- July 23, 2019

- Posted by: Shivani Chopra, CFA

- Category:BLOG, Events

Contributed by : Sidhant Daga

The rewards of good behavior: Where theory meets practice

The last speaker to grace the CFA Society India Kolkata Chapter’s marquee event was none other than Mr. Sanjoy Bhattacharyya(Managing Partner, Fortuna Capital) himself. Mr Bhattacharyya’s wise words compelled the audience to introspect about their inherent behavioral limitations. Mr. Bhattacharyya explained with great intricacy as to how one must put behavioral finance into practice. During his speech Mr. Bhattacharyya busted various myths, explained various behavioral errors we suffer from and also taught ways to overcome the same. Mr. Bhattacharyya credited his presentation’s (The rewards of good behavior: Where theory meets practice) ideas to Crosby, Zweig,Monteir and Maubossin.

Mr. Bhattacharyya started with a bold statement that “Bhav Bhagwan Che” is a myth. He stressed on how in the markets we need to work against human hardwired nature of seeking social approval. One must work against social coherence, become a rational contrarian to achieve success in the markets. He told how important an another 2008 is to make some handsome amount of money, as buying in the times of distress can help one gain spectacular returns.

The speaker busted few more myths, the myths being

- Large caps are less risky than mid cap and small cap

- You are good at a particular skill based on the community you come from

Mr. Bhattacharyya beautifully correlated research facts and how they impact people in the investment field. He told that how brain which is only 2-3% of the body weight consumes more than 25% of our energy and this is the reason why people try to find shortcuts while researching and picking stocks as everyone wants to avoid extra brain activity as we all are inherently lazy.

Mr. Bhattacharyya gave an important teaching, he told that he doesn’t and others should also not take investment decisions when they are going through the state of HALT ( Hunger , Anger , Loneliness , Tired)

The speaker mentioned how newcomers in the stock markets are always more bullish than the seasoned players, as they haven’t gone through a bear cycle, whereas, seasoned investors who have faced a bear market are cautious because their memory of the bear market haunts them.

One of the key statements he made during the course of his presentation was that “Sensible investing is not about finding multibaggers, it’s about managing risk.” He further elaborated on the concept of risk and subdivided risk into behavioural, market and business risk. One must be managing all 3 well to become successful as an investor.

According to the speaker, the crux of behavioural risk is defined by –

- Ego– Mr. Bhattacharyya via practical examples showed how ego is the enemy of every investor. He via interactive questions to the audience showed how each one of us suffer from overconfidence which is a by-product of the ego inside us. According to him one must overcome ego to be more successful. The ways he mentioned to do the same are:

- Diversify

- Feynman Technique – figure out what you don’t know, educate yourself and teach it to a beginner.

- Take the outside view, which depends more on probability and facts than convenience and personal experience.

- Look for the right questions instead of looking for answers because market are uncertain and need a dynamic process

- Doubt to stimulate through enquiry

- Manage overconfidence

- Avoid Confirmation Bias

- Use the process of thesis – antithesis – synthesis

- Conservatism – Mr. Bhattacharyya explained how we prefer sameness over change, even if it is suboptimal because change requires cognitive effort, and has the potential for loss and regret if the decision of activity provides lesser returns than the decision of being status quo. Conservatism causes investors to hold losers too long and to overvalue stocks which they own. Mr. Bhattacharyya also explained how the conservatism bias goes hand in hand with the sunk cost fallacy. The ways to conquer conservatism as per the speaker are :

- Evaluate risk in terms of long-term rewards rather than short-term harm. Smart Investors buy stocks which seem more risky to the average investor.

- Portfolio Management should be rule based rather than discretionary

- When you know your stock idea is a disaster, exit it, don’t seek advice from others

- Banish the fear of losing

- Be prepared for the worst. Decisions during the time of crisis should consist 3 elements- denial, deliberation and decisive action.

- Practice logical thinking

- Attention – Investors sometimes do not rely on information which is factually correct due to recency bias. They also suffer from information overload. In attention bias, the problem is that salience trumps probability when making investment decisions and leads one to rate the unfamiliar one as more risky and show a preference for the familiar regardless of their fundamental qualities. The ways by which Mr. Bhattacharyya guided to face this behavioral risk are :

- Distinguish between signal and noise

- Play the odds, ditch the story.

- Look for simple solutions

- Examine the deepest motivations behind your thoughts and actions and consistently seek feedback from those with diverse viewpoints

- Emotion – Mr. Bhattacharyya explained how emotions play an important role in our investment decision making. Emotions cause investors to cut their gains fast, over bet, make irrational decisions etc.The ways by which one can keep their emotions under check as per the speaker are:

- Meditate

- Use the concept of RAIN ( Recognise, Ask, Investigate and Negotiate)

- Automate your processes, use rule based investing

- Try and understand your emotional state while making a decision

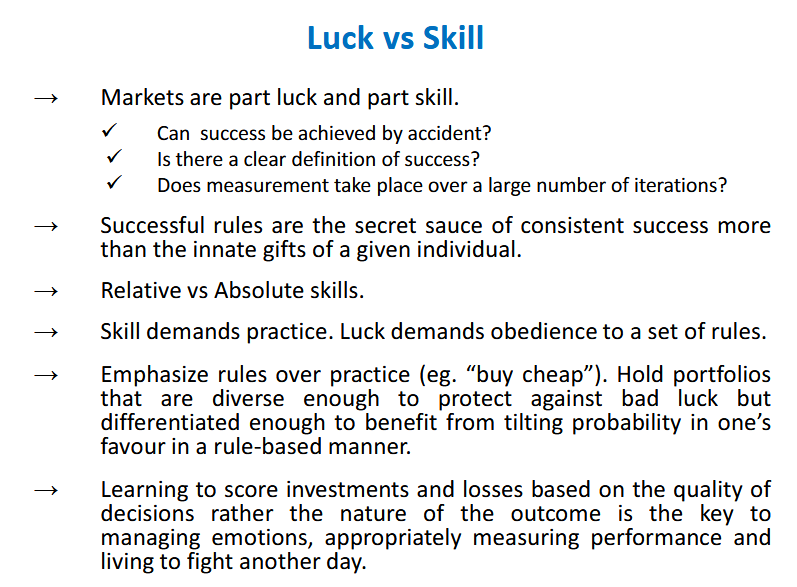

The Speaker interestingly differentiated between the role of luck and skill in the markets.

Book Recommendation – The Zurich Axioms by Max Gunther

The presentation by Mr. Bhattacharyya was followed by a short panel discussion moderated by Mr. Anirban Dutta(Director, Jet Age Securities). Viewpoints shared during the panel discussion –

- On how one can be a rational contrarian – One can become a successful rational contrarian investor only when one takes contra bets in companies he/she understands. A deep understanding of the company is essential to take a bet opposite to the crowd, because without a deep understanding one cannot have a strong conviction.

- On what test will Mr. Bhattacharyya take while choosing a fund manager – Mr. Bhattacharyya told that as per him, a personality and a stress test are the most important criteria, knowledge test being secondary ,as to him having a personality suited to withstand market pressure and still act wisely is important.

- On how to remain happy in markets – Mr. Bhattacharyya advised the audience to not to get attached to money, if they want to remain happy in the markets. He simply said that the key is “If you have enough, great. And if you don’t, great.”

The link to Mr. Bhattacharyya’s complete presentation –https://www.cfasociety.org/india/Presentations/The%20rewards%20of%20good%20behavior-%20MAW%2029th%20June-%20Sanjoy%20Bhattacharyya.pdf

WAITING FOR YOUTUBE UPLOAD