10th India Wealth Management Conference | Mumbai

- August 29, 2025

- 3 pm - 8 pm

- Jio World Convention Centre, Mumbai

Date-Friday 29th August 2025

Venue: Jio World Convention Centre, Entry from gate no-18

Indian Association of Investment Professionals (CFA Society India), in collaboration with CFA Institute, is pleased to host the 10th India Wealth Management Conference, a premier platform that brings together leading investment thinkers, policymakers, and industry practitioners to share insights, explore trends, and discuss the future of investing.

This year’s conference will also feature four pre-conference workshops on Manager Selection, Risk Profiling & Suitability, Impact by Design and Wealth Architecture offering attendees an opportunity for deeper learning and practical engagement ahead of the main sessions.

Theme: Agile. Inclusive. Global. Reimagining the Future of Wealth.

The future of wealth is agile in strategy, inclusive in approach, and global in perspective. Today’s wealth professionals must navigate volatile markets, broaden access to sophisticated financial solutions, and embed cross- asset and cross-border thinking into every client strategy.

Over the past decade, India’s wealth management industry has evolved from a boutique service into a technology-driven, client-focused ecosystem. A new generation of investors—aspirational, digital-native, and globally oriented—is reshaping the expectations of advice and service.

Yet while India’s economic momentum continues, the global environment presents new layers of complexity. Persistent macroeconomic uncertainty, geopolitical realignments, and accelerated innovation are transforming how wealth is created, preserved, and transitioned across generations.

In this era of opportunity and disruption, traditional playbooks no longer suffice. Agile thinking, accessible solutions, and a global perspective are not optional—they are essential.

Pre-Conference Workshops (Optional – Limited Capacity)

Venue for workshops- Jio World Convention Centre, Mumbai, Gate no-18, 2nd floor

Workshop 1-a : Manager Selection

Time: 10:00 AM – 11:30 PM (Room no-206A)

Workshop 1-b :Impact by Design

Time: 9:30 AM – 11:30 PM (Room no-206B)

Workshop 2-a : Risk Profiling & Suitability

Time: 12:00 PM – 2:00 PM (Room no-206A)

Workshop 2-b : Wealth Architecture

Time: 12:00 PM – 2:00 PM (Room no-206B)

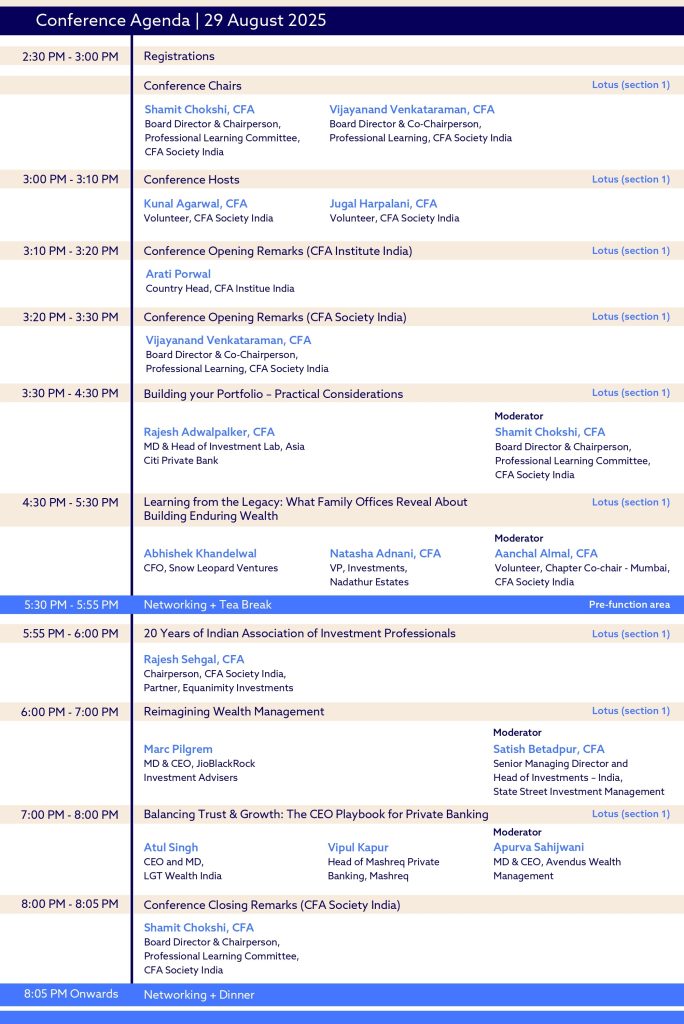

Main Conference

Time: 3:00 PM – 8:00 PM, followed by Dinner

Venue: Jio World Convention Centre, Mumbai- Lotus Ballroom-1 Entry from gate no-18

Date: 29th August 2025

If you’re interested in purchasing bulk passes (10 or more), please email us. “events@india.cfasociety.org”

Marc Pilgrem

Marc Pilgrem is the Managing Director and Chief Executive Officer (CEO) of JioBlackRock Investment Advisers Private Limited. Marc brings over 25 years of global financial services experience to his new role.

