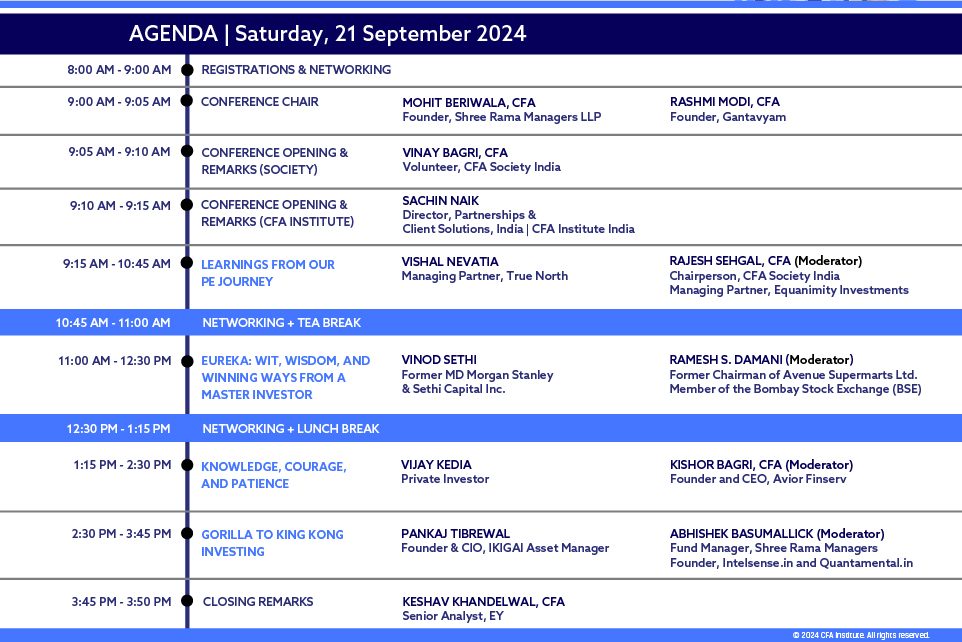

4th Masters at Work | Kolkata

- September 21, 2024

- 9.00 am - 5.00 pm

- Taj Bengal

” When a collection of brilliant minds, hearts, and talents come together, expect a masterpiece”- Anonymous

The CFA Society India is delighted to announce the highly anticipated Masters at Work Summit, a grand event set to grace the vibrant City of Joy on the 21st September 2024.

Prepare to embark on a memorable journey with the nation’s most illustrious investors, as they unveil their priceless insights and pioneering strategies to navigate today’s ever-evolving financial markets.

Co-hosted CFA Institute, which proudly supports a global network of over 160,000 seasoned practitioners, this summit will bring together the biggest names in the world of Investment.

With their profound reservoirs of experience and stellar track records, these master investors will bestow upon you the knowledge and acumen necessary to flourish in the dynamic realm of investment.

We invite you to join us as we convene luminaries from diverse investment styles and markets, promising a rich, comprehensive learning experience.

Seize this golden opportunity to elevate your investment prowess and move towards unparalleled success & Financial Independence!

To learn more, join us at the Masters at Work Summit on the 21st September 2024 at Taj Bengal in Kolkata.

Pankaj Tibrewal

Pankaj Tibrewal brings over two decades of extensive fund management experience. At Kotak Mutual Fund, he successfully managed assets worth ₹56,000 crore ($6.75 billion) over a remarkable 14-year span. He significantly grew the Kotak Emerging Equity Fund from ₹113 crore ($13 million) in 2010 to ₹36,000 crore ($4.33 billion), establishing it as the country’s second-largest mid-cap fund. Additionally, he expanded the Kotak Small Cap Fund from ₹127 crore ($15 million) to ₹13,000 crore ($1.56 billion), ranking it the fifth-largest small-cap fund. Under his leadership, Kotak Mutual Fund’s total AUM reached ₹3.50 lakh crore as of November 2023, positioning it among the top five Indian asset management companies. He also managed the Kotak Business Cycles Fund and the equity portion of the Kotak Equity Hybrid Fund. Pankaj has been consistently recognised among the top 10 fund managers in India by Outlook Business (2016-2021) and featured as a top fund manager by The Economic Times and Morning Star (2016-2022).

Vijay Kedia

Vijay Kedia is a private investor in the stock market, having experience of more than three decades. Kedia, a commerce graduate born and brought up in Kolkata, joined the stock market with zero capital. Some of his investments have been appreciated 100 times in the last 15-20 years. One of his investments has given him 16400 times return. He has been a key note speaker in many business schools, including IIM Ahmedabad, IIM Bangalore, IIM Amritsar, and London Business School. He has been a TEDx speaker twice. In 2017, Kedia was conferred with a doctorate degree. He has written and sung many songs on investing to educate new and small investors. Recently, he was given an award for " ACE INVESTOR" by Hon'ble ministers Shri Piyush Goyal ji and Shri Devendra Fadnavis ji.

