9th India Wealth Management Conference | Mumbai

- August 2, 2024

- 8:30 - 17:30

- 462, Senapati Bapat Marg, Lower Parel, Mumbai, Maharashtra 400013

FROM DISRUPTION TO TRANSFORMATION

In the recent years marked by uncertainty and global disruption, the Indian investor has evolved. A roaring bull market, economic progress, online access to capital markets and the India tech stack resulted in resilient domestic flows. A thriving investment culture has emerged, led by a surge in “DIY (Do-It-Yourself)” and “Advised” wealth solutions for the younger generation of investors.

As macro-economic cycles, wealth effect and regulatory enhancements unfold, it is imperative for wealth managers to incorporate a risk aware and goals oriented approach in advising the next generation of investors. We are bound to witness a transformation of client expectations for hyper personalisation, with technological ease and outcome based portfolio management. A client centric approach that priorities investment policy statement (IPS), asset allocation and rebalancing, tax considerations, succession planning, and in many cases clients’ philanthropy goals may require sophisticated and holistic wealth management solutions.

These shifts necessitate agility and innovation among wealth managers. The defining features of the future model will be sustainable wealth growth, personalisation at scale, global portfolio approach and technology.

Join us for the 9th edition of our flagship India Wealth Management Conference, as the industry’s renowned thought leaders and practitioners from around the world deliberate and debate the opportunities, risks, and portfolio solutions for professional wealth managers in India.

Don’t miss out on reconnecting and building connections with thought leaders, private bankers, advisors, sophisticated investors, and specialists from leading product and service providers.

Bijal Ajinkya

Bijal Ajinkya, a partner in the Direct Tax, Private Client, and Investment Funds practice groups in the Mumbai office, has over 24 years of experience. She specializes in international tax, inbound and outbound investment structuring, SPAC transactions, M&A tax negotiations, tax insurance, and complex tax issues like GAAR, POEM, and PE. Bijal has led many successful and groundbreaking tax litigations in India, offering unique litigation strategies and serving as an expert witness in international arbitration. She recently concluded a precedent-setting tax information exchange case involving the Channel Islands. Her notable international tax litigation work includes cases on the India-Mauritius Tax Treaty, Minimum Alternate Tax for Foreign Portfolio Investors, and taxation issues for companies like Morgan Stanley and Dun & Bradstreet. As a Private Client practitioner, Bijal advises on succession planning, asset protection, and cross-border inheritance tax, helping family businesses create frameworks for wealth and leadership succession. Bijal has pioneered tax structures for investment funds and has been recognized by IFA, India, for her contributions. She advises clients on fund formation, structuring, and has represented fund managers before tax authorities. Bijal is regularly featured in leading legal directories like Chambers & Partners, Legal 500, and Who’s Who Legal. She was ranked as a Leader Tax Champion by Legal Era and one of Asia’s Top 15 Female Lawyers by Asian Legal Business in 2021. Bijal is a serving Steering Committee Member of Private Client Exchange, Asia. She is the first Indian lawyer admitted as an international fellow to ACTEC and actively participates in consultations with the Indian Government on tax policies.

Daniel Farley

Dan Farley is executive vice president of State Street Global Advisors, and chief investment officer of the Investment Solutions Group. In this role, he oversees a team of over 75 investment professionals managing over US$180 billion in multi-asset class portfolios, including tactical asset allocation, liability driven investments and working with clients in developing customized investment portfolios to meet their specific objectives. He is also a member of our Executive Management Group. Prior to this role he was responsible for the US multi-asset class solutions team. Dan holds a Master of Business Administration from Bentley University, a Bachelor of Science in business administration from Stonehill College and has earned the Chartered Financial Analyst (CFA) designation. He is a member of the CFA Institute and the Boston Securities Analyst Society. He is on the State Street Foundation's Corporate Allocations Committee and executive sponsor of the firm's Latin American Professionals Group. Dan is a frequent speaker with the media and conferences on a variety of investment topics. He is also vice chairman of the Board at the Crispus Attucks Children's Center.

Hemendra Kothari

Mr. Hemendra Kothari represents the fourth generation of a family of prominent stock brokers. After serving the Stock Exchange, Mumbai, in the capacity of Vice President for three years, he was elected President in March 1991. He founded the company "DSP Financial Consultants Ltd." (DSP) in 1975 which has evolved into a full fledged financial services organisation with offices in all the major metros in the country. In 1995, DSP entered into a joint-venture with Merrill Lynch and the name was changed to DSP Merrill Lynch Limited. Mr. Kothari served as the Chairman of the Company till March 31, 2009. Mr. Kothari is also a member of several leading representative trade forums including Confederation of Indian Industry (CII) and Federation of Indian Chambers of Commerce and Industry (FICCI).

