- July 15, 2025

- Posted by: CFA Society India

- Category:BLOG, ExPress

Dr. Shagun Thukral, CFA

Development of India’s bond market, specifically corporate bond markets has long been a long-standing discussion amongst policymakers. There have been multiple attempts by regulators over the years and they have laid out a slew of reforms emphasizing the need to deepen and broaden participation. One recommendation has been to encourage greater participation from retail investors to deepen the bond markets. As a result, we have seen RBI launch the RBI Retail Direct platform which allows retail investors to invest in government bonds as well as the launch of various online bond platforms that allow for buying and selling of corporate bonds. While widening the investor base is an important factor in market development, one wonders if direct retail participation is a prerequisite for a robust bond market. In fact, the development of an efficient, transparent and liquid bond market in India can—and should—continue to be driven by institutional players. Some of the reasons are as listed below:

1. Bond Markets Globally Are Driven by Institutions

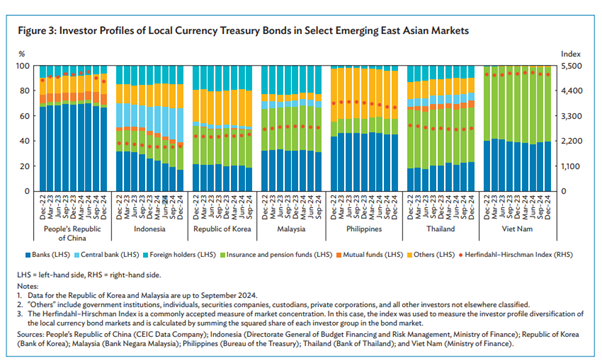

Bond markets globally are dominated by institutional investors such as mutual funds, pension funds, insurance companies, and sovereign wealth funds. According to the Securities Industry and Financial Markets Association (SIFMA), less than 10% of the US household investments is in ‘directly held debt’ and institutional investors account for the bulk of daily trading volumes. Similarly, in the Eurozone, institutional entities are the primary participants in both primary and secondary bond markets. A look at data from ASEAN countries also suggests that institutional investors account for substantial holdings in the region.

Source:asianbondsonline.adb.org

The prevailing influence of institutional players is attributed to their expertise to analyze credit risk, interest rate trends, and macroeconomic indicators, unlike retail investors. In India, many institutions like banks and insurance companies have regulatory mandates to invest in bonds. Their involvement ensures liquidity, price discovery, and market depth.

2. Bonds Are Far More Complex Than Equities

A large part of the success in the efficiency of equity markets in India since the 1990s has been attributed to increased retail participation. The equity market, while risky, is relatively straightforward for retail investors to understand: one buys shares, holds them, and hopes for capital appreciation or dividends. If prices go up, you make money and if they go down, you lose money.

An attempt to replicate the same experience in bond markets in misplaced. Bonds, by contrast, are far more nuanced. Retail investors must understand complex issues like the difference between coupon and yield to maturity, interest rate risk, credit ratings and accrued interest—all of which require financial literacy levels that the average retail investor may not possess. Lack of understanding of these aspects can lead to financial losses that the investor cannot anticipate. Moreover, unlike stocks, where prices are transparent and widely published, bond pricing is often opaque.

3. Liquidity Challenges on Online Bond Platforms

India’s recent regulatory push to enable retail participation through online bond platforms is well-intentioned. However, liquidity remains a challenge. The problem isn’t just about awareness or usability—it’s a structural issue that even institutional investors deal with.

Bond issuance in India is still largely private placement-based, with low issuance frequency and limited fungibility across tranches. Moreover, most institutional investors like insurance companies and pension funds tend to have a buy and hold strategy when it comes to their bond portfolios and are rarely sellers in the market. Consequently, liquidity remains thin. Retail trades are a small fraction of the overall market, and even when executed, suffer from wide bid-offer spreads and poor exit options.

While the average Indian investor has an affinity for fixed income assets like fixed deposits and small savings schemes by the government, they associate these with low-risk and predictable returns. The investor is unwilling to accept any decline in value of bonds due to lack of liquidity in the secondary market.

Data from platforms like RBI Retail Direct and BSE’s Bond platform show that volumes are miniscule as compared to the broader bond market. This lack of depth creates a vicious cycle—low volumes mean high illiquidity, which in turn deters further participation.

4. Wide Bid-Offer Spreads Erode Retail Value

In illiquid markets, bid-offer spreads are a hidden cost that can materially impact investor returns. In India’s bond market, especially for lower-rated or less-traded bonds, these spreads can range from 25 to 100 basis points or more, significantly reducing returns for retail investors.

