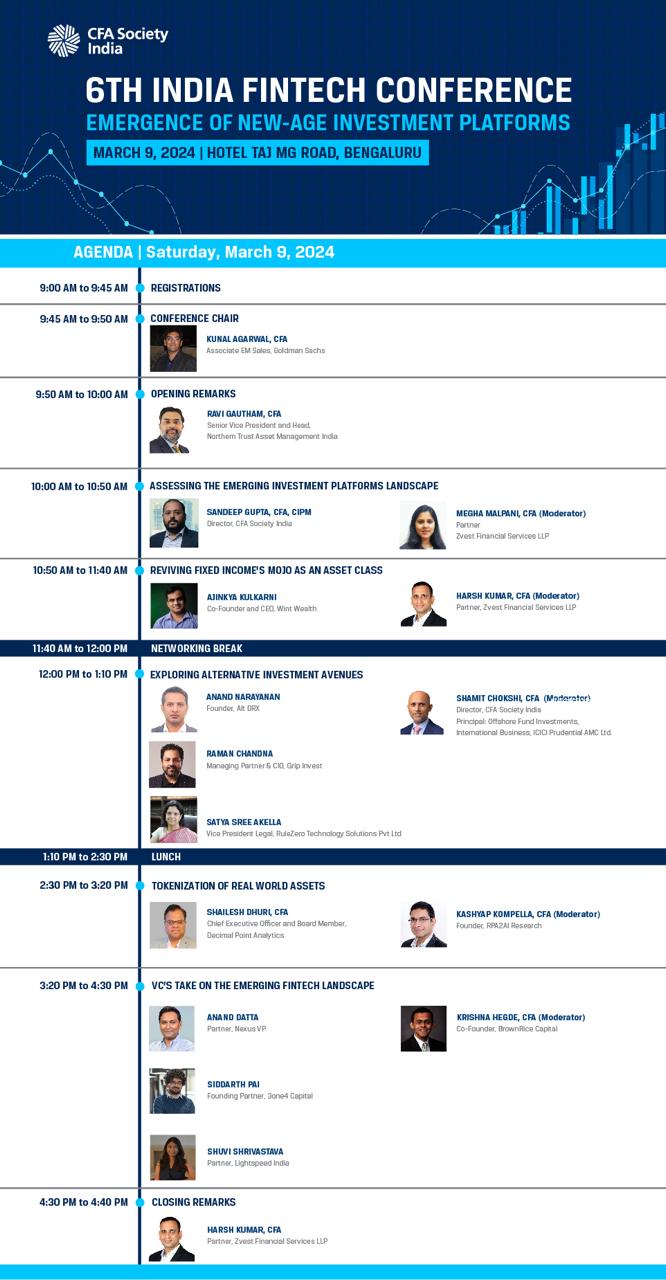

6th India Fintech Conference | Bengaluru | CFA Society India | Emergence of New-Age Investment Platforms

- March 9, 2024

- 9 am to 5 pm IST

- Hotel Taj MG Road

Emergence of new-age investment platforms

In the ever-evolving Fintech landscape in India, this year we discuss the emergence of new-age investment platforms in India. Investors now have a multitude of investment avenues available. For starters, capital markets expansion has been helped with innovative tech-enabled platforms, in the form of new-age discount brokers, wealth-tech platforms, robo-advisors, etc. Fixed income as an asset class has found its mojo, with the emergence of bond investing platforms; making even fixed deposits look attractive.

Furthermore, several alternative asset classes, such as real-estate, commodities, startup equity, renewable energy assets, have become accessible to investors via fractional investing.

While there is a rush of such platforms in the market now, it is important as an investor to understand the intricacies of each, evaluate the suitability, ensure adequate due diligence, and consider one’s risk profile.

To discuss these aspects, let’s get together on 09th March 2024 (Saturday) at Taj MG Road for the 6th edition of the CFA India Fintech Conference. With the entire Fintech ecosystem under one roof, make the most of the opportunity to interact with top Fintech startup founders and senior industry professionals. Registrations open.

