9th Value Investing Pioneers Summit 2025|Delhi

- November 15, 2025

- 9:00 am to 5:00 pm

- Hyatt Regency, Delhi

“It is not knowledge, but the act of learning, not possession but the act of getting there, which grants the greatest enjoyment.” — Carl Friedrich Gauss

This powerful insight resonates deeply with a core principle of value investing: true fulfillment arises not from the destination, but from the journey itself.

In both investing and learning, the richest satisfaction comes not from simply accumulating facts but from engaging in the reflective and ongoing process of discovery and growth. While hands-on experience remains invaluable, much of the wisdom we seek can be gleaned by learning from those who have already navigated the complex path. This shared knowledge enriches our own journeys, helps us avoid common pitfalls, and accelerates our progress, embodying the spirit that the greatest enjoyment lies in the act of learning itself.

The most successful investors understand that the journey never truly ends. Real growth transcends mere market gains; it stems from the intellectual discipline of continuously refining one’s approach.

With this vision, we invite you to join us at the 9th edition of Value Investing Pioneers Summit (VIPS)— a unique platform designed to foster meaningful conversations, collaborations, and learning among a community of like-minded professionals. Here, you will gain invaluable insights from leading industry veterans, fund managers, and academics, all dedicated to pursuing excellence through knowledge.

This summit offers a rare opportunity to connect, cultivate new relationships, and grow alongside peers who share your passion for value investing and continual learning.

We look forward to welcoming you to VIPS, where the journey of learning and investing is shared, inspired, and celebrated.

EVENT DETAILS

Date- 15th November 2025

Time- 9:00 AM To 5:00 PM

Venue- Hyatt Regency, Delhi

Sailesh Bhan

Sailesh Raj Bhan is the CIO Equities at Nippon Life India Asset Management overlooking close to S30bn of Active Equities. Sailesh has over 29 years of experience in Indian Equity Markets with over 21 years at Nippon Life India Asset Management Limited.Sailesh is among one of the longest serving equity fund managers in Indian Mutual Fund Industry with over 2 decades of fund management expertise. About one in three folios in Indian Equity Mutual Fund industry is with Nippon Life India Asset Management Ltd.He manages the flagship diversified equity schemes like Nippon India Multi Cap Fund since its inception in March 2005 (over 19 years) and Nippon India Large Cap Fund since its inception 2007 (over 17 years).Sailesh also manages the Largest Pharma Sector Fund in India since its inception in May 2004.

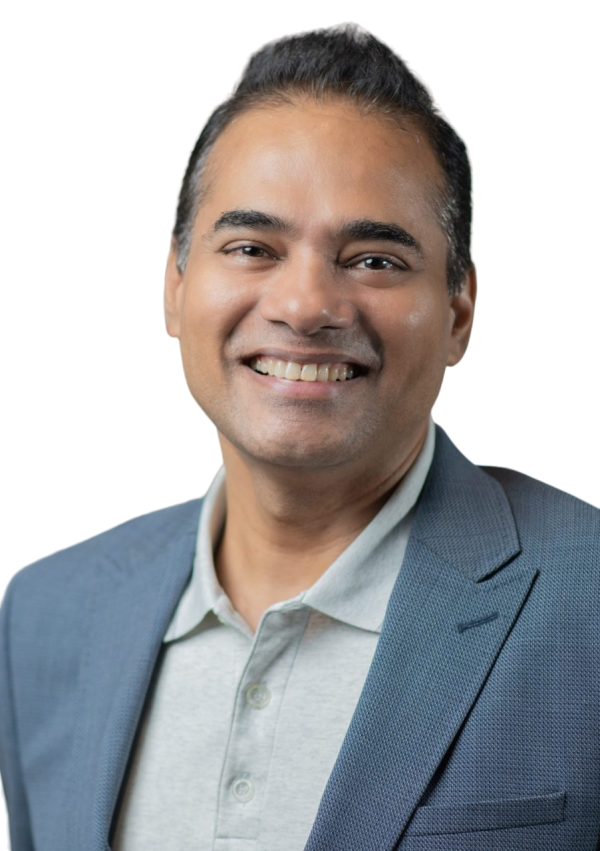

Dinesh Balachandran, CFA

Mr. Dinesh Balachandran is a seasoned investment professional with over 23 years of experience across global and Indian financial markets. He joined SBI Funds Management Limited (SBIFM) in 2012 as a Senior Credit Analyst and went on to head both the Research and Equity teams, while actively managing several funds. Currently serving as Head of Investments, he oversees the firm’s investment strategy and continues to manage a number of funds directly. Prior to joining SBIFM, Dinesh spent over a decade at Fidelity Investments in Boston, USA, where he specialized in Structured Finance and the U.S. Fixed Income markets. He holds a B.Tech from the Indian Institute of Technology (IIT), Bombay, and an M.S. from the Massachusetts Institute of Technology (MIT), USA. He is also a CFA Charterholder.

