- October 3, 2018

- Posted by: Shivani Chopra, CFA

- Category:BLOG, ExPress

Contributed By: Sumit Duseja, CFA (Co-founder Truemind Capital Services)

What is the best time to prepare for the retirement?

A study of 1,000 senior citizens conducted by LendEDU in the US reveals the biggest regret among elders in not saving enough for retirement. The concerns are not much different from what can be witnessed in urban India. The situation may be worse in India since the financial literacy is very poor compared to developed economies.

The worst feeling post retirement is to ask for help from others to meet your basic requirements or to compromise with your lifestyle. Moreover, nobody wants to lose self-respect at any stage of life. However, a simple planning can help you avert such a situation post retirement.

The biggest reason for failing to appropriately prepare for the retirement is the wrong notion that the retirement planning should start a few years before the retirement. Another reason is procrastination. In reality, the best time to start preparing for the retirement is TODAY.

Why Today? For the simple reasons – inflation and the power of compounding. Let us see how inflation affects our expenses and how the power of compounding can be used to trounce it.

Inflation: A silent monster

Inflation is the most under-rated threat that is always feeding on your money, reducing your purchasing power. It is under-rated as it grows gradually without making one realize the severity of its impact in the long term.

If you are currently spending INR 50 thousand per month on your lifestyle, you will have to spend a much higher amount at the time of your retirement to sustain the similar lifestyle. Assuming our lifestyle inflation of INR 7%, you will need INR 98 thousand (almost double the amount from today) after 10 years just to maintain the current lifestyle standard. That means, what you can buy today for INR 50 thousand, you will have to shell out INR 98 thousand for the same after 10 years. It keeps on increasing with every passing year due to inflation. This also means that if you are not saving or your savings are not earning more than inflation, your purchasing power will gradually reduce.

Check below the inflation adjusted expenses of INR 50 thousand/month over the following years.

![]()

Source: Truemind Capital Services Research

#Average inflation assumption of 7%

If you are retiring after 20 years, be ready to spend INR 1.93 Lakhs per month to sustain the present lifestyle at the time of retirement. Unfortunately, inflation will continue to hurt post retirement also. 10 years after the retirement, the monthly expenses will become INR 3.80 Lakhs.

To fund your monthly expenses post retirement, you will need around INR 8-10 Crores (assuming the current age of 30, 30 years to retirement from today, a life expectancy of 80 years and returns on your post retirement funds at 8%). This calculation doesn’t even take into account the rising medical expenses in the old age. Do you think you are prepared for such a situation?

You can calculate your own retirement corpus that you would need at the time of retirement by using the tool on our website. Click here to find out.

Now, since you know that a substantial corpus is needed at the time of retirement, don’t let that frighten you into feeling that it is not achievable. Simple planning, discipline, and power of compounding are all that you need.

Power of Compounding: Eighth wonder of the world

Power of compounding is a powerful method to reach any of your financial goals. Sooner you start better it works. Let us see how procrastinating your investment plan affects your wealth in the long term.

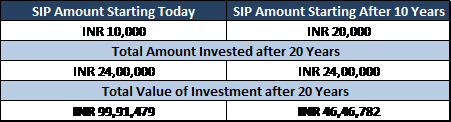

Imagine today you have started investing INR 10,000 per month over the next twenty years. You will be investing INR 24 Lakhs over the twenty-year period. One of your friends started late – 10 years from today. To make up for the loss of time and savings, he decided to double up the investment amount to INR 20,000. In that way, his total investment after the end of 20 years from today will be INR 24 Lakhs, same as yours.

However, if both yours and your friend’s investment grow at 12% per annum, by the end of 20 years the value of your investment would be INR 99.91 Lakhs whereas the value of your friend’s investment would be INR 46.46 Lakhs. Therefore, despite putting the same amount, a delay of 10 years resulted in a loss of INR 53.44 Lakhs to your friend.

Source: Truemind Capital Services Research

From the above discussion, we learn that the power of compounding is a powerful tool that multiplies your wealth in the long term.

In the same manner, to prepare for retirement, you can start with even small amount to create a substantial corpus for your retirement. To find out the amount to be invested per month for creating retirement corpus that you need, click here.

Referring to Mr. Warren Buffet quote, it is essential to make your savings work for you while you are sleeping to achieve financial independence.

With two sources of income – from job and higher compounding returns on savings, you will be able to achieve your retirement goal with ease. Only other traits you need are patience and discipline.

Retirement is inevitable. You cannot wish it away. Therefore, don’t procrastinate. Start your retirement planning today.