Ajinkya Kulkarni

Mr. Ajinkya Kulkarni comes with rich experience of working in lending and Financial services for 10+ years. He is the driving force behind Wint Wealth, where his aim is to democratise Indian debt capital markets. His SEBI regulated platform allows users to invest in structured & regulated debt assets along with fixed income assets. Before starting Wint Wealth, Ajinkya was Vice President and head of Merchant lending business at Mswipe. Through Mswipe merchant lending, he enabled credit access to thousands of merchants who otherwise won't get the credit facilities. In a short span of six months from launching, he built a profitable portfolio of ₹25 Cr+. Before Mswipe; he was at CreditVidya, leading its marketplace business which enabled low interest rate loans for first time borrowers. Ajinkya’s continuous efforts and innovations have helped create significant value in the financial services sector.

Anand Datta

Anand is passionate about helping entrepreneurs build high-impact enterprises in Fintech, InsureTech, Education, and Logistics. With a background in operations at high-growth companies, Anand is keen to help start-ups with his experience. He believes in the immense scope that “Bharat” presents for innovative India-specific models. Anand was an entrepreneur and business leader prior to joining Nexus. He was a founding team member of MagicPin, a hyperlocal deal discovery platform. Most recently he was heading New Market P&L and Growth across Asia for BIMA (Milvik) – a global insure tech company. Previously, Anand worked with Bain & Co. as a strategy consultant, where he advised Technology and Consumer Goods companies in India and Silicon Valley. Anand holds an MBA from IIM Ahmedabad and B.Tech from IIT Kharagpur.

Anand Narayanan KB

Anand has worked in diverse functions around the world, both in real estate & banking. He is seen by most as astute, persuasive, innovative & an action obsessed leader with strong domain expertise in Development Management, Strategy, Sales & Marketing and Financial engineering. In May 2021, Anand set up Alt DRX, the world’s first Digital Real Estate Exchange with an India first strategy, where people can buy & sell real estate 1 SQFT at a time. Alt DRX has created a new financial instrument that captures the economic value of 1 sqft of real estate and a stock exchange like marketplace for these instruments to be traded. The funded start-up has garnered significant interest from asset owners & the rest of the start-up ecosystem. Since Sept 2019, Anand has been with Damac Properties, Dubai as its Managing Director. Damac is the second largest listed real estate developer in the middle east, with about a USD 1.5 billion business. Anand played a pivotal role in managing the revenue side of the firm’s UAE operations, as well as acting as the owner’s representative for international operations. He focused on new project launches, strategy, sales & sales operations Since Nov 2012 Anand has been with Puravankara, a listed real estate player as its Chief Operating Officer. His P&L responsibilities were to aggressively grow the $300 million top-line & $20 million bottom-line generating real estate business. He spearheaded changes within the firm, including the transformation of team culture & mix, quasi book-building method for project launches, using audacious designs to build USPs, standardization of product design / spec / material to de-bottle construction challenges, obtained SEBI’s consent to launch a fractional sale model for office assets in 2014, large multi-channel sales distribution, amongst others. His direct responsibilities were Design & Engineering Services, CSQ – Cost, Schedule & Quality of Construction, Contracts & Purchases, Marketing, Sales, Collections & Handovers for both from both Brand Puravankara & Brand Provident, across the country. Since April 2009, Anand was part of the leadership team of Knight Frank India & ran its residential transaction & advisory business. He helped the firm break-free from an archaic resale & leasing based broking model into a trajectory that involved the firm acting as ‘Institutional Marketing Advisors’ for a portfolio of mid-size domestic & international developers He specialized in innovative use of low cost but high impact digital & direct marketing initiatives to build the Brand’s profile in India. Since April 2000, Anand was associated with ICICI Bank for close to a decade in Global Payments, Corporate Banking (SME) & Treasury Sales. He had primarily held sales leadership responsibilities across these domains and was part of the Bank’s elite talent pool with fast-track career moves. His last assignment was in New York, as AGM & Head - Consumer Banking, responsible for setting up the Bank’s consumer initiatives in USA, where amongst other things he ran the Bank’s board mandate for an acquisition led entry into the US market. Anand holds an MBA in marketing from India

Kunal Agarwal, CFA

Raman Chandna

Raman Chandna is a seasoned financial expert with over 16 years of experience in the wealth management and financial services industry. Currently serving as the Head of Retail and Institutional Capital at Grip Invest, Raman oversees new initiatives, retail investments in alternate assets, and fund management businesses. His expertise lies in providing comprehensive advice on various asset classes such as equity, debt, startup equity, and private credit. Prior to joining Grip, Raman spent nine formative years at Edelweiss where he rose through the ranks to become a partner in their wealth management division. During this time, he managed a pan-India team of investment managers while advising clients with assets worth over $3 billion. This role required extensive knowledge of global markets and trends, enabling him to provide sound strategic recommendations that helped grow his clients' portfolios significantly. Following his successful stint at Edelweiss, Raman took up the mantle of Chief Investment Officer for a leading auto ancillary firm. Here, he oversaw an investment portfolio exceeding $100 million spread across multiple asset types. His tenure saw the implementation of effective investment strategies that maximized returns and minimized risk exposure.