Vinod Sethi

Vinod Sethi is a veteran investor. He pioneered international investing in India. He joined Morgan Stanley straight out of Business School in 1989. Mr. Sethi founded the India business for Morgan Stanley Investment Management and was its Chief Investment Officer for 12 years. Under his leadership, Morgan Stanley became one of the earliest FII's to come to India. During his tenure,the India business grew to exceed $2bn in assets under management making Morgan Stanley one of the largest investors in India. He was appointed as the Chief Investment Officer for all of Asia ex-Japan in 1997-98. Mr. Sethi has been one of the early entrants in some noteable investments, such as Infosys, HDFC, Titan, Hero Motors, among others.

Vishal Nevatia

Vishal has been at the helm of True North as its Managing Partner since its inception in 1999. For more than two decades spanning diverse economic cycles, the Firm has partnered with more than 60+ investments businesses in their journey towards realizing true potential. Hallmark of each of these journeys has been the focus on earning customers’ trust, delighting them and in the process creating industry-leading value for all stakeholders. Under Vishal’s leadership, the Firm’s value-driven philosophy of only doing business “The Right Way” has become firmly rooted in its interactions. Prior to True North, Vishal was with the Indian practice of Arthur Andersen for 11 years. He was initially a part of their Tax & Business Advisory practice and then a member of the Corporate Finance division. Vishal holds a Bachelor of Commerce degree from the University of Mumbai and is a qualified Chartered Accountant. In his spare time, he enjoys trekking, traveling, listening to music, reading, and keeping mentally & physically fit.

Ramesh S. Damani

Ramesh S. Damani, age 67 years, is a Member of the Bombay Stock Exchange (BSE). A graduate of H.R. College, Mumbai, he did his MBA from California State University, Northridge. He has been a broker, at the BSE, since 1989. He is the former Chairman of Avenue Supermarts Ltd (popularly known as DMart). He is Managing Director of Ramesh S. Damani Finance Pvt. Ltd. He also serves on the Board of VIP INDUSTRIES LTD. He has hosted a number of shows on CNBC-TV18, amongst them are Wizards of Dalal Street, Oriental & Occidental and RD 360. He is a frequent commentator of financial issues on various business channels. Married to Ruchi and has one son.

Kishor Bagri, CFA

Kishor has experience of more than 22 years across multiple industries and functions including 15 years in capital markets. He has worked across the investment chain including research, portfolio management and investment sales. He was with Edelweiss Securities where he headed the Corporate Access function. He previously worked with ING Investment Management as Senior Vice President & Portfolio Manager, managing INR 2,000 crore of AUM including INR 400 crore of offshore assets. During his 8 year stint at ING, he worked across investment styles such as fundamental, quantitative etc. He also managed funds and multi-manager portfolios which were later subsumed in the quantitative strategies – the focus area of the business. His capital market stint began with Dimensional Securities Pvt. Ltd. where he was a Research Analyst, involved in bottom-up equity research across sectors, investment strategy, opportunistic and event-based trading ideas etc. Kishor has also worked in various roles and functions including sales, business development in financial services, FMCG and the Telecom industry. He is a CFA charterholder and has completed his MBA

Rajesh Sehgal, CFA

Rajesh is a long-term investor with tremendous breadth and depth of experience managing early stage investments, private equity and public equity funds for over 2 decades. He has on-the-ground experience across emerging market countries, analysing various industries and businesses spanning different stages of their lifecycle. Rajesh has the distinction of being the Founding Chair of the India chapter of CRUF, a global body set up for learning about and responding to the many accounting and regulatory changes that affect corporate reporting. He is a Board Member of the CFA Society India and of the Mumbai chapter of TiE (The Indus Entrepreneur), a global non-profit community that works to help entrepreneurs in all ways. He is also a member of the Board of Directors of Apar Industries Limited. Rajesh started his career as Deputy Manager - Corporate Finance at SBI Capital Markets Limited in 1996 and swiftly moved into the Treasury & Investments Group where he was involved with investing in equity and fixed income securities. In 1999, he was hired by Dr. Mark Mobius to join the Emerging Markets Group (EMG) at Franklin Templeton in their Mumbai office. He spent the next 17 years working with Dr. Mobius, helping the EMG invest in equity markets across Asia, Africa, East Europe and Latin America. Rajesh managed investments in equities and equity related instruments of companies, large and small, listed and unlisted, across emerging market countries through public and private equity funds. His investment experience ranges all across the deal spectrum from deal sourcing, screening, financial modelling, evaluation, diligence, closing, post- investment monitoring including board representations, providing value-add to the investee company, working on exit and ensuring exits from such investments. He has also been instrumental in fund raising for all Franklin Templeton Private Equity funds and completely involved in related LP (Limited Partner) interactions globally. Rajesh has been active in the Indian startup ecosystem since 2007 when he made his first startup investment. Since then he has been a prolific angel investor having invested in over 20 startups, worked closely with the management teams in most cases and successfully secured exits in a handful of these startup investments. Rajesh is a Wharton alumnus in addition to being an XLRI management graduate specialising in finance and marketing. He is a CFA charter holder and has earned a post- graduate diploma in Securities Law from Mumbai University