Navin Upadhyaya

Navin Upadhyaya is Chief Human Resources Officer at 360 ONE (formerly known as IIFL Wealth & Asset Management). He is responsible for the overall human resources strategy, with a deep focus on culture, talent management, learning & development, and diversity & inclusion. Prior to joining 360 ONE, Navin was the Director and Head of HR at Citibank for its Institutional Client Group (ICG) for India, Bangladesh & Sri Lanka. Previously, Navin has also worked with IDBI, Standard Chartered, and Blue Dart. Navin has two decades of experience in the financial industry as a Senior HR Advisor in various roles spanning Markets, Private Banking, NBFC, Banking & Advisory, Retail Banking, Commercial Banking, Technology, Operations, Analytics, and Corporate functions. His HR experience has been at both strategic and operational level. He also mentors startups for building inclusive ecosystems for supporting the Diversity & Inclusion agenda. Navin has a Master's degree in Personnel Management from the University of Pune.

Nimesh Chandan

Nimesh Chandan is the Chief Investment Officer at Bajaj Finserv Asset Management. An Investment Professional with over two decades of experience in investing in the Indian capital markets, Nimesh has an established track record in managing funds and advising clients, both Domestic and International, Retail as well as Institutional. Over the years, he has developed an investment process that generates alpha through informational, analytical as well as behavioral edge. He has been part of the mutual fund industry for 17 years where has managed products across market capitalisation and themes, and developed models on Sustainable Investing, Quant Investing and Asset Allocation. Nimesh is a keen follower of Behavioural Finance and has been writing and presenting on the role of psychology in Investment Decision-making to the investment community. He has developed a set of processes and tools that help reduce one’s behavioural mistakes and understand the crowd or market behaviour. Prior to joining Bajaj Finserv Asset Management, Nimesh was associated with Canara Robecco Asset Management Company as the Head – Investments, Equities.

Satish Swamy, CFA

Satish Swamy, CFA is senior managing director at the University of California Investments office, which he joined in 1998. He is currently the Head of Asia, co-head of both Global Real Estate and Asset Allocation for the UC system’s $180 Billion portfolio, including oversight of global fixed income. His more than 30 years of investment industry experience have also included positions with Lincoln Financial Group and Analytic Investors. At UC Investments, Swamy is a member of the leadership team and investment committee. Additionally, Swamy holds a prestigious position as a faculty member in the finance department at the Haas School of Business at UC Berkeley, where he teaches a highly sought-after elective in Finance for MBA students. Swamy received his B.E. in electronics engineering from Bangalore University, an M.S. in electrical and computer engineering from University of Houston, and an M.B.A. in finance from University of Southern California. He was a board member of the CFA society of San Francisco from 2004-2012 and served as society president in 2010-2011. He also served as the head of the San Francisco chapter of the Global Association of Risk Professionals (GARP) from 1996-2016. He has published in the Handbook of Derivative Instruments and was invited to speak at the Federal Reserve Bank of Atlanta’s financial market conference in 2017.

Umang Papneja

Umang Papneja is CEO at Julius Baer India. A seasoned banker with a proven track record and profound knowledge of working in businesses of significant scale, size, and reputation. In his current role, Umang is responsible for driving the India growth strategy, focusing on building up a major presence locally. He is also responsible to steer the firm's local product and infrastructure innovation and develop a broader range of sophisticated and relevant products and services catered to the growing community of high-net-worth individuals in India. During his long tenured career, Umang has held several senior management positions in the finance and private banking and wealth management industry. In September 2009, he joined IIFL Wealth where he was instrumental in providing strategic guidance for investment decisions across asset classes including equities, real estate, fixed income, commodities, and alternatives with a focus on continuous product innovation. In September 2005, he joined Societe Generale Private Banking in Mumbai as Director & Head, Investment Advisory, India and successfully created investment products and ideas for domestic and NRI clients of the Global Indian Subcontinent. A post-graduate in Management Studies (Finance) from Jamnalal Bajaj Institute of Management Studies, Umang has also completed an executive programme from Singularity University, US.