Ravi Gautham. CFA

Sandeep Gupta CFA, CIPM

Sandeep Gupta CFA, a serial startup entrepreneur most recently Co-Founded BHIVE Alts (a fractional Real Estate Fintech) and BHIVE Fund (Cat 2 SEBI Registered Alternative Investment Fund). His last corporate role was as head of Fractional Investments at Magicbricks. Sandeep is a blockchain enthusiast who had earlier founded Trusken Blockchain Solutions and Frooms (Fractional Rooms) to create blockchain security tokens. Sandeep has over two decades of Real Estate transactions and investment experience. He has worked for marquee corporates like BCCL (TOI Group), Britannia (Wadia Group), New Chennai Township, GMR, Cinepolis, ISB etc. Sandeep is a Charter Holder from the CFA institute USA and is a Certified Investment Performance Measurement professional. He is a B. Com from Delhi University and is a Post Graduate in Management from IIM, Ahmedabad. He is an active volunteer with CFA Society India and chairs the Public Awareness Committee as a Board Member.

Satya Sree Akella

Satya is at the forefront of RuleZero's mission to transforming private markets by bringing liquidity to previously illiquid assets. As the head of the legal team, Satya spearheads RuleZero's innovative approach, overseeing the development of their proprietary platform, hissa, which empowers founders, employees, and investors to seamlessly manage their ownership interests. With over two decades of experience spanning venture capital, private equity, and corporate advisory, Satya brings a wealth of expertise to her role. Prior to joining RuleZero, she served as a Partner at IndusLaw, a prominent law firm in India, where she played a pivotal role in advising entrepreneurs, businesses, and investment funds through various stages of financing, M&A, and exits. Satya's passion for supporting startups is evident in her track record of guiding numerous companies from inception to successful exits, including some of today's unicorns. Beyond her professional endeavors, Satya remains deeply committed to nurturing the next generation of entrepreneurs, frequently offering mentorship and guidance to startups in their early stages of development.

Shailesh Dhuri

A result driven professional with nearly three decades of experience in Entrepreneurship, Fund Management and Artificial Intelligence for Data Analytics. He is a highly sought-after leader and Innovator in the space of real life applications of artificial intelligent technology that are used in massive data, quantitive, statistical analysis, and algorithms. His passion for innovation and technology driven solutions has been the backbone of Decimal Point Analytics since its inception in 2003. Shailesh has not only built strong and successful businesses of his own, but he has also supported many notable organizations in creating and sustaining a dynamic environment even at the beginning of his career. From being instrumental in setting up Unit Trust India’s first Private Sector Bank to launching India’s first Money Market Fund back in 90’s, his vision for the future has remained unparalleled to date. He is an alumnus of some of the most prestigious educational institutes in India and yet considers himself to be a forever student of mathematics and philosophy. His strong academics include an MBA from IIM Bangalore, FRM from GARP, PRM from PRMIA, CFA from ICFAI, CWA from ICWAI and Bachelor of Commerce from Mumbai University are the key founding pillars of his career as an analyst and strategist of par excellence. He currently overlooks Growth Strategy, Financial Planning, Corporate Governance and Risk Analysis for Decimal Point Analytics, Algocircle and Advance Investment Mechanics in the capacity of CEO and as an honorable board member. With his strong business acumen, he is focused on building new industry verticals by delivering excellent Business Strategy, Audit Plans and Risk Analysis for his current as well future ventures.

