- March 1, 2017

- Posted by:

- Category:BLOG, Events, New Delhi, Speaker Events

Contributed by: Jyoti Soni, CFA

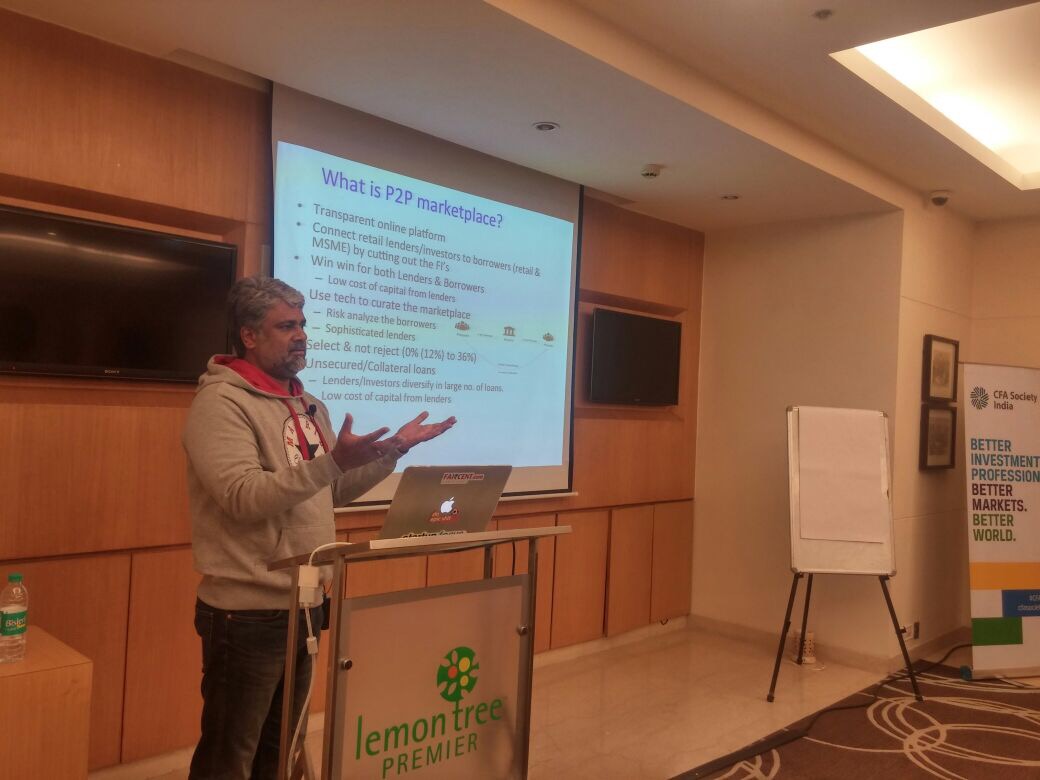

The Delhi chapter of the Indian Association of Investment Professionals (IAIP) organised a speaker event titled, ‘P2P Lending – The new & rising asset class’ on 25th February 2017.

Peer-to-Peer lending is a very new concept in India. We have seen a presence of unorganised market for P2P in India for a very long time but this concept never came in an organized and regulated way before. The audience present at the event were already sounding too curious to know about this asset class. How does it work? How is it different from our banking system and old aged lending system? To address all these questions, we had an eminent speaker, Mr. Vinay Mathew-Founder & COO of Faircent.com.

Faircent.com is India’s leading P2P lending platform. Vinay started the session by highlighting the importance of structured data today. Data is the foundation for all online businesses. Structured and unparalleled data about individuals and companies is available on the internet through various social media and e-commerce sites. It can be used to understand an individual’s behaviour and likely social demands. Along with data structuring, a rapid increase in mobile users, mobile applications, digital or online payment systems has together given a boost to e-commerce and online platforms.

The basic premise in P2P lending is to break down the incumbency of an investor and a borrower. An investor can add a new asset class to his portfolio with high risk-adjusted returns. In a growing economy with high aspirations of the people, lending phenomenon tends to grow multiple times in future. Hence, the demands of the borrowers either remain unserved or underserved by the banking system. Banking institutions are highly regulated and have a high cost of capital. Hence, they cannot fulfil the loan requirements of a large number of people. Thanks to Peer-to-Peer lending platforms, today we have an alternative lending source.

The platform works by first verifying the details about the lenders and the borrowers. In the second step, a credit rating is assigned to the borrowers and lender’s money gets deposited in an escrow account. After this, fractionalization of loans is done among borrowers and lenders.

Main Pillars of P2P lending:

Retail Lenders: The funds lent by a retail investor is allocated amongst several borrowers rather than a single borrower. In this way, the lender can diversify his credit risk and achieve a high risk-adjusted return.

Retail or SME Borrower: A borrower can get the loan quickly without any documentation hassle and at a better cost than any of traditional bank.

Data from different sources: Data about borrowers is gathered from different sources like E-KYC, CIBIL, Bank data, Mobile data, ITR data, social data and psychometric data to evaluate the credit risk of a borrower.

Technology: Faster, transparent, convenient, tech-enabled processes and auto lending reduce the cost of borrowings and quickly process the loan disbursement.

Conclusively, the P2P lending seems to be a win- win situation for both the parties (lender and borrower). It has been prevailing in developed nations like US, UK and China for many years now. However, in India, it is till at a very formative stage. IAIP Delhi chapter wishes all the very best to the team at Faircent.com and is grateful for sharing this knowledge with us.

-JS