He previously served as the Head of Specialist Clients and Investment Trusts for Europe, the Middle East and Africa at BlackRock, where he led initiatives to enhance client engagement and expand BlackRock’s investment trust offerings across the region. Prior to that, he was Chief Operating Officer and Head of Business Strategy for iShares EMEA, overseeing strategic planning and operational execution for BlackRock’s exchange-traded fund business.Marc will draw upon his extensive experience in wealth management, digital transformation and client engagement as JioBlackRock Investment Advisers aims to deliver innovative investment solutions to millions of investors in India.

Vipul Kapur

Vipul Kapur-Head of Mashreq Private Banking, Mashreq.Vipul brings over 30 years of senior management expertise in Consumer Banking and Wealth Management, building businesses, managing change, mentoring fintech start-ups, implementing technology platforms & nurturing leadership talent.He built an international career across Citibank & Mashreq spanning London, Singapore, Dubai, Bahrain, and India, with 7 years leading Private Banking at Mashreq. Prior to Mashreq, he was heading international businesses including the Global Non-Resident Indian Wealth, the Consumer Bank for the UK & the Private client wealth business for EMEA.Vipul holds Dual Post Graduate degrees in Chartered Accountancy & Cost & Management Accountancy with specialization in Finance & Economics.

Atul Singh

Atul Singh is a Chief Executive Officer and Managing Director at LGT Wealth India Pvt. Ltd. Prior to this he was the Founder & CEO of Validus Wealth. He has over two decades of experience in the wealth management industry. He was the Managing Director &CEO of Julius Baer, India, where he led the acquisition of its business from Merrill Lynch. Before the acquisition, he was the Managing Director of privateclient businesses at Merrill Lynch,Singapore. Prior to Merrill Lynch, he spent 7 years at the Booz Allen Hamilton in New York,advising large financial services clients.

Atul holds an MBA from IIM Bangalore with a Director’s Medal and a degree in Electrical Engineering from the Birla Institute of Technology, Ranchi, with a Presidential Gold Medal. He believes in the philosophy of client centricity,recommending only investments he would himself put his money in. Outside the office, he enjoys photography and exploring wines from around the world

Paul Resnik

Paul is founder of PlanPrompt - Suitability built in India for India.Paul Resnik’s fifty year career in all parts of the wealth management service chain includes primary roles in financial advice, goals based planning software, asset management, life insurance, pensions management, training, retirement planning & recruitment. Paul is a successful (& sometimes unsuccessful) entrepreneur having founded, developed & exited

• international financial risk profiling house FinaMetrica - now owned by Morningstar,

• the multi asset, multi manager Transact Platform - listed on the FTSE valued at £1.25 billion serving 8,000 HNW advisers, and

• several other financial services businesses to listed & private equity holders.

Paul runs his own family office, has family offices as clients & is an investor in a network business servicing 165 Australian family offices.

Rajesh Adwalpalker, CFA

Rajesh Adwalpalker is the Head of the Citi Wealth Investment Lab for Asia.The Investment Lab comprises analysts based across Singapore, Hong Kong, New York, Chicago, Miami, Los Angeles, Toronto, London, Geneva and Dubai focused on portfolio construction, asset allocation and risk management. As the head of the Investment Lab for Asia, Rajesh is responsible for the creation and delivery of innovative wealth-management strategies catering to our clients and family offices in the region.Rajesh has been part of the Lab since its creation in Asia in 2010. His prior assignments at Citi include Product Development across multiple Asian markets and across asset classes for the Private Bank, development of liquidity and interest rate risk models for Citigroup, and management of the centralized client service team for the Institutional Clients Group in India. Rajesh has 27 years of banking experience, including 25 years at Citi. He completed his graduation from IIT Delhi and his post-graduation from IIM Lucknow. He is a Chartered Financial Analyst® (CFA®) Charter holder.