Mrinal Singh

Mr. Singh has over two decades of rich experience and a successful track record in investment management and equity research.

A well known name in the field of “Value Investing”, he is known for long-term approach and keen eye on Risk-adjusted returns. As a fund management veteran, he positions himself as experienced but hungry investor: he credits rigorous bottom-up research and steadfast process for his funds’ outperformance, yet reminds listeners that “equity investments is a long term process and there can’t be shortcuts for wealth generation”. He routinely invokes the principle of “margin of safety” and counsels embracing volatility for superior returns. He has multiple times stuck to his conviction through tough and demanding situations.Professionally he made his mark by pioneering Value Style of investing in a growth market like India during his more than 12 year stint with ICICI Prudential AMC. As Deputy Chief Investment Officer, at ICICI Prudential AMC he managed various flagship products like ICICI Prudential Value Discovery Fund for 10 years, ICICI Prudential Midcap Fund for 5 years, ICICI Prudential Focused Equity Fund for 5 years amongst many other industry leading return generating fund mandates. He was instrumental in building the AMC’s research processes, product strategy as well as business & talent development.Currently, he heads ‘Vedartha’ which is the Alternative Investment arm of Bandhan AMC as “Head -Alternates (Listed Equity)”.Mr. Singh is a Mechanical Engineer & an alumnus of SP Jain Institute of Management & Research, Mumbai. He is also passionate about team building & social causes for poverty eradication in the country. He has been a vocal advocate for empowering individuals with the knowledge and skills they need to make informed financial decisions and achieve their financial goals.

Ganeshram Jayaraman

Mr. Ganeshram Jayaraman has over 25+ years of experience in equities. He has joined Avendus Long Only Public Equities as Chief Investment Officer & Head.Prior to assuming his current role, he headed the Institutional Equities division of Spark Institutional Equities Private Limited for 18 years. He joined as the first professional in 2006 and thereon was instrumental in building the Institutional Equities business at Spark to its market-leading position. As MD and Head of the business, he led India's top ranked strategy desk advising CIOs and portfolio managers on their India portfolios. He played a pivotal role in nurturing and growing the business, steering it through critical phases of development and expansion. In his early days, he worked with Standard Chartered, Crisil Global Research & HSBC.With a keen focus on building a credible, differentiated, and scaled domestic investment platform, he is going to be at the forefront of driving our long-term investment strategiesHe is a CPA and is deeply passionate about family, food and cricket.

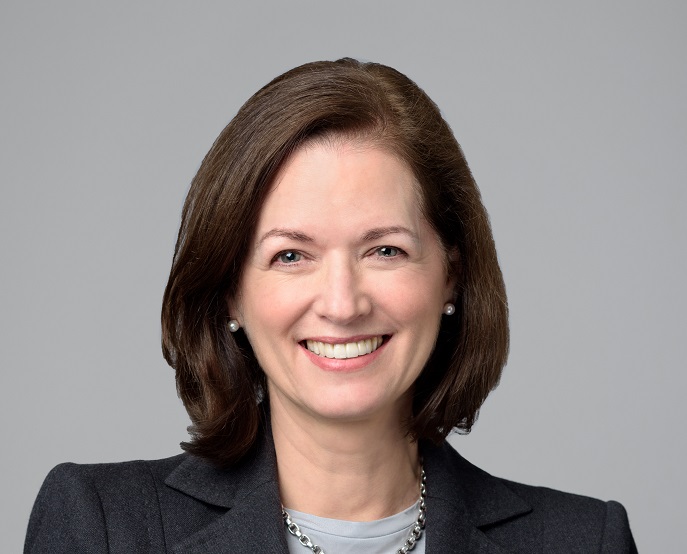

Marg Franklin, CFA

Margaret Franklin, CFA, is President and Chief Executive Officer of CFA Institute. She leads CFA Institute in promoting the highest standards of education, ethics, and excellence in the investment profession. She assumed her role in September 2019 and has more than 25 years of industry experience. Before joining CFA Institute, Margaret led International Wealth Management for North America and was president of BNY Mellon Wealth Management, Advisory Services in Canada. She is a founding member of the CFA Institute Women in Investment Initiative and sits on its Future of Finance content council. Margaret holds a bachelor’s degree in administration in economics from McMaster University, Ontario.”