Shuvi Shrivastava

1991 was a special year: the World Wide Web was made publicly accessible, and India finally opened up its economy following the liberalization reforms. It marked India’s first generation to grow up ‘on’ the internet, modest in means owing to their small-town roots but unconstrained in ambition given the exposure to all of the world’s information. Born in Kanpur, raised in Ahmedabad, and then traveling across India, Taiwan, Singapore, and the United States for work and education, Shuvi embodies this New India: aspirational yet grounded, starry-eyed about building for India yet pragmatic about the constraints that come with operating in a country of 1.3 billion people. “Having been a part of the tech ecosystem for over a decade, I’ve seen first-hand the value of technology in democratizing access to products and services reserved for the ‘privileged’, and the value of venture capital in amplifying these products to impact hundreds of millions of people,” says Shuvi. At Lightspeed, she looks at internet-first businesses and is especially excited about the financial services sector given the potential of technology in serving the credit and investment needs of the retail user currently ignored by the large financial institutions. Previously, she was also a part of the investment team that deployed the first Lightspeed India fund across consumer and enterprise companies. Outside her investing career, she’s been a consultant across consumer and IT with Bain & Co., managed Business Development and operations at an early-stage venture-backed computer vision startup Drishti Technologies in Silicon Valley, and run a labs venture launching multiple products and services before coming back to her roots in venture investing. “My time in the Bay Area helped me appreciate the value of human networks which inspired me to build a similar community in India where knowledge, connections, and resources are shared abundantly.” Having been a founder who didn’t get to product-market fit, she deeply understands the psychological price of entrepreneurship. “As a result, even as I help founders with strategy, partnerships, fund-raising, and recruitment – I think the most important and fulfilling part of my role is being a part-therapist part-coach as they endure the ups and downs of their often isolating journey,” says Shuvi.

Siddarth Pai

Siddarth Pai is a Founding Partner, Chief Financial Officer, and ESG Officer at 3one4 Capital. Siddarth works extensively on policy and growth of the Indian startup and alternative investment industry. He is the youngest member of the SEBI AIPAC, (Alternative Investment Policy Advisory Committee), created to work with the regulator on the ordered growth of the Indian AIF industry. Siddarth is also the youngest Executive Council member of the IVCA (Indian Venture Capital Association) – the apex body for Indian funds investing in alternative assets and serves as the co-chair of the Regulatory Affairs Council, working on matters related to security markets, alternative investment funds, taxation, foreign exchange, law and startups. He is the founding member and vice-president of the PEVCFOA, a collective of the CFOS of Venture and Private Equity Funds investing in India and is part of the startup councils of CII and AIMA. He is an expert policy member of ISPIRT, the Indian Software Product Industry Round Table, a Bangalore-based think-tank. Siddarth completed his B.Com. from St. Joseph’s College of Commerce Bangalore and is a qualified Chartered Accountant.

Krishna Hegde, CFA

Krishna Hegde is Co-Founder of BrownRice Capital. BrownRice Capital helps HNIs & Family Offices in India to invest in crypto. Krishna has 20+ years of global professional experience spanning India, South East Asia, US & Europe - spanning large multinationals to small startups - from financial services & fintech to FMCG & commodities - with different ownership structures (family owned, VC-funded & listed). Highlights of recent work include launching industry-first products to Indian market viz Fixed Deposits on API at Setu in 2020, Digital Gold at Paytm in 2016, BNPL/Postpaid at Paytm in 2017, an Indian Rupee Onshore Crypto Index at CoinSwitch in 2022. Before moving to fintech in early 2016, Krishna was Managing Director at Barclays based in Singapore and was head of Asia Credit Research. He was promoted from newly hired Associate to Managing Director in under 8 years. Krishna graduated with a Bachelors in Engineering (Hons), Computer Science from BITS Pilani, Rajasthan. He completed his MBA from the Tuck School of Business at Dartmouth College where he was an Edward Tuck Scholar with Distinction. He is also a CFA charterholder.

Megha Malpani, CFA

Megha is a seasoned financial professional with a background in Wealth Management. Her experience spans over 13 years, during which she has worked at prominent institutions like ICICI Bank Private Banking, Standard Chartered Bank, and Kotak Securities Limited. Her educational qualifications include a graduate degree in Economics, a post-graduate degree in Management, and Chartered Financial Analyst®️ (CFA) charter from the CFA Institute, USA. She is currently an entrepreneur and a Partner with Zvest Financial Services LLP. One of Megha's key strengths lies in her ability to decipher complex behavioural patterns, particularly in the realm of investment. She understands the importance of addressing these patterns, as neglecting them can hinder an investor's ability to generate long-term wealth. Megha's agility and interpersonal skills have enabled her to cultivate enduring relationships with her clients, contributing to her success in the financial services industry. Beyond her professional endeavours, Megha is deeply passionate about financial literacy. She actively engages with various segments of society through educational sessions aimed at promoting financial awareness and empowerment. Her dedication to this cause underscores her commitment to making a positive impact beyond the confines of her professional role.