Abhishek Khandelwal

Abhishek Khandelwal is a seasoned finance and investment management professional with over two decades of experience across multiple industries, functions, and geographies at the executive level. Currently, he serves as the Chief Financial Officer (CFO) of Snow Leopard Ventures, the private equity and venture capital arm of the Kirloskar Group, as well as the family office of the Kirloskar family. In this role, he manages a portfolio of investments in private businesses across India, the US, and Singapore.Abhishek's career trajectory is a testament to his ability to reinvent himself. Beginning as an engineering professional, he spent seven years in product development and management roles at tech startups before making a bold transition into finance. Seeking to broaden his horizons, he pursued MBA at IIM Bangalore, where he graduated as a Gold Medalist. After IIM Bangalore, though he joined mid-management role in Chennai based Real Estate conglomerate, he quickly ascended to lead the finance and accounts functions different organization before becoming the CFO of a real estate company in Pune. There, he played a pivotal role in the development of over 7 million sq. ft. of residential and commercial real estate projects across Pune, Mumbai, and Nashik, overseeing Finance, Accounts, HR, IT, and Admin functions. His expertise and leadership eventually led him to Snow Leopard Ventures, where he now steers high-value investments across global markets.He resides in Pune with his wife and two children.

Natasha Adnani, CFA

Natasha Adnani, CFA - Vice President Investments Nadathur Estates.She is a seasoned investment professional at Nadathur Estates, the family office of Infosys co-founder N. S. Raghavan. As CFA charter holder, she began her career at Merrill Lynch during the global financial crisis, building a deep foundation in portfolio management through multiple investment cycles. Over the past 12 years at the family office, she has led initiatives across asset classes, strategies, and geographies, including a hands-on operational role in an APAC hospitality venture. With experience spanning public markets and private equity, Natasha now focuses on institutionalizing the firm into an evolved, globally diversified family office. She is particularly interested in thematic investing, governance-driven portfolio construction, and building resilient capital allocation frameworks for multi-generational wealth.

Hem Kishore

Hem Kishore is Wealth Investments Leader – Mercer Global Service Delivery.He leads Mercer’s Wealth Investments function across India and Portugal as part of Global Service Delivery (GSD). Since joining Mercer in 2014 as a founding member of the Investments team in India, Hem has been instrumental in its growth — expanding the team from 5 to over 600 professionals and supporting more than 3,500 institutional clients globally, with over $2 trillion in assets under advisory and fiduciary management.His leadership spans investment consulting, performance analytics, research, portfolio analytics and quantitative modeling. Hem has played a pivotal role in building high-performing teams across geographies and elevating Mercer’s global capabilities through innovation in data and analytical frameworks. He is widely recognized for shaping solutions that enhance client outcomes and align with evolving investment needs.With over two decades of experience across equity research, investment banking, and asset management, Hem brings deep expertise and strategic perspective to Mercer’s global investment platform. He holds an MBA in Finance and has previously held senior roles at CRISIL and NewRiver Inc.

Akshay Dua

Akshay Dua-Director – Investments, Mercer Global Service Delivery .He leads Mercer’s Investment Solutions capability from GSD India, spanning investment strategy, portfolio management, quantitative modeling, and asset class research. His teams support global OCIO clients through high-impact insights and deep quantitative expertise.Before joining Mercer, Akshay was a Senior Portfolio Manager at Ostrica Investments in Amsterdam, managing UCITS Funds across equity and fixed income using model-driven, multi-asset strategies. He holds a B.Tech from IIT Delhi and a Master’s in Quantitative Finance from VU University Amsterdam.

Bijal Ajinkya

Bijal Ajinkya, a partner in the Direct Tax, Private Client, and Investment Funds practice groups in the Mumbai office, has over 24 years of experience. She specializes in international tax, inbound and outbound investment structuring, SPAC transactions, M&A tax negotiations, tax insurance, and complex tax issues like GAAR, POEM, and PE. Bijal has led many successful and groundbreaking tax litigations in India, offering unique litigation strategies and serving as an expert witness in international arbitration. She recently concluded a precedent-setting tax information exchange case involving the Channel Islands. Her notable international tax litigation work includes cases on the India-Mauritius Tax Treaty, Minimum Alternate Tax for Foreign Portfolio Investors, and taxation issues for companies like Morgan Stanley and Dun & Bradstreet. As a Private Client practitioner, Bijal advises on succession planning, asset protection, and cross-border inheritance tax, helping family businesses create frameworks for wealth and leadership succession. Bijal has pioneered tax structures for investment funds and has been recognized by IFA, India, for her contributions. She advises clients on fund formation, structuring, and has represented fund managers before tax authorities. Bijal is regularly featured in leading legal directories like Chambers & Partners, Legal 500, and Who’s Who Legal. She was ranked as a Leader Tax Champion by Legal Era and one of Asia’s Top 15 Female Lawyers by Asian Legal Business in 2021. Bijal is a serving Steering Committee Member of Private Client Exchange, Asia. She is the first Indian lawyer admitted as an international fellow to ACTEC and actively participates in consultations with the Indian Government on tax policies

