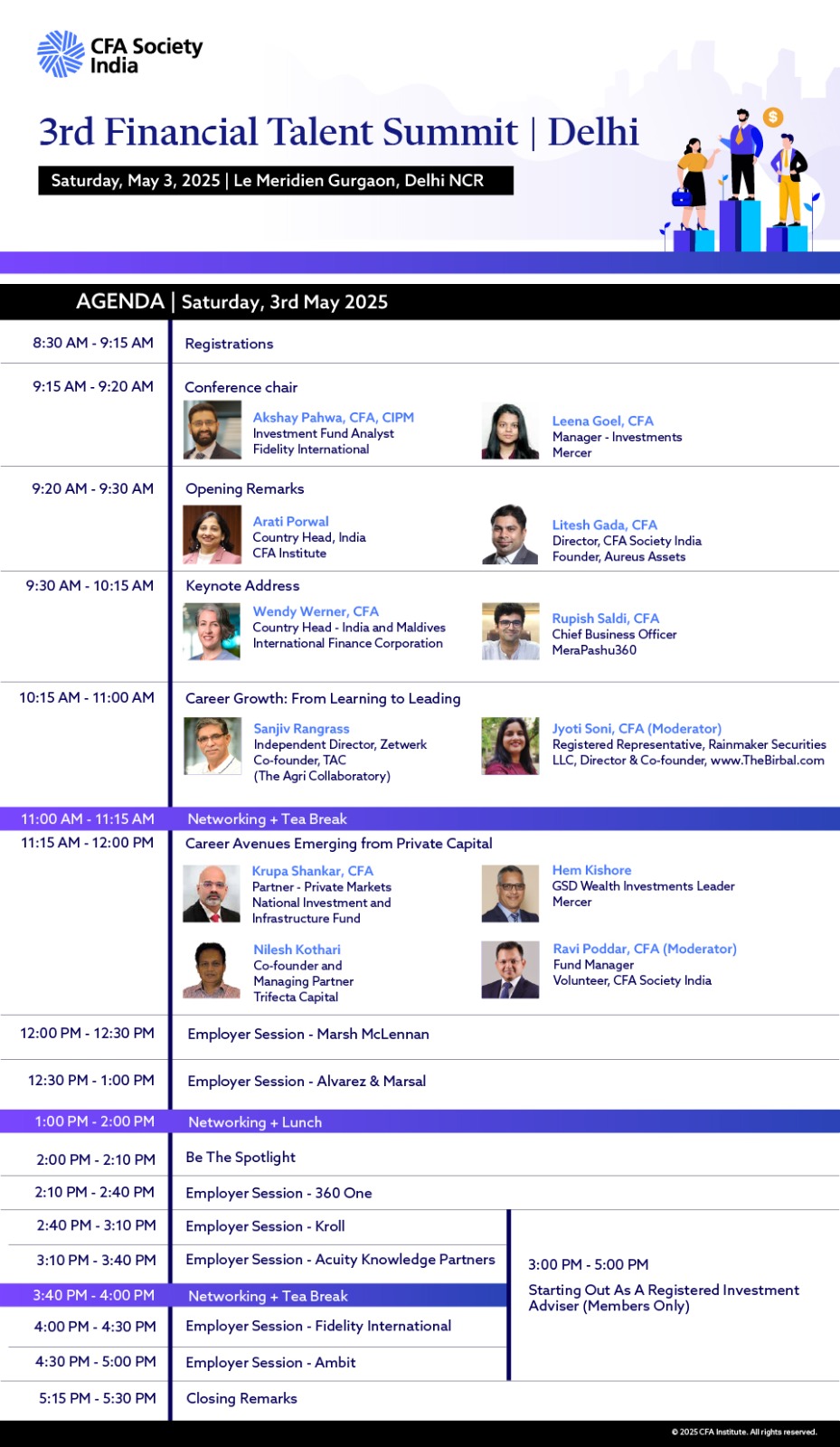

3rd Financial Talent Summit | Delhi

- May 3, 2025

- 9 am to 5 pm

- Le Meridien, Sector 26 M.G. Road, Gurgaon Delhi, Border, Gurugram, Haryana 122002

The 3rd Financial Talent Summit, Delhi, co-hosted by CFA Society India and CFA Institute, is an excellent platform to engage with industry leaders, explore career opportunities, and gain insights into the evolving landscape of private investments and entrepreneurship.

Key Highlights:

Career Development: Learn how to build a compelling personal and professional narrative that can enhance career growth. Discover techniques to position yourself effectively in interviews, networking opportunities, and leadership roles.

Insights on Entrepreneurship: Understand the mindset and skills required to thrive as an entrepreneur. This session with seasoned entrepreneurs and investors will explore topics including risk-taking, innovation, and long-term strategic thinking.

Panel Discussion on Private Investment:

- Gain insights into the key factors that influence private capital investments, including market trends, risk assessment, and value creation.

