CFA Career Day-Pune

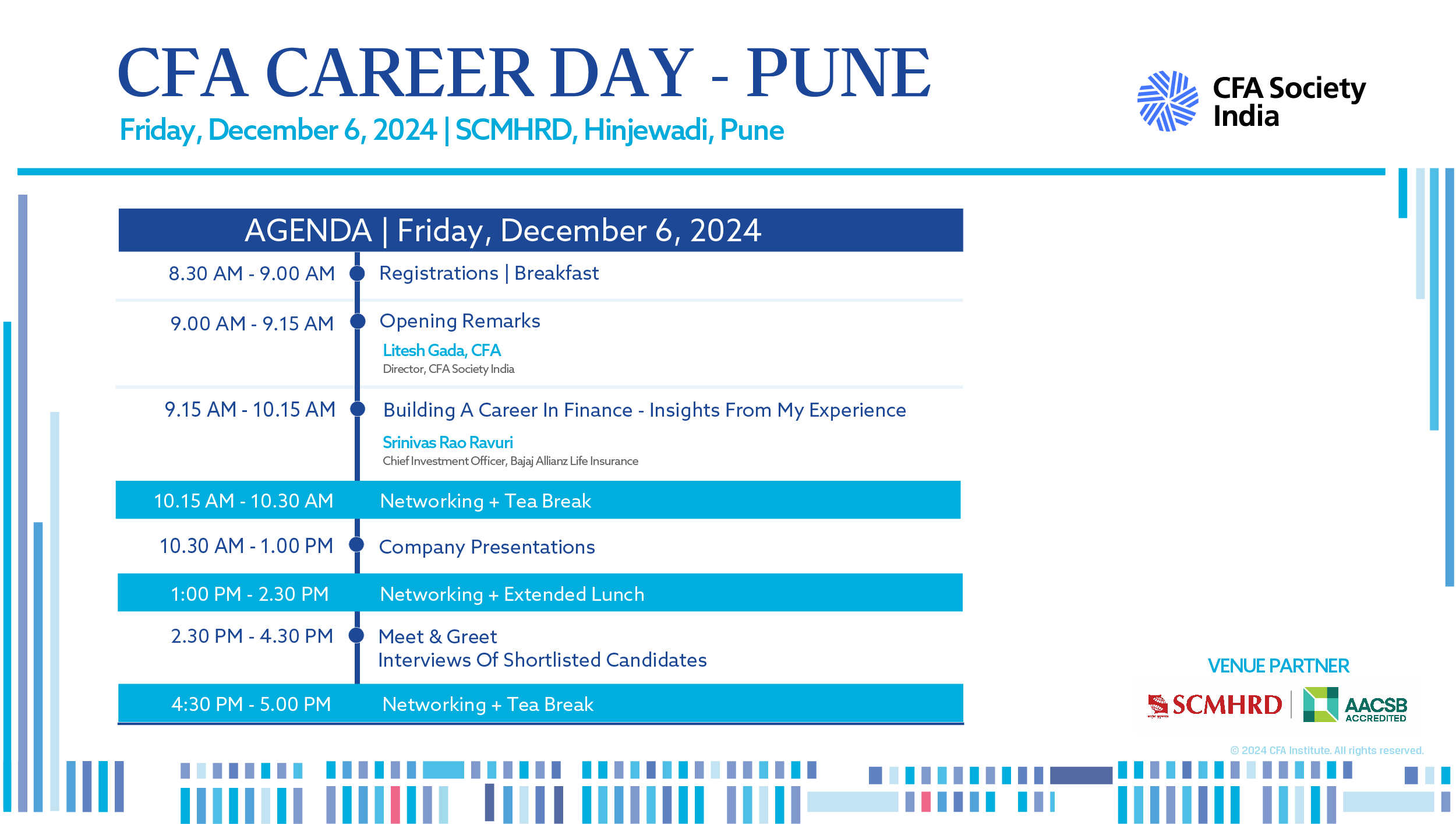

- December 6, 2024

- 9:00 am - 5:00 pm

- SCMHRD, Hinjewadi, Pune - 411057

CFA Career Day is a great opportunity to meet the top employers from the city and chart your next career move. It’s a chance to apply for current opportunities, showcase your skills and network with the leading employers.

Don’t miss it. Register now!