Anushka Venketram

Anushka Venketram is a Senior Associate in the Private Client Practice at Khaitan & Co, India’s largest Tier-1 law firm.

Relevant experience: Anushka, alongside the Private Client team at Khaitan & Co., advises prominent and influential Indian business families and leading C-suite executives on succession-planning through bespoke private trusts, family arrangements, testamentary instruments and also advises on incapacity planning, surrogacy, adoption, guardianship, and marital agreements. Anushka also provides advisory garnered towards achieving efficiency from US / UK inheritance and gift tax implications for Indian families with US and UK nexus. Anushka regularly participates in thought leadership initiatives by authoring articles in leading domestic and international journals for tax and estate-planning. Anushka also advises individuals and companies, both domestic and cross border, in the design, creation and implementation of employee / management incentives and schemes.

Jesse Pagliuca

Jesse Pagliuca spent a decade proving that spreadsheets and empathy make an unbeatable team. By day, he steers multi-million-dollar allocations at the Pagliuca Family Office, scouting venture and private-equity bets that can compound both capital and positive impact. His deal sense was forged at Altamont Capital, where he modelled billion-dollar acquisitions and then rolled up his sleeves inside portfolio companies, coaching CEOs to turn strategy into EBITDA. Harvard Business School sharpened those instincts, but it also sparked his philanthropic streak. Jesse co-founded the Racial Equity Fund, channelling patient capital to minority-owned small businesses and proving that inclusive finance can deliver market returns. The experience planted a bigger idea: investors should demand measurable impact from every dollar, not just the ones earmarked for “philanthropy.”With Impactful Giving, Jesse helps other philanthropists apply term-sheet rigour to non-profit portfolios, turning donor intent into evidence-backed projects that move the needle on poverty, health, and climate. Off the boardroom, you’ll find him on an improv stage 50+ shows and counting, where quick wit and narrative flair keep audiences (and, frankly, boardrooms) leaning in. His promise to conference delegates: walk away with a playbook that treats philanthropy like your smartest investment.

Chetan Kharbanda

Chetan Kharbanda speaks the twin languages of venture finance and frontline impact. As co-founder of Impactful Giving, he helps wealth managers and donors translate generosity into evidence-backed projects that deliver “alpha for humanity”. Before stepping onto the philanthropy stage, Chetan engineered operations for a non-profit, Fortify Health, a non-profit that fights iron-deficiency anemia at a national scale. He then co-founded Ansh, where his government-hospital partnerships unlocked life-saving care for vulnerable newborns. He has also worked on issues including increasing child vaccination and disability. He also sits on the advisory group of the Health Progress Hub, a global initiative by Global Policy Research Group nurturing the talent and infrastructure needed to tackle tomorrow’s hardest health problems.

Chetan’s route to impact runs through boardrooms and being on the ground: he has been at the forefront of building the ed-tech and fintech ecosystem early on, he co-programmed 400-person tech conferences for TLabs, and now directs an Urban Futures Lab in Dubai that prototypes people-first cityscapes. This cross-sector fluency, grassroots, government, tech, and capital make him a sought-after strategist for donors who demand measurable, multi-bottom-line returns.

Arati Porwal

Arati Porwal, is the Senior Country Head - India at CFA Institute, and is responsible for designing and implementing CFA Institute’s strategy in India along with managing its enterprise resourcing in the country. She works closely with CFA Institute stakeholders in the country, such as financial institutions, regulators, CFA Societies, and universities. She joined CFA Institute in 2015 and led the Society Relations function for India and surrounding markets before taking over as the Country Head. She was also responsible for implementing CFA Institute’s candidate and member strategy. In her time with the organization, Arati has made significant contributions towards strengthening the investment profession industry, while also demonstrating the immense value that the CFA qualification adds to an individual’s career. Before joining CFA Institute, Arati was the Senior Market Advisor at Enterprise Ireland, providing advisory services to Irish enterprises on market entry into India. Arati also led the Chartered Institute of Management Accountants (CIMA) in India for five years. Prior to joining CIMA, Arati also worked in various roles within the financial services and insurance industry for thirteen years. Arati holds a bachelor’s degree in physics from Mumbai University and an MBA from Narsee Monjee Institute of Management Studies. She is also a certified life and leadership coach.