Retail investors, unlike institutions, do not have the leverage to negotiate better prices or access interbank markets. As a result, they are often compelled to buy at the offer and sell at the bid—effectively locking in a loss at both ends. In such an environment, bonds cease to be the “safe” investments they are often marketed as.

5. The Smarter Way: Let Funds Do the Heavy Lifting

From an asset allocation perspective, bonds are an important asset class for retail investors. It may be more prudent to achieve this allocation via products/vehicles like debt mutual funds and bond ETFs that offer a far more efficient and diversified route to participate in the fixed income segment. These vehicles pool savings, have professional fund managers who construct diversified portfolios, actively manage interest rate and credit risk, and navigate market inefficiencies. They also mitigate risks associated with daily liquidity, transaction costs and bid-offer spreads, making them far superior to direct bond purchases for most individuals. In fact, in developed markets like the U.S., retail exposure to bonds is primarily through mutual funds and ETFs rather than direct holdings—a model that India should look to replicate rather than reinvent. Debt Mutual Funds and ETFs can also allow retail investors to explore varied debt portfolio strategies that would otherwise be challenging to replicate independently.

6. Exposure to Credit Risk

Assessing credit risk in corporate bonds presents a significant challenge for retail investors, primarily due to the complexities involved in evaluating a company’s financial health, industry position, and broader economic factors. Most of them rely on credit ratings that have been misleading in the past. Unlike institutional investors, who conduct thorough credit analysis of a company prior to investment, retail investors do not have the extensive information or skill set to evaluate the same comprehensively. This knowledge gap can lead to mis-judgments regarding the creditworthiness of bond issuers, potentially resulting in unexpected defaults and financial losses.

Historically, there have been notable instances in India where corporate bond defaults have adversely affected retail investors. For example, the default of Dewan Housing Finance Corporation Limited (DHFL) in 2019, which was a AAA-rated entity, had significant repercussions, with numerous individual investors facing substantial losses on their investments. Similarly, defaults on fixed deposits by companies like Jaiprakash Associates have underscored the risks associated with inadequate credit risk assessment. These cases highlight the potential pitfalls for retail investors venturing into the corporate bond market without a comprehensive understanding of the associated credit risks.

7. Findings from Author’s Doctoral Thesis

In the author’s doctoral study on Factors Constraining the Development of Corporate Bond Markets in India, the findings showed that market participants did not believe that retail investors had a role to play in market development. In fact, the study indicated that the most important requirement for market development was to create the right ecosystem which involved a well-developed, liquid government bond market across the yield curve, an effective bankruptcy code, transparent credit rating process, etc.

Conclusion: Let Institutions Lead, for Now

India’s corporate bond market does need to evolve—but retail participation is neither necessary nor sufficient for that evolution. Instead, the focus should be on strengthening institutional engagement, improving market infrastructure, and expanding the tools that enable true price discovery and liquidity.

Retail investors have transformed India’s equity landscape and mutual fund ecosystem. But in the bond market, their involvement should come through professionally managed funds—not direct exposure. Sometimes, letting the professionals take the lead is not exclusion—it’s protection.

Disclaimer:

The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the official position of CFA Society India. The content is intended for informational purposes only and should not be construed as financial, investment, legal, or professional advice.

Readers are encouraged to consult qualified experts before making decisions based on the information provided. While efforts have been made to ensure the accuracy and timeliness of the content, no guarantees are offered regarding its completeness or reliability. The author and CFA Society India will not be held responsible for any errors, omissions, or outcomes related to the use of this material.

By accessing and reading this article, you acknowledge and agree to this disclaimer.

About the Author:

Shagun is a Doctorate, CA and a CFA with over 20 years of experience in the investment industry. She was recognised as one of India’s Top 100 Women in Finance by AIWMI in 2019. Shagun started her career as part of a buy-side fixed income team at a leading insurance company, working in various capacities including credit analyst and fund manager. After 7 years, she moved to the education industry with a keen interest in bringing real-world and application based learning to the classroom. She teaches subjects like Financial Markets, Financial Accounting, Fixed Income and Wealth Management. While continuing as an Adjunct Faculty, she moved on to an entrepreneurial role of a wealth manager managing investments for retail and HNI clients. She also conducts sessions and workshops on financial awareness for individuals. Having a passion for bond markets, she completed a Ph.D in Corporate Bond Markets in India in 2020 and has published several research papers and case studies in both national and international journals.