent corrections are up to 20% which occurs while the markets go through a longer trajectory from trough to peak. From the peak a major secular correction of 50-60% occurs once in a decade. These corrections happened multiple times in the past and will continue to happen in future. The timing and the extent of such corrections is difficult to ascertain but there are telltale signs during the extremes of the market.

We usually observe the following behavior during market peaks:

- Retail participation is huge. People with very less knowledge about stocks and most risk-averse FD investors start putting money in equity markets.

- Newspaper headlines scream with euphoria about new peaks achieved by markets

- There is utter rejection/ridicule of thought or statement that markets can decline by more than 20%

- Majority of the stocks start trading at the valuations much above their historical averages

However, those consumed by greed always have reasons to ignore on the premise that “this time it’s different”. Unfortunately, these words prove to be the most dangerous words in investments every time.

During market bottoms most common behavior to witness:

- Retail participation dips significantly. Rather, they start taking out money fearing a further fall.

- Newspaper headlines sounds of gloom and doom scenario

- There is a loss of hope and complete rejection of the idea that situation can improve from here and markets can bounce back with handsome returns in the medium to long-term

- Majority of the stocks start trading at the valuations much below their historical averages

Again, the investors consumed by fear believe that the world is going to end and this time it’s different than the previous bottoms.

In hindsight, everyone saw the financial crisis coming in 2007. In reality, it was only a fringe view. The next correction will be the same (they all work like that). However, the reasons are different every time.

“Stock markets cycles don’t repeat but they rhyme”

Our memories of financial history seem to extend about a decade back. It also erases many important lessons. Here are some lessons that we learn from market history which helps us prevent major losses and maintain sanity at market extremes to use it to our advantage:

- Do not get mislead by the term – this time it’s different. Never forget that “mean reversion” happens over medium to long term.

- Do not buy something which is priced much higher than it’s worth. Finding true worth of any business/asset class is not an easy exercise. You can invest in the best business and still lose your money.. Price you pay versus the value you get makes a lot of difference in investment returns.

- Markets can continue to remain irrational (expensive or cheap) for a very long time. Be patient. Expensive doesn’t mean that market will fall tomorrow and cheap doesn’t mean that market will start moving up tomorrow.

- Never predict or try to time the market on day to day basis. But this doesn’t mean that you buy at any price. The price, compared to the intrinsic value, at which one buys, determines the potential risk and returns.

- Caution yourself against the herd mentality. Investing in popular themes/assets etc. won’t generate good long-term returns. Do not get mislead by past returns.

- Selling is important too. Market peaks provide a good opportunity to reduce allocation to ridiculously expensive assets. If you avoid loses during a market downfall, you can make significant returns in a market upswing, provided you have courage to buy when everyone else has given up hope.

Based on the lessons learned, one should develop an investment philosophy which guides you during different market scenarios. If you do not have an investment philosophy in place, you end up buying at the top and selling at the bottom like all other people.

The most significant tenet of investment philosophy followed by many successful investors is “margin of safety”. Many wised-up investors understand that they cannot predict the future. So, the best one can do is to invest at prices lower than what something is conservatively worth, thus providing a margin of safety. Lower the price from the worth of an asset, higher is the margin of safety (lower downside) and greater are the potential future returns.

[…] *Please note the above article was first published on CFA Society India Blog. […]