Elibigility:

Level 1 cleared and above are eligible to attend the event.

Details:

Date – Friday, 6th December, 2024

Time – 9:00 am onwards

Venue – SCMHRD, Hinjewadi, Pune – 411057

For any queries, write to soumik@india.cfasociety.org

Registration fee:

Member (CFA Society India) – INR 500

Non-member CFA Charterholders:

- Early bird offer – INR 1,000

- Regular price – INR 1,500

CFA Program Candidates and Charter Pending

- Early bird offer – INR 1,000

- Regular price – INR 1,500

Note: CFA Program Candidates who have cleared at least CFA Level 1 are eligible to register

Acuity Knowledge Partners

Acuity Knowledge Partners (Acuity) is a leading provider of bespoke research, analytics and technology solutions to the financial services sector, including asset managers, corporate and investment banks, private equity and venture capital firms, hedge funds and consulting firms. Its global network of over 6,000 analysts and industry experts, combined with proprietary technology, supports more than 500 financial institutions and consulting companies to operate more efficiently and unlock their human capital, driving revenue higher and transforming operations. Acuity is headquartered in London and operates from 10 locations worldwide. Acuity was established as a separate business from Moody’s Corporation in 2019, following its acquisition by Equistone Partners Europe (Equistone). In January 2023, funds advised by global private equity firm Permira acquired a majority stake in the business from Equistone, which remains invested as a minorityAllianceBernstein

AllianceBernstein (AB) is a leading global investment management firm that offers diversified investment services to institutional investors, individuals, and private wealth clients in major world markets. We are one of the largest investment management firms in the world, with more than $793 billion in assets under management as of October 2024. We foster a diverse, connected, collaborative culture that encourages different ways of thinking and differentiated insights. We embrace innovation to address increasingly complex investing challenges. We pursue responsibility throughout our firm—from how we work and act to the solutions we design for clients.Bajaj Allianz Life Insurance

Bajaj Allianz Life Insurance is a joint venture between Bajaj Finserv Limited, one of the most diversified financial institutions in India, and Allianz SE, a leading global financial services provider. The company enables the Life Goals of 4.19 Crore lives with INR 1,09,829 Crore Assets Under Management, 432% Solvency Margin and 99.23% Claim Settlement Ratio. It offers a comprehensive range of innovative plans with industry-first features: Zero Allocation Charge ULIP with Return of Mortality Charges; SISO (Systematic-In/Systematic-Out) Investment Approach; Term Plan exclusively designed for Diabetics; ACE, a participating plan with enhanced flexibility to choose income levels. The company has a robust distribution network of 533 branches, 1.50 Lacs+ Insurance Consultants, and strategic partnerships with India’s leading and most trusted banks. It prides itself in creating a culture that fosters an innovative mindset and collaboration among its 24K+ employees who have made Bajaj Allianz Life a Great Place to Work for.DSP Mutual Fund

DSP Asset Managers Private Limited (DSPAM) is an Indian asset management company (AMC), with a wide range of offerings across the risk-reward spectrum. The company has 1,50,000 crore+ assets under management and is backed by the 150+ year old DSP Group.SG Analytics

Established in 2007, SG Analytics, a global insights and analytics firm is a leading provider of data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment and Healthcare sectors. A GDPR and ISO/IEC 27001: 2013 compliant firm, SG Analytics has a team of over 1200 employees, and has presence across the U.S.A, the U.K, Switzerland, Canada, and India.RDA Holdings

RDA Holdings is the ex-India family office of the Thermax family. It is one of the well-structured and evolving family offices in India.AllianceBernstein

- Product Analyst

- Private Wealth- Operations Associate

- Performance & Analytics

- Multi Asset Solution

- Fixed Income Technology

- Client Guideline Management

- Investment Research Analyst

Acuity Knowledge Partners

APPLY WITH ACUITY KNOWLEDGE PARTNERSBajaj Allianz Life Insurance

APPLY WITH BAJAJ ALLIANZ LIFE INSURANCEBajaj Holdings and Investment Ltd.

APPLY WITH BAJAJ HOLDINGS AND INVESTMENT LTD.SG Analytics

- CFA Senior Analyst- Investment Research, Fixed Income Research

- Senior Analyst- Investment Banking

- Financial Modelling