Vikram Srinivasan

Dr. Vikram Srinivasan is the Founder of Needl.ai, a deep-tech AI company, that aims to build AI-assisted information workflows for the Financial Services industry. He received his PhD from UC San Diego. He has straddled academia (NUS, IISc), research labs (Bell Labs), and entrepreneurship (Zettata, Needl.ai). He loves to bring deep technology to bear on business problems to drive significant value.

Shreenivas Kunte, CFA, Ph.D.

Shreenivas Kunte leads the AI and content work at HDFC AMC. He codes in Python and has an avid interest in promoting AI and Machine Learning use in investment decision-making. Prior to joining HDFC AMC, Shreenivas was Director of Professional Learning and Advocacy at CFA Institute. Before that Shreenivas worked as the country trading strategist for Citi in Japan. Shreenivas has worked for over two decades in the investment industry. He has worked closely with key stakeholders, both in Japan and in India's topmost institutions, including regulatory bodies. Shreenivas is a computer engineer and Ph.D. from IIT Bombay.

Shamit Chokshi, CFA

Shamit joined ICICI Prudential AMC in February 2016, and oversees ~USD 4.4billion of assets advised for international investors.

He brings 17+ years of asset management experience across investing, manager selection, products, global asset raising, and strategy. He has set up and advised several India equity and FI funds across Asia (incl Japan) and Europe, selected international manager strategies, and is also helping implement ESG frameworks at the firm. Previously he worked with Nippon Life India Asset Management in Mumbai and Nippon Life Insurance in Tokyo, with past experience across firms in New York, Boston, Tokyo and Mumbai. He holds a MBA from Boston College, M.Com and B.Com degrees from University of Mumbai. He is a CFA Charterholder, Board Member and Chairperson for Professional Learning at the CFA Society India

Rajesh Sehgal, CFA

Rajesh is a long-term investor with tremendous breadth and depth of experience managing early stage investments, private equity and public equity funds for over 2 decades. He has on-the-ground experience across emerging market countries, analysing various industries and businesses spanning different stages of their lifecycle. Rajesh has the distinction of being the Founding Chair of the India chapter of CRUF, a global body set up for learning about and responding to the many accounting and regulatory changes that affect corporate reporting. He is a Board Member of the CFA Society India and of the Mumbai chapter of TiE (The Indus Entrepreneur), a global non-profit community that works to help entrepreneurs in all ways. He is also a member of the Board of Directors of Apar Industries Limited. Rajesh started his career as Deputy Manager - Corporate Finance at SBI Capital Markets Limited in 1996 and swiftly moved into the Treasury & Investments Group where he was involved with investing in equity and fixed income securities. In 1999, he was hired by Dr. Mark Mobius to join the Emerging Markets Group (EMG) at Franklin Templeton in their Mumbai office. He spent the next 17 years working with Dr. Mobius, helping the EMG invest in equity markets across Asia, Africa, East Europe and Latin America. Rajesh managed investments in equities and equity related instruments of companies, large and small, listed and unlisted, across emerging market countries through public and private equity funds. His investment experience ranges all across the deal spectrum from deal sourcing, screening, financial modelling, evaluation, diligence, closing, post- investment monitoring including board representations, providing value-add to the investee company, working on exit and ensuring exits from such investments. He has also been instrumental in fund raising for all Franklin Templeton Private Equity funds and completely involved in related LP (Limited Partner) interactions globally. Rajesh has been active in the Indian startup ecosystem since 2007 when he made his first startup investment. Since then he has been a prolific angel investor having invested in over 20 startups, worked closely with the management teams in most cases and successfully secured exits in a handful of these startup investments. Rajesh is a Wharton alumnus in addition to being an XLRI management graduate specialising in finance and marketing. He is a CFA charter holder and has earned a post- graduate diploma in Securities Law from Mumbai University

Gajendra Kothari, CFA

Mr. Kothari is the Managing Director and Chief Executive Officer of Etica Wealth Management Private Limited, recognized for his dynamic leadership and expertise in the financial industry. With over 15 years of experience in both Indian and overseas capital markets, he has established himself as a prominent figure. Holding the prestigious Chartered Financial Analyst (CFA) Charter and having completed programs such as Chartered Alternative Investment Analyst (CAIA) and International Certificate in Financial Advice (ICFA), Mr. Kothari possesses a strong educational background. Since taking charge of Etica Wealth Management in 2011, Mr. Kothari has successfully steered the firm's growth and strategy. His responsibilities encompass overseeing the firm's operations, meeting with esteemed clients, and managing their personal finance portfolios. Prior to his current role, Mr. Kothari held significant positions at UTI Mutual Fund, including Vice-President and Head - Products for the Portfolio Management Division. He also served as the Business Development Head for the UK and European Markets at UTI International Ltd in London. Driven by a passion for financial empowerment, Mr. Kothari has conducted numerous training sessions and empowered over 10,000 participants in the last 15 years. He is a sought-after speaker and thought leader, regularly invited to industry forums and events. His insights have been featured in international and domestic print media, including Financial Times UK, The Economic Times, and Times of India. He has also made live appearances on premier business channels in India such as CNBC TV18, ET NOW, and ZEE Business. Recognized for his contributions, Mr. Kothari has received accolades such as the Wealth Forum Rising Star Award in 2013. His dedication to creating financial awareness and his expertise have positioned him as one of the top financial planners in India

