- January 4, 2018

- Posted by: annlin@india.cfasociety.org

- Category:BLOG, Events, Pune, Speaker Events

Contributed by: Manish Chandak

CFA Society India, Pune hosted a session on “Small and medium enterprises (SME) IPO Pitch” by Mr. Sachin Shirol on 9th September 2017. Mr Sachin is Director at SkyBridge Financial Services. He is a qualified Chartered Accountant and CFA charter holder. Prior to launching SkyBridge in May 2017, he worked with Deutsche Bank in the Global Markets division for about 10 years. His session on SME IPO Pitch was an attempt to raise awareness about how SMEs can and are raising capital through SME Platform of BSE and NSE. Also, he made a strong case for retail investors to invest money in SMEs which are available at the attractive valuation and reap benefits in the long run.

Mr. Sachin started the session by explaining the significant role played by Small and medium enterprises (SMEs) in Indian economy. He said that SMEs are finding it difficult to raise institutional credit. However, SME IPO is an opportunity for both the Small and medium enterprises as well as domestic investors.

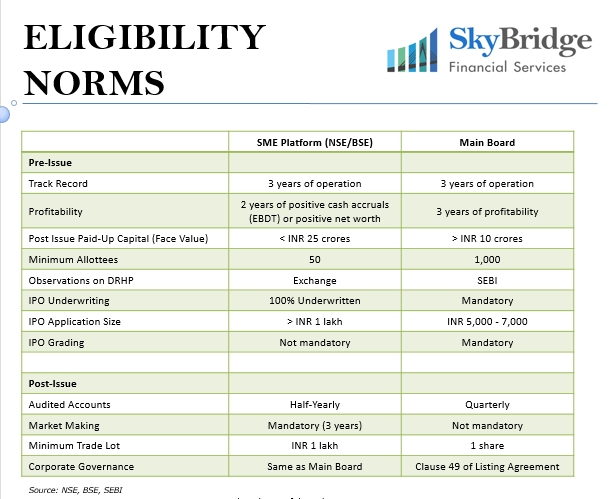

He spelled out the eligibility norms of SME IPO as below.

He enumerated various benefits of the listing on SME Platform. Few of them are as below:

Net Worth: Substantial growth in the net worth of promoters with increase in the price of listed securities

Liquidity: Exit route for VC/PE/angel investors and unlocking of shareholder wealth

Tax Benefits on Transfer of Shares: NIL tax on LTCG (vs. 20% tax on unlisted securities) and 15% tax on STCG (vs. 30% tax on unlisted securities)

Monetization of Shares: Listed securities can be pledged as collateral to raise funds from financial institutions

Access to Capital: Unconventional ways of raising funds via Preferential Issue, Rights Issue, QIB Placements, etc.

Credit Rating: Equity infusion lowers Debt/Equity ratio, thereby improving credit ratings and lowering financing costs

Employee Stock Options (ESOP): Way to attract, retain and promote human capital

Brand: Listed companies enjoy brand recall and separate identity amongst peer group

He talked about the key players involved in the SME IPO Process. Also, he explained in detail the process for listing including various timelines and compliance formalities involved. In 2017 YTD, SME IPOs were oversubscribed 17.5x on NSE and 3.8x on BSE. He expressed his anguish over the fact that there is not enough media coverage about SME IPO and less information being available in the public domain. However, he was confident that things will change for better on SME IPO front. He used his presentation to explain how promoters can unlock the potential through SME IPO listing and create significant wealth for themselves and retail investors.

Since most of the participants were not aware of the SME IPO and its benefits, they listened to the presentation with rapt attention. It was followed by Q&A session where Sachin answered questions ranging from eligibility norms for SME IPO, differences between SME Platform and Main Board (NSE/BSE) and benefits of SME IPO to the Indian economy and retail investors

-MC