Satish Betadpur, CFA

Satish Betadpur, CFA, is the Senior Managing Director and Head of Investments – India at State Street Investment Management, where he leads investment research, strategy, macroeconomics, oversight, and other investment functions across all asset classes. With over 30 years of global experience spanning the United States, United Kingdom, and India, Satish has held key roles at TIAA Investment Management in New York and San Francisco, managing portfolios across fixed income, equities, and alternatives. He later founded and led research, advisory, and investment firms in all three regions. Satish holds dual master’s degrees in Computer Science and Mechanical Engineering, with a specialization in Robotics, AI, and Pattern Recognition, as well as an MBA in Finance from the University of Illinois at Urbana-Champaign. He is a Chartered Financial Analyst® and holds a Certificate in ESG Investing from the CFA Institute.

Apurva Sahijwani

Apurva Sahijwani joined Avendus Wealth Management Private Limited as Managing Director & Chief Executive Officer in May-24. He has over 25 years’ experience in the business of private banking and wealth management having worked in senior positions across prominent domestic private-sector and foreign banks including Axis Bank, Kotak Mahindra Bank, Citibank N.A., HSBC and ICICI Bank in the past, segueing a variety of roles encompassing relationship management, investment advisory and business strategy. Prior to joining Avendus, Apurva was the head of private banking and was instrumental in launching and scaling up Burgundy Private – Axis Bank’s private banking business. Since joining Avendus last year, Apurva has rebuilt the business and has been instrumental in making Avendus Wealth as one of the fastest growing and most respective private wealth franchises in the country. Apurva is an MBA from Gujarat University and holds a Diploma in Business Finance. Apurva was ranked among the top 10 leading investment professionals of the year 2024 by ET NOW.

Shamit Choksi, CFA

For more than 18 years, Shamit led the offshore funds group at Indian asset manager(s), advising or raising ~6BN USD of cumulative investments of institutional or wholesale clients largely in Asia, Europe and GCC. His career includes previous significant tenures with ICICI Prudential AMC and Nippon Life India AMC, working alongside their affiliates worldwide. Shamit brings a unique perspective of advising Foreign Portfolio Investors into Indian public markets since early mid 2000’s, developing several international equity MF strategies for Indian clients, and executing cross border partnerships with managers in USA, Japan and other regions. He has been a contributor on the AMFI ESG working group for mutual funds, and directly led industry led group advocacy and recommendations to simplify regulations for the onshore management of offshore funds or the safe harbour clause (popularly known as Section 9A). His expertise spans all functional aspects of developing and advising offshore fund strategies and expanding international business for asset managers. Earlier, he was seconded to Nippon Life Insurance Japan to collaborate for funds and related synergies between the Indian and Japanese shareholder. He started his career with financial firms in NewYork, Boston and Mumbai. He holds a MBA from Boston College, M.Com and B.Com degrees from University of Mumbai. He is a CFA Charterholder and Board Member at the CFA Society India (Indian Association of Investment Professionals)

Chanchal Agarwal, CFA

Chanchal Agarwal is CIO at Credence Family Office.Having started her career during Global financial crises, she brings with her about 17 years+ of Industryexperience spanning across verticals like Family Office Investment Advisory, Portfolio management services,Investment banking, Offshore investing etc.Over the past 8 years at Credence, she was instrumental in institutionalising the whole advisory frameworkfor HNIs, the one that relies on building long term approach to client’s portfolio needs. As a part of her role,she provided strategic guidance for investment decisions across asset classes including Equities, Real Estate,Fixed Income, Commodities and Alternatives with a focus on continuous product innovation.Being a Chartered Accountant and CFA Charterholder, her focus was always interpreting beyond numbers and

joining dots to understand the wholistic perspective.In 2020, AIWMI recognized her amongst the “Top 100 women in Finance”. She regularly features on TV and Print media and is very vocal on LinkedIn for her views on Global Investing, Asset Allocation path for Investors,Personal finance etc.