Ashish Gumashta

Ashish was the former Executive Chairman and CEO at Julius Baer India. He has more than two decades of experience in senior management positions in the Indian private banking industry. Previously, Ashish was Managing Director at DSP Merrill Lynch. He was a founding member of DSP Merrill Lynch’s Private Client Group and held various leadership positions at the firm, where he was responsible for establishing the wealth management platform for the organisation. Mr. Gumashta is involved in several corporate social responsibility activities, as well as in philanthropic initiatives related to disability, education, health, and community services. He attended the Chevening Gurukul Executive Program at the London School of Economics and has taken executive courses at Harvard University, Peking University, and the Haas School of Business. Mr. Gumashta has a master’s degree in management studies (finance) from the University of Mumbai.

Gaurav Kaushik, CFA

Gaurav currently serves as Executive Director at Avendus Wealth Management. He has two decades of experience in Wealth management in India. Previously he had a successful 18 year stint at Kotak Wealth Management (now Kotak Private) working in various roles in Family office advisory and Client relations. He has been an active member of the CFA Society India since 2012 and currently serves as Co-Chair , Professional learning committee and leads the Delhi chapter. He completed his graduation from SSCBS in Delhi University and attained his CFA Charter in 2011 .

Litesh Gada, CFA

Litesh is the founder of Aureus Assets which provides services like business consulting, valuations, transaction advisory and wealth management. He is a qualified Chartered Accountant, Company Secretary and a CFA charter holder. Mr. Gada has over 14 years of experience in leading Private Equity investments, Investment Banking, Merger & Acquisition (M&A) transactions in the consumer, retail, real estate and agro sectors. In the past, he has worked with organizations like RSM & Co (merged with PwC), PwC India, Chess Capital, SEAF India and SREI Alternatives. He was awarded with ‘40 Under 40 Alternative Investment Professionals in India’ award by the Indian Association of Alternative Investment Funds (IAAIF) in January 2018. He has been a long distance runner since 2009 and has participated and successfully completed many full marathons and half marathons.

Kishor Bagri, CFA

Kishor has experience of more than 22 years across multiple industries and functions including 15 years in capital markets. He has worked across the investment chain including research, portfolio management and investment sales. He was with Edelweiss Securities where he headed the Corporate Access function. He previously worked with ING Investment Management as Senior Vice President & Portfolio Manager, managing INR 2,000 crore of AUM including INR 400 crore of offshore assets. During his 8 year stint at ING, he worked across investment styles such as fundamental, quantitative etc. He also managed funds and multi-manager portfolios which were later subsumed in the quantitative strategies – the focus area of the business. His capital market stint began with Dimensional Securities Pvt. Ltd. where he was a Research Analyst, involved in bottom-up equity research across sectors, investment strategy, opportunistic and event-based trading ideas etc. Kishor has also worked in various roles and functions including sales, business development in financial services, FMCG and the Telecom industry. He is a CFA charterholder and has completed his MBA

Navin Vohra

Navin is a Partner and National Leader for Valuations, Modelling and Economics at Ernst & Young India, heading one of the largest valuation practices in the country with a team of over 100 professionals. His expertise is in complex private company valuations for litigations, dispute settlements, transactions, M&A and regulations. Navin and his team have authored many Thought Leadership Reports on technical aspects of valuation, including on Transaction Valuations in India, Accounting for business combinations, Valuations for Early Stage Companies, Control Premium in India. Navin has spent over two decades with EY, prior to which he worked as an equity analyst with DBS Securities. Navin is a PGDM from IIM Bangalore, a Cost Accountant and a CFA Charter holder.