Kashyap Kompella, CFA

Kashyap Kompella is an award-winning industry analyst, best-selling author, educator, and advisor, with 25 years of experience. Currently, Kashyap is the CEO of RPA 2 AI Research, a technology industry analyst firm with presence in US and India. RPA2AI advises venture capital/private equity firms, enterprises, and public sector agencies on transformative technologies, AI investments, Responsible AI & Governance. Kashyap has created several courses on Artificial Intelligence, Blockchain, Cloud, and Digital Transformation and delivered executive education and masterclasses for several leading organizations across the world. Kashyap is the co-chair of the IEEE Planet Positive 2030 Economics and Regulation committee, a global interdisciplinary group of senior academics, industry leaders and policy experts working on climate and sustainability solutions. Kashyap is an alumnus of BITS Pilani and Indian School of Business Hyderabad. He also has a Masters in Business Laws from National Law School, Bangalore.

Harsh Kumar, CFA

Harsh is the Co-Founder and Managing Partner of Zvest Financial Services LLP, a one-stop solution for integrating financial needs. He specialises in designing holistic financial solution frameworks for UHNIs. His vast knowledge and insight across global and Indian markets spans across asset classes and helps in innovative strategy, planning, and business development. At Zvest, he heads Research and manages some of the leading families in Bangalore. Harsh has an overall experience of 19 years and has been associated with organisations like Citibank N.A, Olam International Limited, and Maruti Suzuki India Limited. In his last assignment, he was the Head of Investment Advisory at ICICI Bank Wealth Management, Bangalore. He completed his MBA from IIT Delhi and is a Chartered Financial Analyst®️ from the CFA Institute, USA. He is also a passionate fiction writer with quite a few of his stories published on various occasions. His debut fiction novel- “Suicide Note of the Father of Punjab,” was published in March, 2020

Shivani Suvarna, CFA

Shivani Suvarna is a Chartered Accountant and a recent addition to the CFA Society, having received her Charter in 2023. Having 4 years of experience as a credit analyst, she currently works with HSBC Bank. She will be the Co-host for this conference

Shamit Chokshi, CFA

Shamit joined ICICI Prudential AMC in February 2016, and oversees ~USD 3.4 billion of assets advised across various offshore funds and institutional mandates. With 17+ years of experience in global asset management across investing, offshore fund structuring and asset raising activities, he is also involved in manager selection, and global manager partnerships. He has set up and advised several India equity and FI funds across Asia (incl Japan) and Europe, selected international manager strategies, and is also helping implement ESG frameworks at the firm. Previously he worked at Reliance-Nippon Life Asset Management in Mumbai and Nippon Life Insurance / Nissay in Tokyo, leading the AM Joint Venture; earlier he gained equity research and fund advisory experience with firms in New York, Boston and Mumbai. He holds a MBA from Boston College, Masters and Bachelor of Commerce degrees from University of Mumbai. He is a CFA charterholder, Board Member and Chairperson for Professional Learning at the CFA Society India.

Dipti Agarwal, CFA, FRM

Dipti is a CFA & FRM Charterholder and currently works with Impact Investment Echange, an impact investing firm based out of Singapore. She leads the South Asia deals for their transaction advisory arm.She will be the Co-host for this conference

| Category | Early Bird Pricing (ends on 26th Feb, 2024 | Regular Pricing |

| CFA Society India Members | Free | Free |

| CFA® Program Registered Candidates | INR 1500 | INR 2500 |

| Passed Level III of the CFA Program | INR 1500 | INR 2500 |

| Non-members | INR 2500 | INR 3500 |

5 PLCFA Institute members can claim PL credit by providing their CFA Institute ID number when registering. |

Global Passport Accredited Programme

Allows members of participating CFA societies to attend each other's society events at the local member price Global Passport Accredited Programme

Allows members of participating CFA societies to attend each other's society events at the local member price |