Jitendra Chawla, CFA

Jitendra has over 25 years of experience in investment management, asset allocation, portfolio structuring, and relationship management. Currently, he is the Head of Client Relations and Distribution (North) for PPFAS AMC. His previous experience includes various key positions at Deutsche Private Wealth, Citi Wealth Advisors, Kotak Private Wealth, ABN AMRO Bank, and Standard Chartered Bank. Jitendra holds a Bachelor’s Degree in Commerce from Delhi University and a Postgraduate Diploma in Business Management. He is also a CFA charterholder

Satyadeep Jain

Satyadeep Jain is a Director in the Institutional Equities Research team at Ambit, where he leads coverage on the Metals, Mining, Cement, Utilities, and New Energy sectors. With over a decade of experience in equity research across global and Indian markets, he brings deep domain expertise and a structured fundamental approach to evaluating long-term sectoral trends, policy shifts, cost cycles, capex dynamics, and company-level strategy. Prior to joining Ambit, Satyadeep worked with leading global research platforms, including Vertical Research Partners, Sterne Agee & Leach, and earlier in his career with Jefferies, where he focused extensively on industrials and commodities across emerging and developed markets. At Ambit, he is responsible for driving sector-focused research, publishing sector insights, and engaging closely with institutional investors, corporate leadership teams, and industry stakeholders. Satyadeep holds an MBA in Finance and Accounting from the NYU Stern School of Business and is also a Chartered Financial Analyst (CFA).

Gaurav Kaushik, CFA

Gaurav currently serves as Executive Director at Avendus Wealth Management. He has over two decades of experience in Wealth management in India. Previously he had a successful 18 year stint at Kotak Wealth Management (now Kotak Private) working in various roles in Family office advisory and Client relations. He has been an active member of the CFA Society India since 2012 and currently serves as Co-Chair , Professional learning committee and leads the Delhi chapter. He completed his graduation from SSCBS in Delhi University and attained his CFA Charter in 2011 .

Rajesh Sehgal, CFA

Rajesh is the Managing Partner at Equanimity Investments. He is a board member of the CFA Society India. He is a long-term investor with tremendous breadth and depth of experience, managing early stage investments, private equity and public equity funds for over two decades. He has on-the-ground experience across emerging market countries, analysing various industries and businesses spanning different stages of their lifecycle. He has been active in the Indian startup ecosystem since 2007 when he made his first startup investment. Since then, he has been a prolific angel investor, having invested in over 20 startups. Rajesh is a Wharton alumnus in addition to being an XLRI Management graduate specializing in finance and marketing. He is a CFA charter holder and has earned a Post Graduate diploma in Securities Law from Mumbai University.

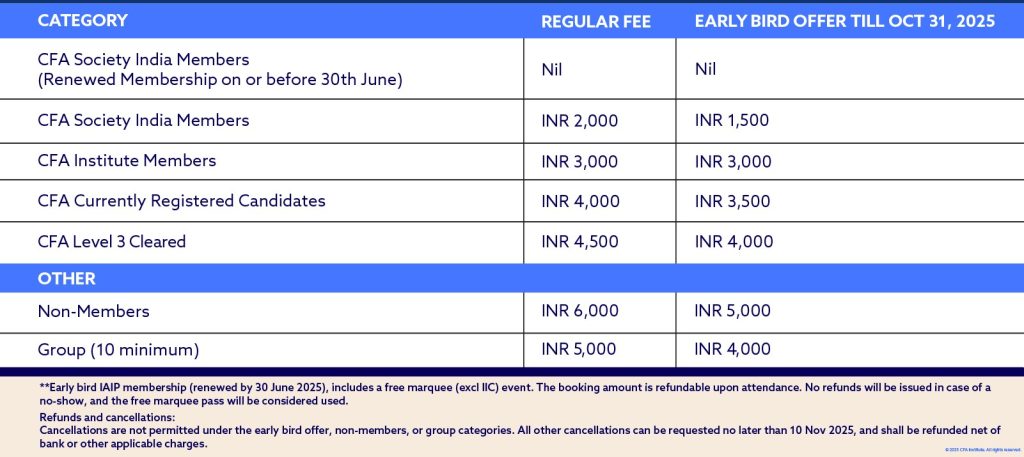

5 PLCFA Institute members can claim PL credit by providing their CFA Institute ID number when registering. |

Global Passport Accredited Programme Allows members of participating CFA societies to attend each other's society events at the local member price Global Passport Accredited Programme Allows members of participating CFA societies to attend each other's society events at the local member price |