GOLD SPONSOR & DELEGATE BAG SPONSOR

PGIM is the asset management business of Prudential Financial Inc with USD 1.34 trillion in assets under management as of March 31, 2024. (PFI). PFI has a history that dates back over 145 years and through more than 30 market cycles. PGIM India Asset Management is a full-service investment manager offering a broad range of equity and fixed income solutions to retail, high net worth individuals and institutional investors throughout the country. In addition to managing our investors assets through domestic Mutual Funds, we also offer Offshore Funds, Alternatives and Portfolio Management Services. Built on a foundation of strength, stability and disciplined risk management, our firm is comprised of autonomous asset management businesses, each specializing in a particular asset class across public and private markets with a focused investment approach. PGIM has its presence across 19 countries through 41 office locations with over 1,400+ investment professionals. PGIM India brings a rich blend of global resources, intellectual acumen and local investment expertise and is committed to designing superior and meaningful, wealth-building solutions for our investors.

GOLD SPONSOR

We are a membership organisation that champions the role gold plays as a strategic asset, shaping the future of a responsible and accessible gold supply chain. Our team of experts builds understanding of the use case and possibilities of gold through trusted research, analysis, commentary and insights. We drive industry progress, shaping policy and setting the standards for a perpetual and sustainable gold market.

SILVER SPONSOR

Franklin Templeton's association with India dates back to over 3 decades as an investor. As part of the group's major thrust on investing in markets around the world, the India office was set up in 1996 as Templeton Asset Management India Pvt. Limited. It flagged off the mutual fund business with the launch of Templeton India Growth Fund in September 1996, and since then the business has grown at a steady pace. At Franklin Templeton, we understand that the strength of our business relationships is a key point of differentiation for us as a company, along with the trust that our business partners and clients have in us. Throughout the company’s history, a strong commitment to corporate values has guided our decision making and has been a roadmap for our success. These values, and our unique perspective, help us achieve our mission by offering high quality investment solutions, providing outstanding service, and attracting, motivating and retaining talented people. They also help to create a “culture of compliance.”

LGT is an international private bank owned by the Princely Family of Liechtenstein with 23 locations in Europe, Asia, Australia, and the Middle East. Our solid capitalization, long-term thinking, and strategic focus underpin our strong values. These are rooted in 900 years tradition and entrepreneurial thinking. Digitization represents a key pillar of how we continually innovate to find better ways of doing things - today and for the future. LGT Wealth India is majority owned by LGT Group, a leading international private banking and asset management group that has been fully controlled by the Liechtenstein Princely Family for over 90 years. We offer comprehensive investment solutions for private investors, with a particular focus on entrepreneurial and family wealth, drawing from the legacy of LGT’s long-standing experience in managing the assets of the Princely Family. The global scale and access of LGT, combined with its stability, deep client focus and long-term approach, will enable us to build relationships that transcend generations with you. A new era in private wealth begins here

SBI is the first Public Sector Bank to offer Wealth Management Services to our esteemed clients. At SBI Wealth we cater to the Investment needs of affluent Clients, a bouquet of Investment products such as MFs, Insurance, PMS, Bonds & AIF are offered to Wealth Clients as per their Risk Profile. Wealth team consists of dedicated and personalized Relationship Managers who will be in constant touch with clients for their Investment and Banking needs. Doorstep banking services are also extended through Customer Relationship Executives. The key elements of value proposition to clients are flexibility in choosing multiple delivery channels, in-depth research and analysis and open architectures. The Bank’s Wealth Management Services are offered at 108 major Centres across the country through a network of 241 Wealth Hubs.

STANDARD SPONSOR

About DSP Mutual Fund DSP Mutual Fund has an over 25-year track record of investment excellence. Today, we have the honour of managing money for over 35 lakh investors from all walks of life: hard-working salaried individuals, high-net-worth individuals, NRIs, small and mid-sized business owners, large private & public corporations, trusts and foreign institutions. We take great pride in knowing that we play a key role in the creation of wealth for all our investors and will always continue to be an organization with a purpose - it is our responsibility to make a real difference to the lives of our investors. DSP Mutual Fund is backed by the 160+ year old DSP Group. Over the past one and a half centuries, the family behind the Group has been very influential in the growth and professionalization of capital markets and money management business in India. DSP Group is currently headed by Mr. Hemendra Kothari. Our investors’ interests will always remain at the core of our business, and we will continue to maintain a relentless focus on doing what's best for them, as they #InvestForGood. About DSP Passive Funds DSP Mutual Fund has passive investment products across all asset classes – Equity, Debt, Commodities, and the entire market range of large, mid and small. We offer a wide range of products of index funds, ETFs and rules based smart beta products. In line with global best practices, we have set up a dedicated Investment Team for passive investments, rather than a common Investment Team responsible for both active and passive funds. This ensures closer attention on the portfolios and demonstrates the business focus that DSP has for ETFs.