- Explore emerging opportunities and challenges shaping the future of private investments in India.

Employer Sessions & Networking: Connect with leading employers from the industry, gain firsthand insights into hiring trends, and explore potential career opportunities.

The 3rd Financial Talent Summit, Delhi, is a must-attend event for CFA charterholders and candidates looking to expand their expertise, engage with industry leaders, and take their careers to the next level.

Registrations are open.

Wendy Werner, CFA

Country Head - India and Maldives, International Finance Corporation

Ms. Wendy Werner is the Country Head of International Finance Corporation for India and Maldives, based in New Delhi. She implements growth and diversification of IFC’s India and Maldives portfolio, with particular focus on maximizing IFC’s development impact. Prior to her current role, Ms. Werner was the IFC Country Manager for Bangladesh, Bhutan, and Nepal. She had implemented IFC’s strategy to expand financial inclusion, sustainable infrastructure and support competitiveness through investment and advisory services. Previously, Ms. Werner was the Manager for Trade and Competitiveness Advisory Services for the East Asia Pacific region. With IFC, she has also worked in Tajikistan and the Western Balkans. Ms. Wendy Werner is a CFA Charterholder and holds a joint MBA/ MA International Affairs from George Washington University and a BA from Grinnell College.Sanjiv Rangrass

Angel Investor

Sanjiv is a Mentor, Coach and an Angel Investor. He is a Senior Adviser with Mckinsey. He works as an Independent Director on the board of Zetwerk - a manufacturing Unicorn and a Venture Partner in Capria – a leading venture fund that supports early-stage tech startups. He is also a co-founder of TAC (The Agri Collaboratory) - a “non-compete” not for profit, Agriculture “Think and Do Tank” – helping build Digital Public Infrastructure and Goods for Agriculture in Open Source, along with the Ecosystem and the Government. His core passion is focusing on talent development, succession planning and mentoring. Several of his mentees have gone on to launch successful start-ups like Blackbuck, Zetwerk, Log 9, Vegrow, OF Business, Bharat Agri, Urban Company, Capillary Technologies and Orange Health where he has personally invested as an angel. Till June 2022, prior to his superannuation from ITC Limited, Sanjiv Rangrass was ITC’s Group Head for R&D, Sustainability and Projects. Prior to this, he was the Chief Executive of the Agribusinesses for ITC Ltd. He joined the Company in 1982 after completing his B. Tech in Mechanical Engineering from IIT Kanpur. With his vast experience covering Production, Engineering, HR, Projects, Supply Chain, Agriculture and Sustainability over 4 decades, he is sought for his inputs and advice by the industry and the startup eco system. He has also been a part of the team with McKinsey which anchored and supported the Expert Group for the Finance Commission of India to make recommendations to double Agri Exports from India. He has been a former Board of Governors for IIM Shillong and is an Executive Member of the Pan IIT Council.Krupa Shankar V, CFA

Partner, National Investment and Infrastructure Fund

Krupa has over 16 years of experience across fund of funds, private equity and investment banking. He joined NIIF’s Private Markets team in Mumbai as a Principal in February 2021, and is responsible for developing the deployment strategy of the Funds, identifying and evaluating prospective fund managers, and managing the portfolio along with the team. Prior to joining NIIF, he was part of the Asia Equity team managing DEG’s ~USD 1 Bn Asia portfolio with investments spanning LP positions, direct equity investments, and co-investments, with a focus on the South Asian region. Earlier in his career, Krupa has worked with MCap Fund Advisors – an India focused, sector agnostic private equity fund manager, and at o3 Capital – a boutique advisory firm focused on M&A and Private Equity. He started his career in finance with YES Bank’s corporate banking division. His overall experience ranges from corporate banking, investment banking, GP and LP positions, across Indian and global institutions, giving him a well-rounded perspective on the Indian market, and a deep network of relationships. Krupa is a CFA Charterholder, holds a Post Graduate Diploma in Management from the Indian Institute of Management (IIM), Lucknow, and has also holds a Bachelor of Engineering (Hons) in Electronic and instrumentation from Birla Institute of Technology and Science (BITS), Pilani.Hem Kishore

GSD Wealth Investments Leader, Mercer

Hem Kishore is the Wealth Investments Leader at Global Service Delivery (GSD), Mercer India, where he has been instrumental in growing the Investments team from 5 to over 600 members since joining in 2014. Under his leadership, the team provides support to Mercer Global Investments, including performance reporting, consulting services, investment solutions/Outsourced Chief Investment Officer (OCIO), and research for more than 3,500 clients with approximately $1.8 trillion in assets under advisory and OCIO. With 25 years of experience in investment banking, equity research, valuation, portfolio management, mutual fund research, and private equity, Hem previously led teams at CRISIL and NewRiver Inc.Nilesh Kothari