Aanchal Almal, CFA

Aanchal Almal, CFA, has over 9 years of diverse experience in the Indian financial markets, specializing in buy-side analysis and family office management. Her expertise encompasses equity research, product development, and advisory services. Previously, Aanchal was part of the passive investments team at DSP Mutual Fund, where she effectively managed equity passive funds and launched innovative products driven by market insights. Her professional journey also includes significant roles at Pi Square Investments, where she focused on equity research and financial modeling. In her current position as Associate Vice President – Products at TrustPlutus Wealth, Aanchal is dedicated to product research and development, ensuring alignment with both client needs and business objectives. She holds the CFA Charter from the CFA Institute and is actively involved in the CFA Society, India, where she serves as the co-chair of the Mumbai chapter of the PL Committee. Aanchal's commitment to the finance community is evident through her volunteer work and leadership roles within professional organizations

Workshop Details

Workshop 1-a:Manager Selection

In this session, Mercer will showcase its global Investments platform, covering Investment Solutions (OCIO) and Advisory services. We’ll highlight how Mercer helps clients navigate complexity and deliver scalable outcomes.We'll start with Manager Research—our key differentiator—followed by insights on Manager Selection, Portfolio Construction, and strategic asset allocation. The discussion will also cover trends in alternatives and active versus passive strategies. Designed to offer practical insights, this session reveals how Mercer helps clients build resilient, future-ready portfolios.

Workshop 1-b-Impact by Design : A Workshop on Evidence-Based Capital Allocation in Philanthropy

Learn to make informed decisions on the scope, structure, and strategy of philanthropic capital allocation. Explore key factors behind each choice and common giving strategies used by leading philanthropists. Use cause prioritisation, cost-effectiveness models, and tailored impact metrics to vet non-profits, supported by real case studies.

Workshop 2-a:Understand & Embrace Next Generation Suitability Processes to Grow Professional & Commercial Success.

Paul is founder of PlanPrompt - Suitability built in India for India.PlanPrompt is a game changing assessment & communication platform that enables the personalisation of initial & ongoing financial advice. The platform offers adaptive suitability processes and is scalable to all providers of wealth management advice from transactional market places, robo advisers, fee only advisers, distributors through to family offices.The PlanPrompt platform is built on the Blockchain for data security & is AI inspired to analyse information & personalise communication.To make matters concrete delegates will be able to identify how their personality impacts their engagement with money, their behavioural biases, values & goals through the prism of the PlanPrompt Indian assessment tool.

In this you will learn about:

- Better Understand Individuals & Families

- Identify Psychological Conflicts & Help to Collaboratively Resolve Them

- Match Needs to Portfolios Initially & Long Term

Workshop Goals

At the end of the two hour workshop attendees will know how to apply valid & reliable suitability processes in a professional advice practice:

-identify the unique traits, values, goals & biases of clients & their families through generations to best match portfolios to their needs

-lower costs of client acquisition, increase levels of client persistency & advance ‘share of client wallet’, and

-Discover the attributes of the ideal client & work more efficiently with difficult clients.

Workshop 2-b: Wealth Architecture: Frameworks for Intelligent Wealth Structuring

Gain a comprehensive understanding of the legal structures available in India for managing and holding wealth—such as private trusts, companies, LLPs, family offices, and charitable entities—by comparing their tax, regulatory, confidentiality, and succession planning implications. Learn how to align these structures with varying family and business needs based on asset type, ownership complexity, governance, and intergenerational goals. Explore the role of private and public trusts in estate planning, assess legal and tax risks, and discover strategies for maintaining control, liquidity, and long-term stability. Real-life case studies will illustrate practical trade-offs in Indian wealth structuring.

Please note: While registering, you will see options listed as Workshop 1a and Workshop 2a. The titles and timings are provided above for reference. The venue for the workshops is the same as the main conference. Workshops are exclusively for members of CFA Society India registered for the conference. Once you you register for the conference, separately register for the workshop after 24 hours of registering for the conference

Register Now-Main conference - Click Here

Register Now- Workshops - Click Here (Only for members who have registered for main conference)

Note-After 24hrs of registration for conference members can register for the workshops

4 PL For Conference2 PL for each WorkshopsCFA Institute members can claim PL credit by providing their CFA Institute ID number when registering. |

Global Passport Accredited Programme Allows members of participating CFA societies to attend each other's society events at the local member price Global Passport Accredited Programme Allows members of participating CFA societies to attend each other's society events at the local member price |