Abhishek Basumallick

Abhishek Basumallick is a seasoned fund manager, leading the active equity funds at Shree Rama Managers. As the founder of Intelsense.in and Quantamental.in, he has been a pivotal figure in the investment landscape, known for his insightful contributions to the Market Moghuls section of The Economic Times and appearances on CNBC TV18. Abhishek is frequently featured on major television channels such as ET NOW and Money9, and his expertise has been recognized internationally in publications like Fortune Global and Nikkei Asia. His reputation as a prominent investor was solidified when he was titled the “Don of Dalal Street” by the Economic Times. In addition to his public roles, Abhishek also advises the equity portfolios of several large family offices and ultra-high-net-worth individuals (UHNWIs).

Mohit Beriwala, CFA

Mohit is the Founder of SRM. He is an FRM, CFA & IIM-B alumnus. Since 2006, he has been helping Entrepreneurs & Professionals safeguard their assets and reach the goal they desire.

Mohit is an FRM, CFA & IIMB Alumnus He has been active in the financial market since he was merely 19 years of age. Since 2006, Mohit has been running a prominent wealth advisory business and has been helping Entrepreneurs and Professionals safeguard their assets and reach the goal they desire.

Rashmi Modi, CFA

Rashmi Modi is the founder of Gantavyam, a boutique wealth management firm she established in 2019. With a BBA in Marketing and a CFA charter earned in 2019, Rashmi began her journey in the world of equities by joining her family's equity broking business. There, she gained comprehensive experience in portfolio management, financial planning, and SEBI compliance. Recognizing a significant gap in how individuals managed and understood their finances, Rashmi launched Gantavyam to bridge this divide. Over the past decade, she has worked diligently to guide more than 100 clients towards better financial health. In addition to her wealth management services, she also assists clients in converting physical shares into demat form. Rashmi is driven by a commitment to excellence, integrity, and hard work.

Sachin Naik

Sachin Naik is the Director of Partnerships & Client Solutions, India at CFA Institute, where he is responsible for creating and nurturing valuable relationships with financial institutions, CFA Societies and learning providers in the region. Since joining CFA Institute in 2016, Sachin has successfully managed diverse portfolios and advanced CFA Institute’s mission across India and neighboring markets. He has been instrumental in executing CFA Institute’s candidate and member strategies for India while leveraging data insights, market intelligence, and a deep understanding of customer experiences. Additionally, Sachin leads collaboration with local societies in India and Sri Lanka, ensuring high standards of service for members and stakeholders. With over 17 years of industry experience, he has a proven track record in advancing education products and services within the financial services and IT sectors across India and South Asia. Sachin has a bachelor’s degree in engineering from Mumbai University and an MBA from Goa Institute of Management. For more information, please connect with Sachin on LinkedIn.

Vinay Bagri, CFA

Volunteer, CFA Society India

Keshav Khandelwal, CFA

Senior Analyst, EY

DELEGATE BAG SPONSOR

DSP Asset Managers – Obsessed with helping you invest better

An investment firm with skin in the game

A professionally managed, family-owned asset management firm, which means you get the best of both worlds. Our shareholders, leaders, employees invest in our own funds, demonstrating our confidence and aligned interests in our mutual schemes, which means sharing the risks and rewards of investing with our investors.

- Comprehensive range with over 50 unique Mutual fund schemes

- Rs 1,50,000 crore+ Assets under Management

- Trusted by 50L+ investors

- Recommended by 80K+ MF Distributors/ advisors

- Backed by our Founders’ 160+ years of rich Indian legacy

People from all walks of like - Salaried people, rich individuals, NRIs, small & medium business owners, big private & public corporations, trusts, and foreign institutional investors.

5 PLCFA Institute members can claim PL credit by providing their CFA Institute ID number when registering. |

Global Passport Accredited Programme Allows members of participating CFA societies to attend each other's society events at the local member price Global Passport Accredited Programme Allows members of participating CFA societies to attend each other's society events at the local member price |