Co-founder and Managing Partner, Trifecta Capital

Nilesh co-founded Trifecta Capital in 2014 and established it as the leading financing and advisory firm serving leading Indian startups. Across its three divisions – Venture Debt, Growth Equity and Tech Enabled Advisory Solutions, Trifecta Capital manages an AUM of around US$ 850 mm and provides alternate capital and solutions to start-ups across different stages. Previously, Nilesh served as Global Managing Director (Ventures & Acquisitions) at Accenture plc. and led several large acquisitions and investments for Accenture across the world. Overall, he has nearly 35 years of experience across investments, operations and entrepreneurship. He also been part of several new ventures at the AV Birla Group, JM Financial and the Hero Group. Nilesh has devoted his career to financial management, operating finance, global investing and scaling tech businesses. As an entrepreneur, he has delivered large outcomes to investors across the past 15 years. He also has a keen interest in travel, rock music and cinema. Nilesh holds a Masters in Management Studies from BITS Pilani, and is also a Cost and Management Accountant.

| Category | Early Bird Offer | Regular Price |

| Members |

1,000 |

1,500 |

| CFA Program Candidates |

1,500 |

2,500 |

| CFA Level III Cleared |

2,000 |

2,500 |

360 One

360 One WAM is an Indian wealth and asset management company headquartered in Mumbai, India. Founded in 2008, it provides financial services, including wealth management, asset management, portfolio management, corporate treasury solutions, and lending. The company operates in five countries and has 27 offices across India. As of December 2024, 360 ONE WAM had assets under management (AUM) of over ₹5.79 lakh crore (US$68 billion) and had more than 7,500 clients, including individuals and institutions.

Acuity Knowledge Partners

Acuity Knowledge Partners (Acuity) is a leading provider of bespoke research, analytics and technology solutions to the financial services sector, including asset managers, corporate and investment banks, private equity and venture capital firms, hedge funds and consulting firms. Its global network of over 6,000 analysts and industry experts, combined with proprietary technology, supports more than 500 financial institutions and consulting companies to operate more efficiently and unlock their human capital, driving revenue higher and transforming operations. Acuity is headquartered in London and operates from 10 locations worldwide. Acuity was established as a separate business from Moody’s Corporation in 2019, following its acquisition by Equistone Partners Europe (Equistone). In January 2023, funds advised by global private equity firm Permira acquired a majority stake in the business from Equistone, which remains invested as a minority shareholder.

Alvarez & Marsal

Alvarez & Marsal is a leading global professional services firm dedicated to helping organizations tackle their most complex business issues, maximize stakeholder value, and deliver sustainable change. Privately held since its founding in 1983, clients select Alvarez & Marsal for its deep expertise and proven ability to create and deliver practical solutions to their unique problems.

Leveraging A&M’s restructuring heritage, the company's fact-driven, action-oriented approach empowers organizations to drive transformation and unlock value at every stage of growth. Its worldwide network extends across six continents, with over 10,000 people comprised of experienced operators, world-class consultants, former regulators and industry authorities. The company fosters a uniquely collaborative environment that embraces our peoples’ diverse perspectives and A&M’s entrepreneurial spirit to deliver end-to-end capabilities that span advisory, business performance improvement, and turnaround management.

Ambit

Ambit is one of India's premier providers of financial advice and capital, known for its business acumen. Ambit comprises Investment Banking (Corporate Finance & Equity Capital Markets), Asset Management, Institutional Equities (Research, Sales & Sales Trading), and a Non-Banking Finance Company (SME Lending). Ambit is focused on delivering tailor-made financial solutions suitable to its client’s needs. These are based on its deep understanding of the Indian economy and market forces, unmatched research, and client-focused approach. Ambit is headquartered in Mumbai, with offices in key cities in India, Singapore, and New York.

Fidelity International Ltd.

Fidelity International Ltd (FIL) is a privately held, global investment management company founded in 1969 by Edward Johnson III. It offers investment solutions and services to a diverse range of clients, including individuals, institutions, and wealth managers. FIL is a subsidiary of Fidelity Investments, but operates independently as a separate entity.

Kroll

Kroll is a global financial and risk advisory firm offering a wide range of services, including valuation, corporate finance and restructuring, cyber security, compliance, and litigation support. Kroll has a history spanning nearly a century, with headquarters in New York City and offices worldwide. Kroll's expertise helps clients in various industries to navigate complex challenges and stay ahead of risks.

Marsh McLennan

Marsh McLennan (NYSE: MMC) is a global leader in risk, strategy and people, advising clients in 130 countries across four businesses: Marsh, Guy Carpenter, Mercer and Oliver Wyman. With annual revenue of $23 billion and more than 85,000 colleagues, Marsh McLennan helps build the confidence to thrive through the power of perspective.

3 PLCFA Institute members can claim PL credit by providing their CFA Institute ID number when registering. |

Global Passport Accredited Programme Allows members of participating CFA societies to attend each other's society events at the local member price Global Passport Accredited Programme Allows members of participating CFA societies to attend each other's society events at the local member price |