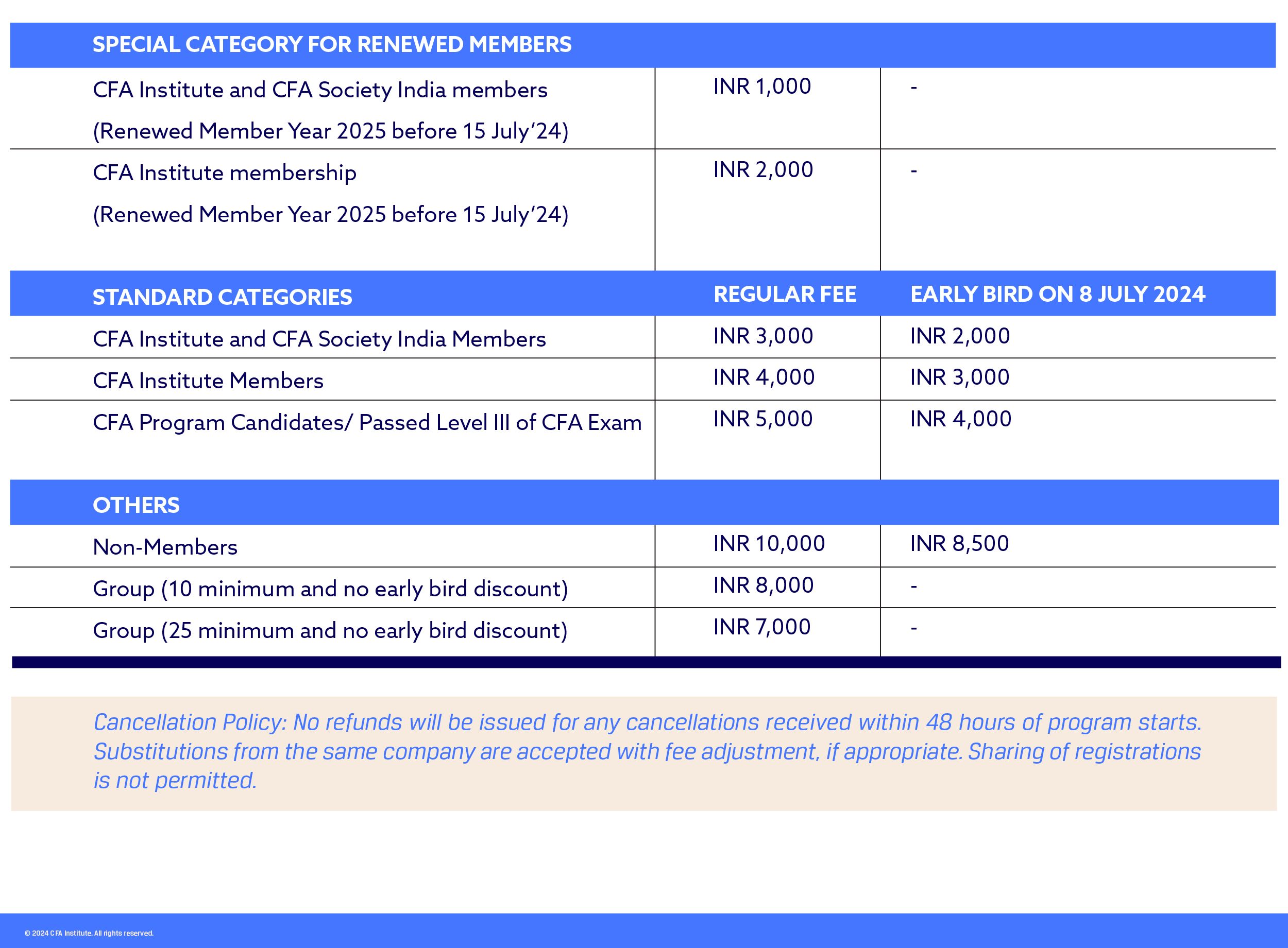

6.5 PLCFA Institute members can claim PL credit by providing their CFA Institute ID number when registering. |

Global Passport Accredited Programme Allows members of participating CFA societies to attend each other's society events at the local member price Global Passport Accredited Programme Allows members of participating CFA societies to attend each other's society events at the local member price |